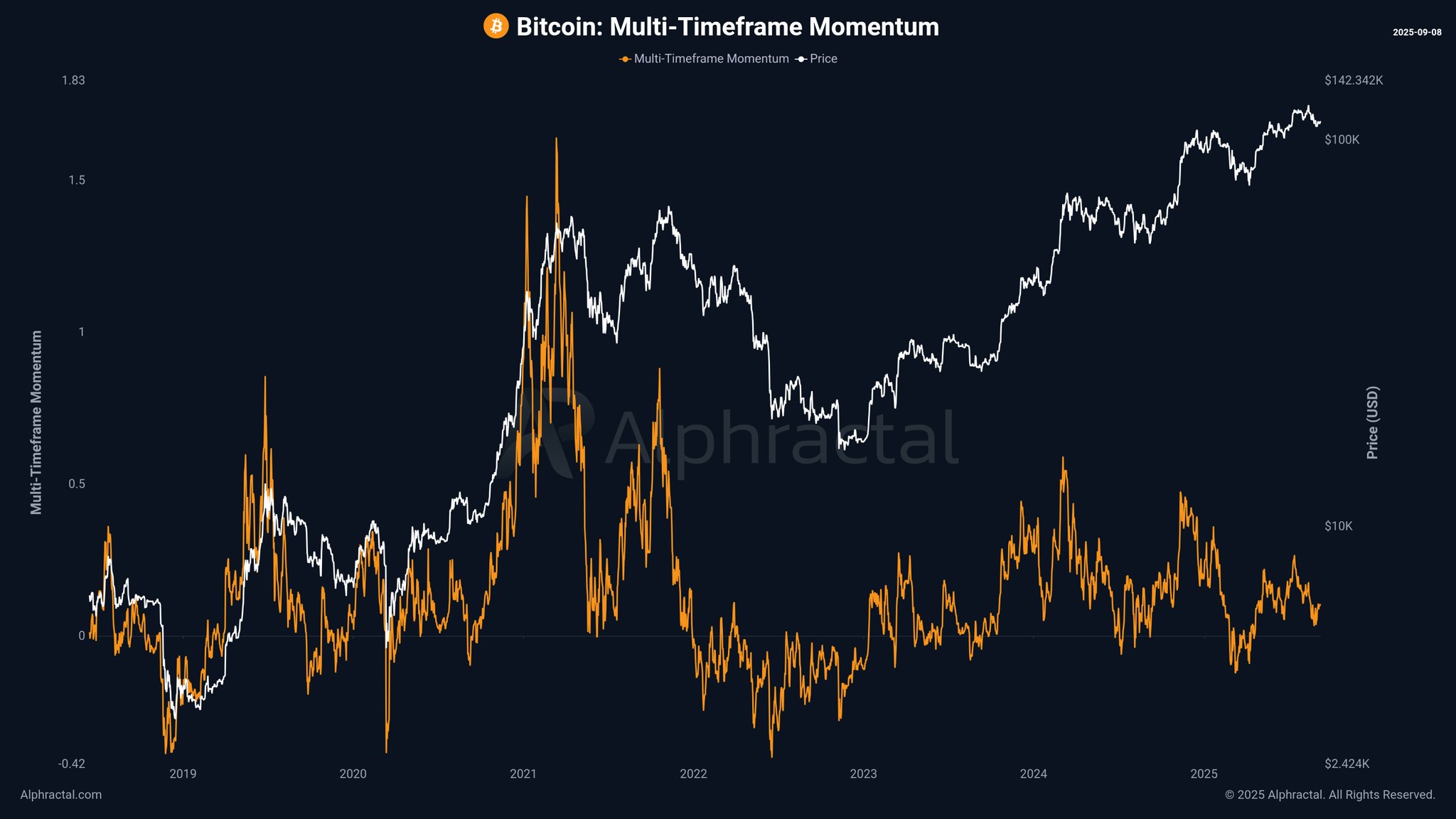

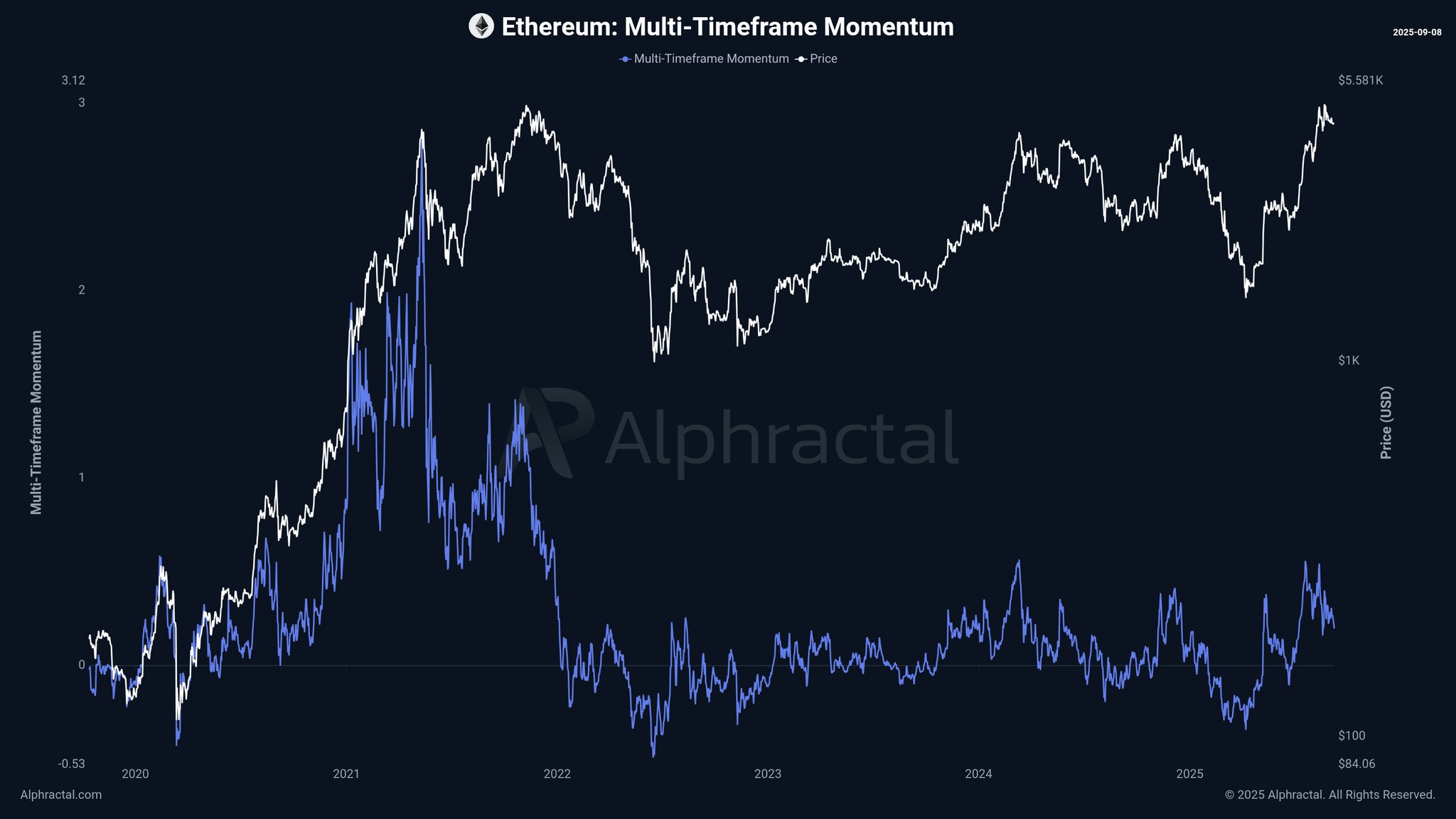

Contemporary evaluation from Alphractal means that the momentum story for Bitcoin and Ethereum is beginning to diverge.

Utilizing its Multi-Timeframe Momentum (MTM) indicator, which blends efficiency throughout 7-day, 30-day, 90-day, and 365-day horizons, the agency highlights a shift in development power between the 2 main digital belongings.

Bitcoin: Excessive Costs, Weakening Momentum

Though Bitcoin continues to commerce close to file highs above $140,000, its underlying momentum has been sliding since early 2024. The MTM indicator exhibits that shorter-term bursts of shopping for are failing to align with longer-term development power. That mismatch implies the market’s upward drive is dropping steam, whilst costs stay elevated. Traditionally, such divergences have typically preceded durations of consolidation or corrective strikes.

Ethereum: Quiet Comeback Positive aspects Power

Ethereum, in distinction, is displaying a unique image. After an prolonged interval of weak momentum, ETH has just lately constructed up power throughout a number of timeframes. The MTM readings flipped greater in latest months, pointing to rising alignment between short-term rallies and broader structural developments. With ETH buying and selling round $5,500, this enchancment might be an early sign that the asset is coming into a brand new cycle of outperformance relative to Bitcoin.

The Greater Image

In Alphractal’s framework, constructive MTM values point out robust alignment throughout timeframes, whereas destructive readings spotlight persistent draw back strain. Proper now, Ethereum is benefiting from bettering synergy throughout horizons, whereas Bitcoin’s MTM development exhibits fatigue.

Crypto markets typically transfer in cycles, with management rotating between belongings. The most recent MTM information means that Bitcoin’s dominance could also be waning simply as Ethereum regains momentum. If the development continues, ETH might emerge because the relative power play heading into the ultimate months of 2025.