Briefly

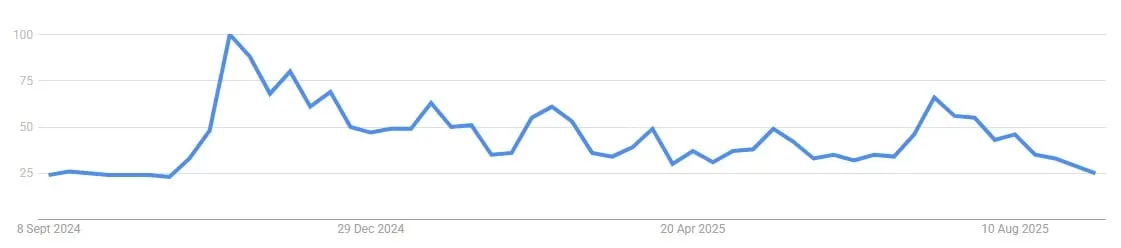

- Bitcoin’s Google search quantity has plummeted to an 11-month low amid a sideways pattern.

- Gold is up 38% because the begin of 2025 in comparison with Bitcoin’s 18%.

- Specialists see potential for capital rotation from gold to Bitcoin if favorable macroeconomic circumstances persist.

Bitcoin’s U.S. Google search quantity has dropped to an 11-month low amid gold’s record-breaking surge, with consultants signaling a possible for capital rotation into the bellwether crypto.

Google Developments knowledge exhibits that Bitcoin’s search curiosity has dipped to lows final seen in October 2024, regardless of sturdy institutional ETF flows in early 2025.

The efficiency between the 2 property displays this diverging pattern, with gold up 38% because the begin of 2025 in comparison with Bitcoin’s 18%.

“This divergence displays a elementary shift in investor psychology towards security over hypothesis amid heightened macroeconomic uncertainty,” Derek Lim, head of analysis at Caladan, advised Decrypt.

Bitcoin has stagnated since Could 2025, buying and selling round $111,565, in response to CoinGecko knowledge. Gold, then again, hit $3,613.48 right this moment.

Search curiosity is “cyclical” and pushed by “retail consideration spikes,” Shawn Younger, chief analyst at MEXC, advised Decrypt. “Macro drivers such because the Fed rate-cut expectations, greenback weak spot, and central-bank shopping for are powering gold to contemporary data,” he defined.

Lim highlighted Bitcoin’s 15% lag beneath its all-time excessive in gold phrases, underscoring the dear steel’s edge in risk-off environments, that are pushed primarily by its “established narratives” and “common acceptance.”

Gold hits report excessive: what subsequent for Bitcoin?

Analysts have beforehand highlighted a lead-lag dynamic, the place gold rallies precede Bitcoin’s outsized strikes.

“Gold typically strikes first after which Bitcoin follows and outperforms,” Lawrence Lepard, co-founder of Fairness Administration Associates LLC, posted in an August tweet.

VanEck’s head of digital asset analysis, Matthew Sigel, echoed this sentiment in a tweet Saturday, stating that, “each gold rally sparks the identical sample: Bitcoin breaks out larger.”

Leopard predicted a gold breakout above $3,500 as a “prelude to $140,000 Bitcoin.”

Specialists are cautiously optimistic. They count on Bitcoin and gold’s lead-lag sample to persist if macro catalysts align.

Lim recognized Fed fee cuts as a key set off that would renew danger urge for food and favor Bitcoin’s “higher-beta traits.”

Younger requires sustained reflation expectations together with moderated central financial institution gold purchases, in addition to on-chain indicators, to “flip marginal allocation from bullion again to Bitcoin.”

Each see rotations accelerating in risk-on shifts.

The consensus is bullish for Bitcoin’s inflation-hedge narrative, with Lim forecasting a $120,000 to $150,000 goal in 2025, with outliers to $200,000 in rotation situations.

Younger tasks $125,000 to $250,000 in a reasonable bull case, pushed by ETF developments and coverage.

Lepard, nevertheless, envisions $250,000 alongside $10,000 gold amid fiat erosion, positioning Bitcoin as an “escape hatch” for development cycles.

Merchants on prediction market Myriad, launched by Decrypt‘s mother or father firm DASTAN, are much less optimistic; virtually 60% count on gold to outperform Bitcoin in 2025.

Each day Debrief E-newsletter

Begin daily with the highest information tales proper now, plus authentic options, a podcast, movies and extra.