The Made in USA coin index closed its first week of September with good points of greater than 7%, pushed largely by sharp strikes in tokens like Worldcoin and WLFI. However whereas these now face the danger of fast pullbacks, consideration is shifting towards three different tokens.

All of those tokens show robust bullish chart patterns, while drawing regular inflows from whales and sensible cash. Collectively, they spotlight the place merchants could discover the following wave of momentum earlier than the September fee cuts.

The primary coin on the checklist of Made in USA cash to look at is Chainlink (LINK). The token has had a subdued week, slipping 2.1%.

Sponsored

Sponsored

Over the previous 30 days, LINK is up solely 5.6% — a comparatively calm stretch in comparison with the broader crypto market. However behind the worth, accumulation has been heavy.

Over the previous 30 days, whales elevated their holdings by 28.48%, including about 1.10 million LINK, now value roughly $24.7 million at $22.40.

Exchanges inform an excellent stronger story. Balances fell 2.33%, with 6.46 million LINK transferring out, equal to just about $145 million. This implies not solely whales but in addition retail and smaller holders are taking tokens off exchanges.

A giant technical sign comes from the Relative Energy Index (RSI). RSI measures the energy of worth strikes on a scale of 0 to 100, with values beneath 30 displaying oversold situations and above 70 displaying overbought situations.

What makes Chainlink stand out is a hidden bullish divergence. Between July 1 and August 2, LINK reached the next low, whereas the RSI slid decrease, establishing a rally that pushed the worth from $15.41 to $27.84 — a achieve of roughly 80%.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Sponsored

Sponsored

The same setup has now surfaced once more between August 15 and September 4. Such divergences typically sign that worth energy is constructing beneath the floor, even when the chart seems quiet.

For worth ranges, LINK holds help at $21.38. If this fails, the following draw back ranges are $18.63 and $15.44. On the upside, resistance sits at $24.74, and a transparent break above $27.86 might set LINK up for an additional leg increased.

Pudgy Penguins (PENGU)

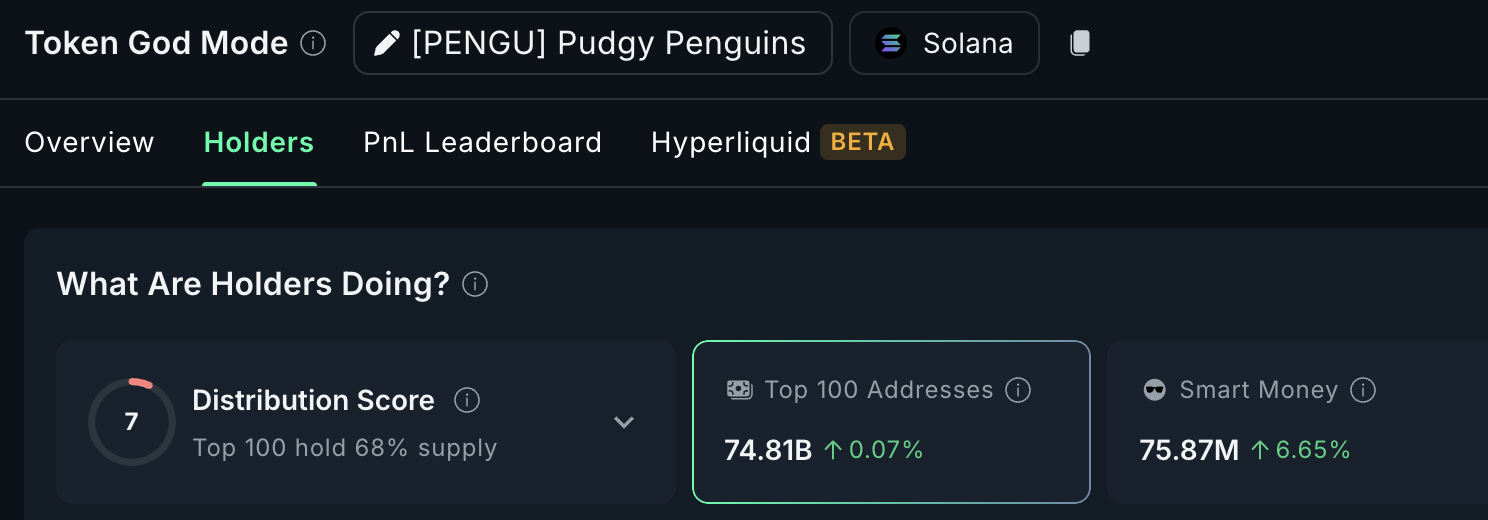

PENGU, the token tied to Pudgy Penguins, has corrected by about 17% over the previous 30 days. However up to now 24 hours, it bounced 8%, bringing 7-day good points to 11.6%. This places PENGU among the many prime made in USA cash to look at for the second week of September.

Sensible cash holdings jumped 6.65% over the previous 24 hours, rising to 75.87 million. Sensible cash typically positions forward of short-term worth strikes, so this influx is a notable sign—extra so earlier than the anticipated fee cuts, due in just a few days.

It’s value noting that sensible cash takes positions anticipating fast rebounds and good points, in contrast to long-term holders.

Sponsored

Sponsored

And the strongest check in that regard comes from the Relative Energy Index (RSI). Between July 7 and September 6, PENGU’s worth made the next low, whereas RSI made a decrease low. This is named a hidden bullish divergence.

Such divergences often counsel that, regardless of short-term weak spot in momentum, the broader uptrend continues to be intact and will resume. For merchants, it typically marks the beginning of a brand new leg increased, one thing sensible cash may be placing their hopes on.

If momentum holds, PENGU faces resistance at $0.032. Clearing that might open the best way to $0.036 and $0.041. Conversely, a break beneath $0.027 would invalidate this setup and threat a slide towards $0.017.

Cardano (ADA)

Cardano rounds out the checklist of made in USA cash to look at, with indicators of a rebound forming. Over the previous week, ADA has slipped barely, however whale exercise tells a distinct story.

Sponsored

Sponsored

The cohort holding 10 million to 100 million ADA has expanded its stash from 12.92 billion to 13.06 billion since August 28. That’s an addition of 140 million ADA, value practically $117.6 million at present costs round $0.84.

This heavy accumulation strains up with a bullish shift on the 4-hour chart. The 20-period exponential transferring common (EMA) or the pink line has crossed above the 50 EMA (orange line), and the worth is now buying and selling above all main EMA strains, together with the 200 EMA. Merchants typically see such “golden crossovers” as early indicators of a much bigger rebound.

An exponential transferring common (EMA) is a line that tracks worth traits by giving extra weight to latest strikes. Merchants typically watch when shorter EMAs cross above longer ones as a sign that momentum is popping bullish.

Sponsored

Sponsored

The 20-EMA line is now closing in on the deep blue or the 200-EMA line. One other bullish cross may help the Cardano worth cross key hurdles.

For ADA, the following hurdle is the $0.85 resistance. Clearing that zone might open the trail to $0.86–$0.87. A sustained breakout above $0.90 would possibly set the stage for a push towards $0.96, a degree not examined in weeks. On the draw back, shedding $0.80 would weaken this bullish view.

With whales piling in and technicals bettering, ADA could also be primed for an additional leg increased in September.