El Salvador’s president, Nayib Bukele, marked Bitcoin Day with a symbolic gesture, igniting hypothesis in regards to the pioneer crypto’s trajectory.

His comment comes at a time when historic patterns recommend turbulence could also be forward.

Bukele’s Bitcoin Day Gesture Meets Market Seasonality Warnings

On September 7, Bukele indicated on X (Twitter) that he was shopping for 21 BTC for Bitcoin Day. At current charges, with BTC buying and selling for $111,175 as of this writing, this meant a purchase order value $2.334 million.

Sponsored

Sponsored

In hindsight, El Salvador adopted Bitcoin as authorized tender on September 7, 2021. The transfer cemented the small Central American nation’s repute as a worldwide crypto pioneer.

“El Salvador Celebrates Bitcoin Day! The Bitcoin Workplace is proud to have been constructing Bitcoin nation for 3 of the 4 years since El Salvador made Bitcoin authorized tender,” the Bitcoin Workplace shared.

Subsequently, the timing is deliberate, and comes at a time when the gold versus Bitcoin dialog is boiling over.

Past gamers comparable to Tether, El Salvador additionally made headlines in the identical narrative solely lately, with gold rising within the Central American nation because the Bitcoin technique progressively faces a worldwide check.

Nonetheless, this yr’s commemoration comes amid rising scrutiny of Bitcoin in El Salvador, with the IMF questioning the authenticity of the nation’s claims. Towards this backdrop, customers stay skeptical about Bukele’s claims.

Technique’s Michael Saylor Hints at Extra Bitcoin Purchases

Sponsored

Sponsored

Past President Bukele, MicroStrategy co-founder and govt chairman Michael Saylor, the world’s most seen company Bitcoin bull, hinted at plans to purchase extra BTC.

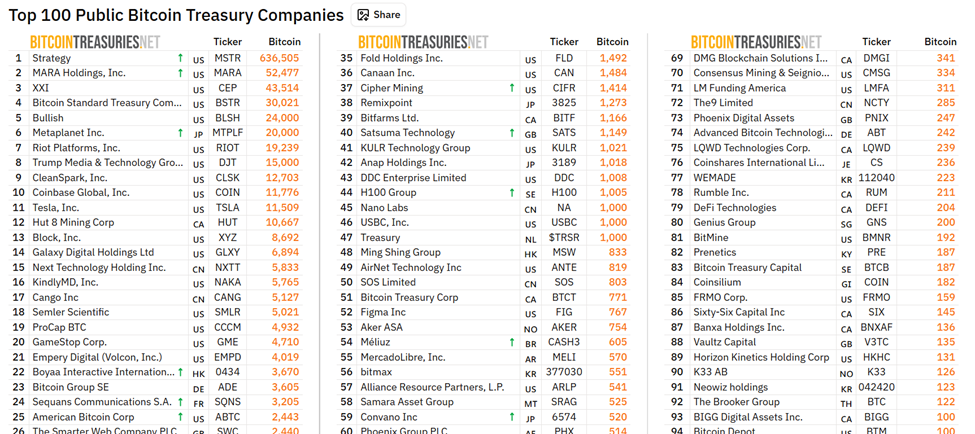

The remark was extensively interpreted as a touch on the enterprise intelligence firm’s additional accumulation of Bitcoin. Knowledge on Bitcoin Treasuries exhibits Technique (previously MicroStrategy) already holds greater than 636,000 BTC.

Traders intently monitor Saylor’s strikes as a result of MicroStrategy has change into a proxy for Bitcoin publicity on Wall Road.

Nonetheless, in addition they appeal to criticism. Hedge fund veteran Fred Krueger pushed again towards claims that MicroStrategy’s debt-fueled technique resembles a Ponzi scheme.

Sponsored

Sponsored

Is September 8 A Bearish Calendar Marker?

Whereas Bukele and Saylor challenge confidence, some analysts warn that the calendar itself could possibly be a headwind.

Timothy Peterson, creator of Metcalfe’s Legislation as a Mannequin for Bitcoin’s Worth, identified that September 8 is traditionally one of many weakest buying and selling days for Bitcoin.

“On any given day, Bitcoin is up 53% of the time for a typical acquire of +0.10%. September 8 is down 72% of the time for a typical lack of -1.30%. This makes it the seventh worst day of the yr,” Peterson defined.

Extra importantly, he added, the day usually predicts the whole month: when September 8 closes detrimental, Bitcoin posts a month-to-month loss 90% of the time.

Such information highlights the strain between Bitcoin’s symbolic milestones and its often-brutal market realities. Whale Insider highlighted an equally brutal actuality, that $10 billion BTC shorts could possibly be worn out if Bitcoin costs attain $117,000.

Sponsored

Sponsored

Regardless of short-term dangers, long-term believers stay undeterred. Billy Boone reminded followers that Bitcoin’s market is dominated by simply two million cash in lively circulation.

“When these dry up, it’s not gradual,” he wrote.

Sponsored

Sponsored

The consumer argues that adoption fears are misplaced and provide constraints may speed up value discovery.

This attitude resonates with El Salvador’s technique. Bukele’s authorities has positioned Bitcoin as a basis of nationwide reserves alongside gold. They wager that shortage and digital adoption will defend the nation from fiat instability.

The anniversary of Bitcoin’s authorized tender experiment coincides with considered one of its traditionally weakest buying and selling days, and the distinction is stark.

Bukele’s 21 BTC gesture and Saylor’s “Extra Orange” trace recommend unwavering conviction, however market information factors to warning.