For a fleeting second, World Liberty Monetary (WLFI), the crypto venture with a direct line to the Trump household, regarded like a golden ticket. Presale patrons noticed their cash multiply 20 occasions over, no less than on paper.

Anybody who purchased on the high bought scorched although, and watched 60% of their funding vanish. This wasn’t simply one other crypto launch; it was a masterclass in how hype, politics, and greed can blow up a market.

Why did it skyrocket?

WLFI’s explosion began on 01 September 2025, the day it hit big-name exchanges. All of the sudden, anybody on Binance, OKX, or Bybit might purchase in, and a flood of cash poured right into a coin with the Trump household’s identify stamped on it as co-founders. This political connection, supercharged by an enormous $550 million raised earlier than it even went public, set the stage for chaos.

From fractions of a cent, the worth tore previous $0.46, briefly giving the venture a paper valuation north of $30 billion. The market was gripped by a basic concern of lacking out, with a staggering $4.46 billion traded in simply the primary 24 hours as folks scrambled for a chunk of the motion.

After which, the inevitable collapse…

The excessive didn’t final. The altcoin’s value caved, cratering to round $0.179. Why? For starters, the individuals who bought in early wished their cash. The principles allow them to promote 20% of their stash at launch, and with income as excessive as 2,000%, who might blame them for cashing out?

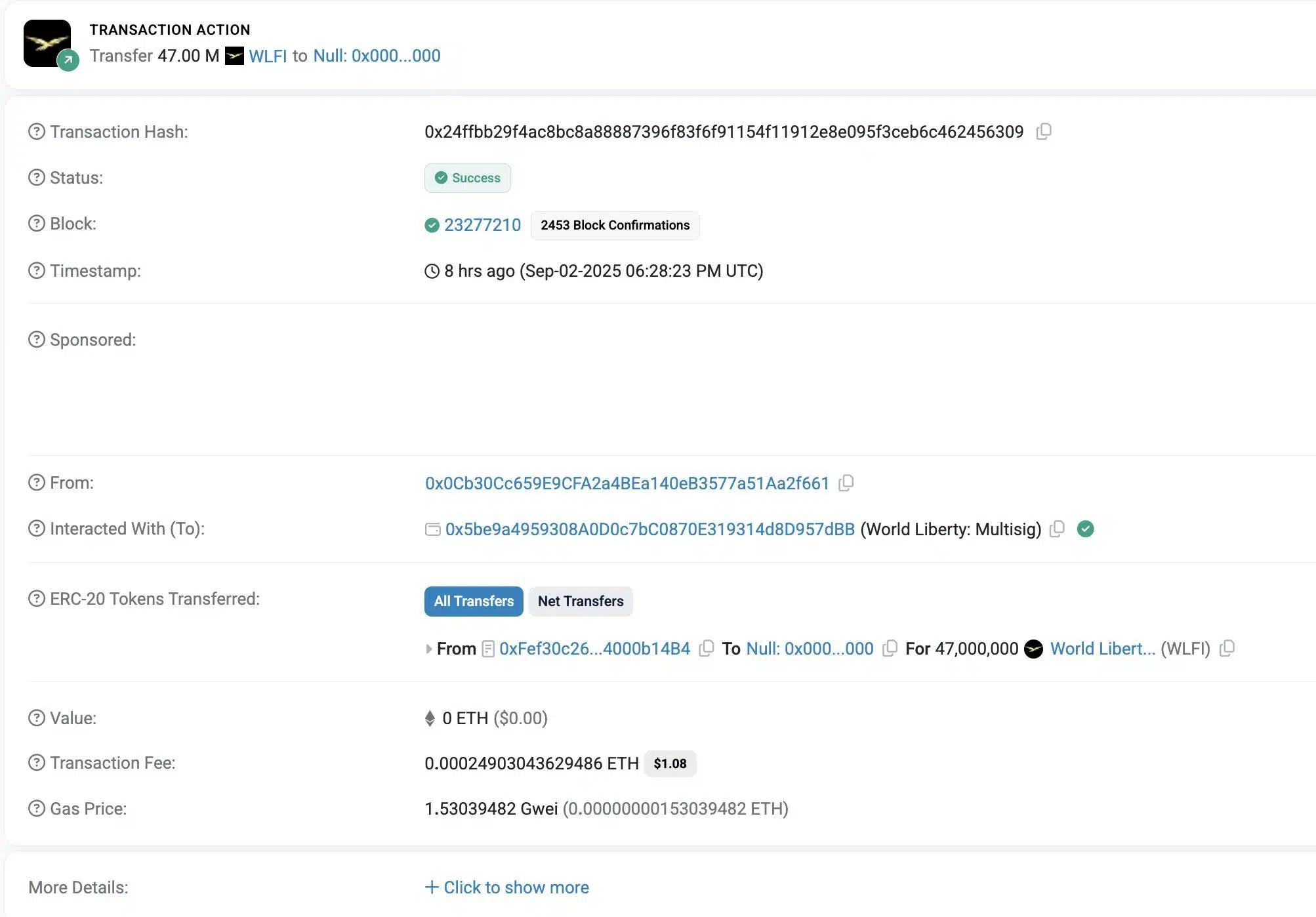

Blockchain watchers noticed the large strikes coming. Big “whale” wallets had been seen shifting enormous quantities of WLFI to exchanges proper after launch – A lifeless giveaway {that a} huge sell-off was imminent. One transaction alone noticed three early birds transfer 160 million tokens, price $51.2 million on the time, to a Binance pockets.

Supply: Lookonchain/X

Digging deeper revealed a shaky basis. A tiny group of wallets holds nearly all of the WLFI tokens, giving them terrifying energy to swing the worth nevertheless they need. It’s a setup that screams market manipulation.

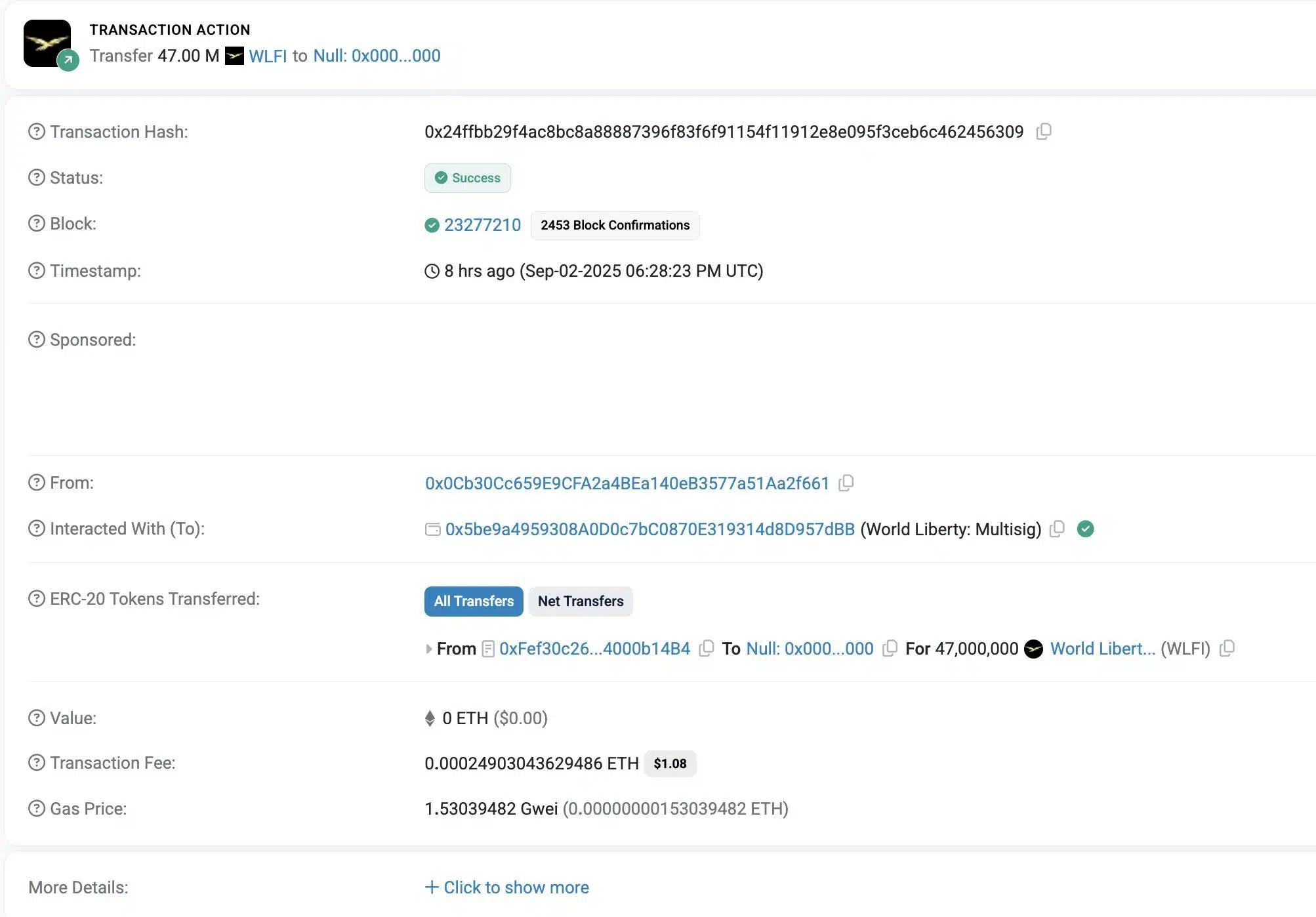

The staff tried to cease the bleeding by “burning” 47 million tokens. Nonetheless, it was a drop within the ocean, lower than 0.2% of the availability, and did nothing to sluggish the panic promoting.

Supply: Etherscan

What are merchants watching now?

In spite of everything that chaos, merchants are nonetheless glued to a couple key value factors.

The ground appears to be someplace between $0.17 and $0.18—the bottom it’s ever been. If it breaks and stays under that, count on extra ache.

To get bulls once more, WLFI must climb again above the $0.23 to $0.25 vary. That’s the place the worth stalled earlier than, so taking it again can be a primary step towards restoration.

A staff with a troubled previous

The venture’s credibility can be beneath fireplace, due to the folks working the present. Whereas the Trump and Witkoff names lend political and actual property clout, the co-founders, Zak Folkman and Chase Herro, have a historical past.

They had been the duo behind Dough Finance, a DeFi venture that went up in smoke after a $2.5 million hack in 2024. Individuals who misplaced their a refund then say the pair merely jumped ship to a brand new venture with out making issues proper.

With 100 billion tokens in existence and insiders holding an enormous chunk, no person is bound if WLFI is an actual long-term enterprise or only a money seize. Proper now, it’s a gambler’s paradise, a coin pushed by headlines and the whims of its greatest holders.