- SUI value has bounced 4% prior to now week, holding sturdy assist close to $3.10.

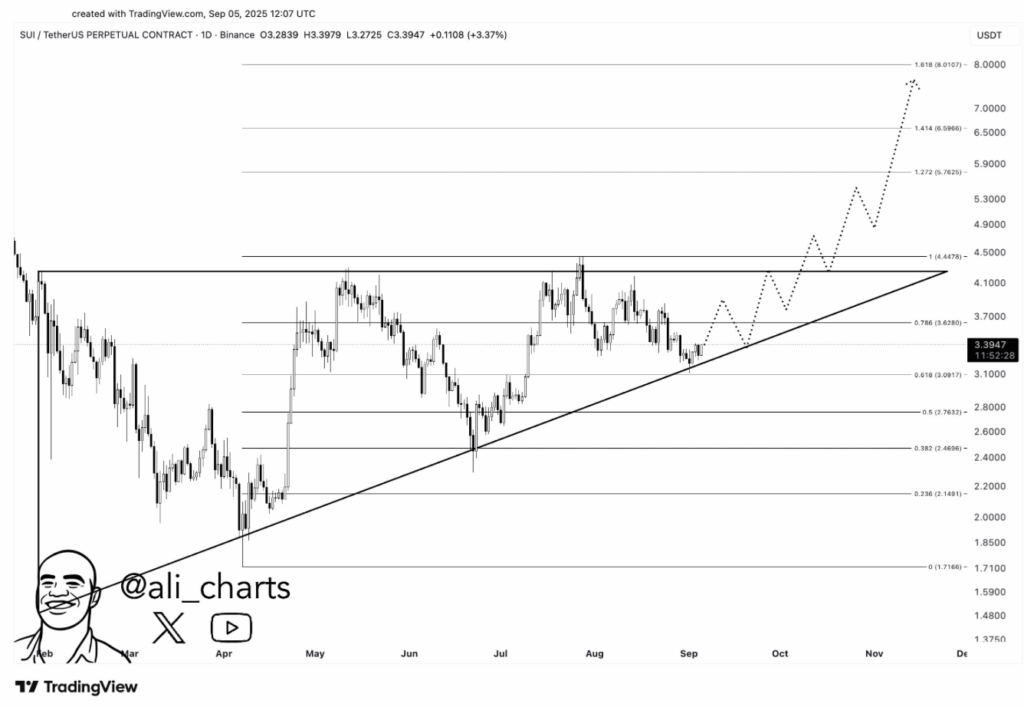

- Analyst Ali Martinez predicts a breakout to $7 based mostly on an ascending triangle sample.

- If the transfer performs out, SUI may rally 110% from present ranges, smashing previous its earlier all-time excessive.

After a powerful August run, SUI couldn’t fairly maintain its steam. The token slid from highs above $4.10 and dipped near $3.20 as September rolled in. The pullback spooked some merchants, however now issues appear to be shifting once more. Over the previous week, SUI has bounced again greater than 4%, hinting that this might simply be the beginning of one thing greater.

Analyst Requires $7 SUI Goal

On September 5, well-known analyst Ali Martinez jumped on X to say it may be time for buyers to begin paying consideration once more. His view? SUI is flashing a bullish sign that would take all of it the best way towards $7 if momentum holds.

Martinez pointed to an ascending triangle forming on SUI’s day by day chart. This sample, for individuals who don’t reside in charts all day, is commonly a bullish continuation setup. It’s mainly a flat ceiling on prime (resistance) and a rising ground beneath (increased lows pushing value up). When patrons lastly break via that ceiling, it may well unleash a pointy rally.

Why the Setup Appears Promising

The chart reveals SUI examined the decrease trendline close to $3.10 and bounced again—discovering sturdy assist round that degree. Martinez nonetheless expects yet one more retest earlier than a breakout, but when the sample performs out, the mathematics suggests a transfer towards $7.

The goal comes from measuring the peak of the triangle and including it to the breakout degree. By that calculation, SUI may rally greater than 110% from its present value, even climbing about 30% above its earlier all-time excessive at $5.80.

For now, the triangle’s higher boundary is holding as resistance, but when patrons maintain urgent, this might be the beginning of SUI’s subsequent leg up.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.