Wall Road’s urge for food for firms holding Bitcoin on their steadiness sheets is cooling, and traders are beginning to present it, in line with the New York Digital Funding Group.

Associated Studying

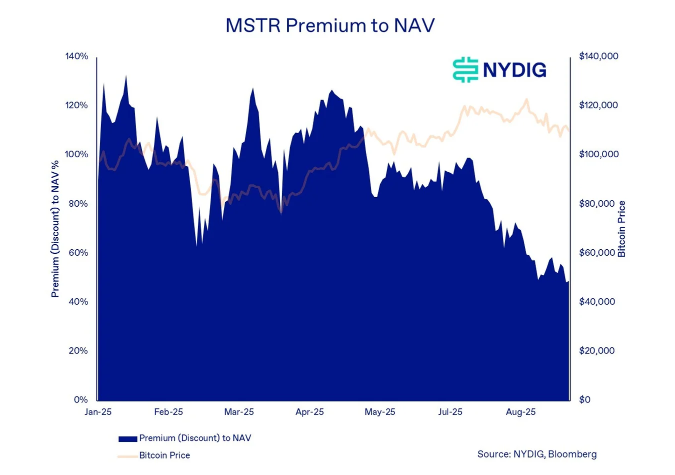

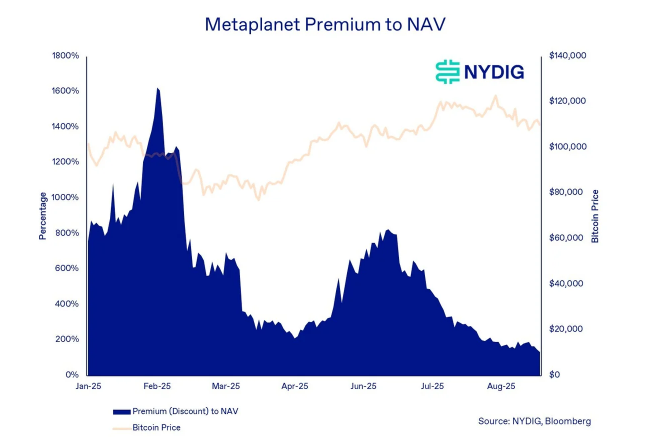

Greg Cipolaro, the agency’s international head of analysis, stated the disparity between share costs and internet asset worth (NAV) for main consumers is narrowing whilst Bitcoin reached highs earlier this yr.

He pointed to a number of forces pushing these premiums down, from looming provide unlocks to elevated share issuance.

Premiums On The Slide

Investor fear over future token unlocks is weighing on costs. Cipolaro listed different drivers: shifting company goals amongst digital-asset treasuries, recent share gross sales, investor profit-taking, and an absence of clear variations between firms that merely maintain Bitcoin.

Firms usually used as proxies for Bitcoin features — names like Metaplanet and Technique — have seen that hole compress. In plain phrases, shares that after traded at a wholesome premium to the cash they personal at the moment are a lot nearer to their NAVs.

Shopping for Exercise Slows Sharply

Studies have disclosed that the mixed holdings of publicly disclosed Bitcoin-buying firms peaked at 840,000 BTC this yr.

Technique accounts for a 3rd of that complete, or about 637,000 BTC, whereas the remainder is unfold throughout 30 different entities.

Knowledge exhibits a transparent slowdown in buy dimension. Technique’s common purchase in August fell to 1,200 BTC from a 2025 peak of 14,000 BTC. Different firms purchased 86% lower than their March 2025 excessive of two,400 BTC per transaction.

Month-to-month development has cooled too: Technique’s month-to-month improve slid to five% final month from 40% on the finish of 2024, and different corporations went from 160% in March to 7% in August.

Share Costs And Fundraising Values Are Coming Below Strain

A lot of treasury firms are buying and selling at or under the costs of latest fundraises. That hole creates danger. If newly issued shares start buying and selling freely and homeowners resolve to money out, a wave of promoting might observe.

Cipolaro warned a tough patch could also be forward and suggested firms to contemplate measures that help their share value.

Associated Studying

Shares Might Face A Bumpy Trip

One easy transfer urged was inventory buybacks. In accordance with Cipolaro, crypto centered firms ought to put aside some capital raised to purchase again shares if wanted. That method can elevate costs by shrinking the variety of excellent shares.

In the meantime, Bitcoin itself has not been proof against swings. Based mostly on CoinMarketCap quotes, BTC was buying and selling round $111,550, down about 7% from a mid-August peak above $124,000.

The value transfer tightens the margin for error for treasury corporations: their fortunes are linked to the coin, however their inventory costs can transfer independently and typically extra harshly.

Featured picture from Unsplash, chart from TradingView