- TRON value dipped beneath $0.333 assist, with technicals hinting at a attainable slide to $0.319 and even $0.297.

- On-chain metrics are weak, with TVL, income, and buying and selling quantity all dropping sharply in latest weeks.

- Regardless of bearish indicators, Bravemorning Restricted pumped $110M into TRX, and lengthy merchants nonetheless dominate futures positioning.

TRON [TRX] hasn’t had the smoothest experience these days. Inside simply two weeks, the token slipped beneath key assist ranges at $0.3440 and $0.333, sliding deeper into bearish waters.

Nonetheless, the story isn’t that straightforward. At the same time as on-chain numbers weaken, bullish merchants are stacking lengthy bets and a $110 million treasury injection has sparked debate on whether or not TRX can truly flip issues round.

On the time of writing, TRX hovered round $0.3313, down somewhat over 2% previously 24 hours. Day by day buying and selling quantity ticked up barely to $885.36 million, displaying loads of participation, although it’s clear sellers are nonetheless leaning heavy.

Why TRX Retains Dropping

A part of the explanation behind TRX’s struggles appears to be mushy fundamentals. DeFiLlama knowledge confirmed TRON’s TVL falling from $6.28B in early August to about $6.009B now. Income dropped too, from $6.68M to $5.33M. Even buying and selling quantity bought slashed in half — tumbling from $9.65B to $4.51B.

If these figures don’t bounce again quickly, draw back strain on TRX might solely worsen.

Technical Image: Bears in Management

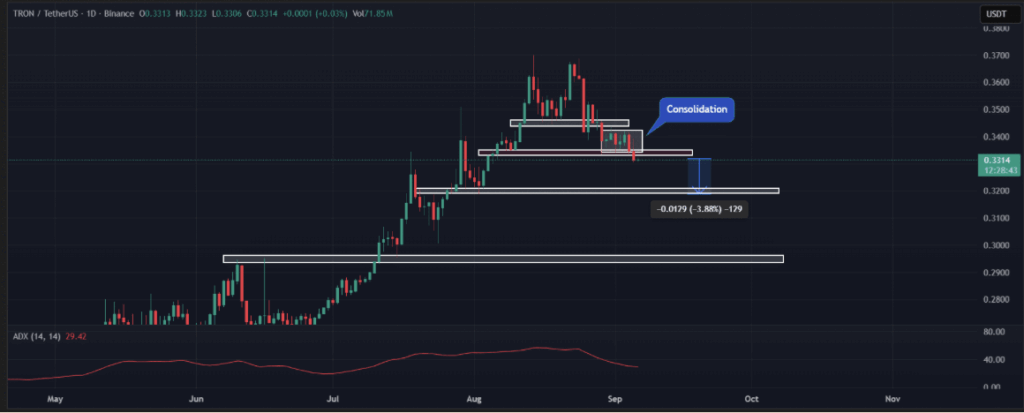

AMBCrypto’s chart evaluation wasn’t too encouraging both. TRX slipped beneath the $0.333 line, confirming a bearish breakdown. On the every day chart, the final candle even fashioned a hammer sample — not a bullish one, however a bearish hammer that indicators extra ache is perhaps coming.

If TRX stays beneath $0.333, it might check the $0.319 zone subsequent, with an opportunity of dipping all the best way to $0.297 if momentum holds. The Common Directional Index (ADX) sat at 29.42, which confirms {that a} sturdy development is in play — and proper now that development isn’t pleasant to bulls.

However Longs and Treasury Enhance Spark Hope

Right here’s the twist: whereas fundamentals scream bearish, dealer positioning tells a unique story. CoinGlass knowledge confirmed the TRX Lengthy/Quick ratio at 1.24, its highest since early August. About 55% of merchants are betting lengthy, in comparison with 44% brief.

After which there’s Bravemorning Restricted, TRON’s greatest shareholder, making a daring transfer. The agency injected one other $110M into TRX by exercising all excellent warrants, including 312.5M tokens to the treasury. That pushed Tron Inc.’s stash above $220M, a sign of long-term religion even because the charts wobble.

TRON’s at a bizarre crossroads proper now. Fundamentals look shaky, value charts level bearish, however merchants and deep-pocketed backers aren’t prepared to surrender simply but. Whether or not that confidence holds — or will get crushed by weak metrics — may resolve the place TRX heads subsequent.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.