New knowledge from River highlights how companies deal with Bitcoin custody – and the image seems very totally different from particular person holders.

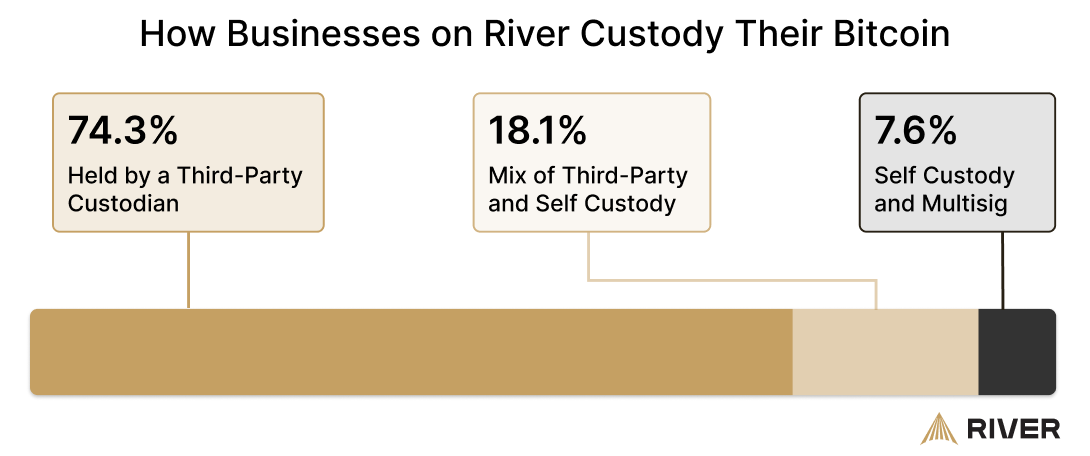

In response to the report, 74.3% of corporations utilizing River maintain their Bitcoin with third-party custodians. One other 18.1% cut up custody between third-party suppliers and in-house administration, whereas simply 7.6% rely solely on self-custody with multisig setups.

River notes that the reliance on custodians is basically pushed by operational realities. Companies face continuity challenges, compliance obligations, and danger controls that make outsourcing custody extra sensible, notably as many solely started shopping for Bitcoin at scale lately.

Distinction With Broader Bitcoin Market

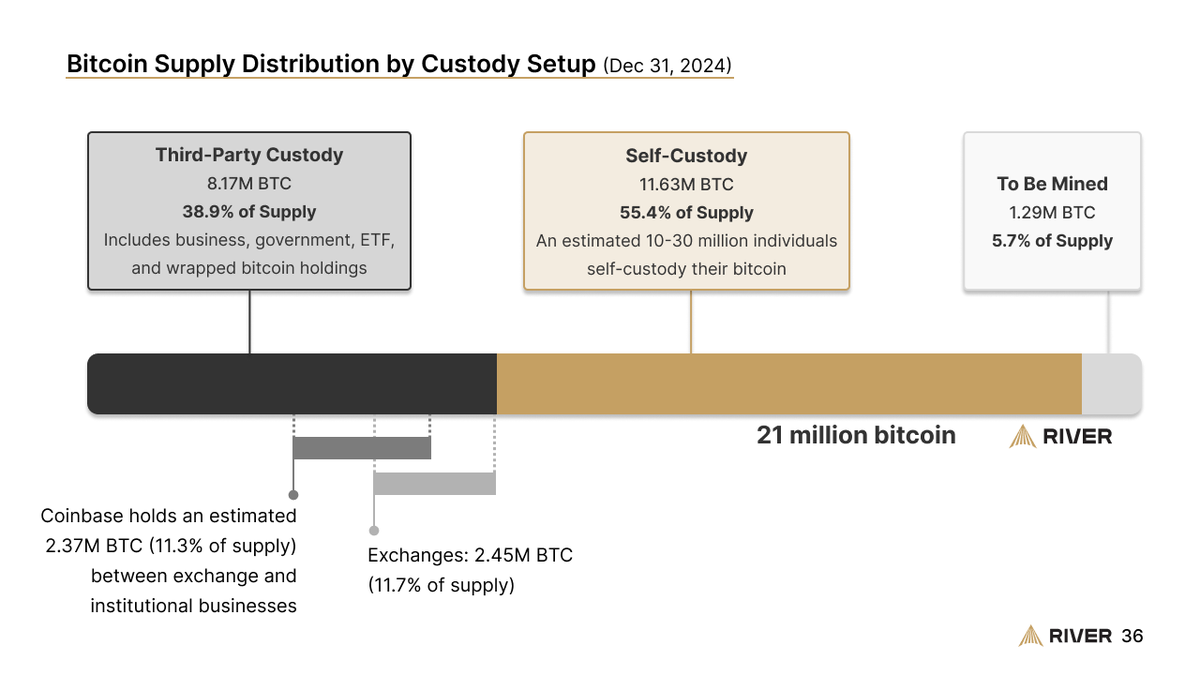

When Bitcoin provide general, the image shifts. As of December 31, 2024, self-custody accounted for 55.4% of all Bitcoin in circulation, or roughly 11.63 million BTC. Third-party custodians held 8.17 million BTC (38.9%), which incorporates balances managed for companies, governments, ETFs, and wrapped Bitcoin. The remaining 1.29 million BTC (5.7%) is but to be mined.

Exchanges and custodians dominate institutional flows. For instance, Coinbase holds about 2.37 million BTC (11.3% of provide), whereas different exchanges management roughly 2.45 million BTC.

The Larger Pattern

Whereas companies nonetheless lean closely on custodians, River suggests a gradual shift towards self-custody fashions might emerge as company Bitcoin adoption matures. For now, corporations choose the perceived security and regulatory readability of third-party suppliers, whereas people proceed to steer the push towards independence.