The thought of Bitcoin hitting $1 million, as soon as simply loud discuss from the market’s fringes, is now being quietly modeled in Wall Avenue’s nook places of work. This isn’t about hype; it’s a couple of sample.

Analysts are wanting on the S-curve, the identical adoption path that took gold mainstream within the ’70s and the Web within the ’90s. With the launch of Spot Bitcoin ETFs, the floodgates for institutional cash lastly opened, probably redrawing Bitcoin’s total future.

International chaos pushing Wall Avenue’s buttons

Large cash isn’t flocking to Bitcoin out of curiosity. It’s a defensive transfer. Governments are drowning in debt, cash printers are working time beyond regulation, and world tensions are excessive. This setting has managers scrambling for an asset that sits exterior of any single nation’s management.

Bitcoin’s arduous cap of 21 million cash is its total gross sales pitch.

That straightforward truth seems more and more enticing when in comparison with the infinite creation of conventional currencies. The “digital gold” story is catching on quick in critical monetary circles. In a world this shaky, including a decentralized, un-censorable asset to a portfolio is beginning to look much less like a suggestion and extra like a necessity.

The ETF – Wall Avenue’s official welcome mat

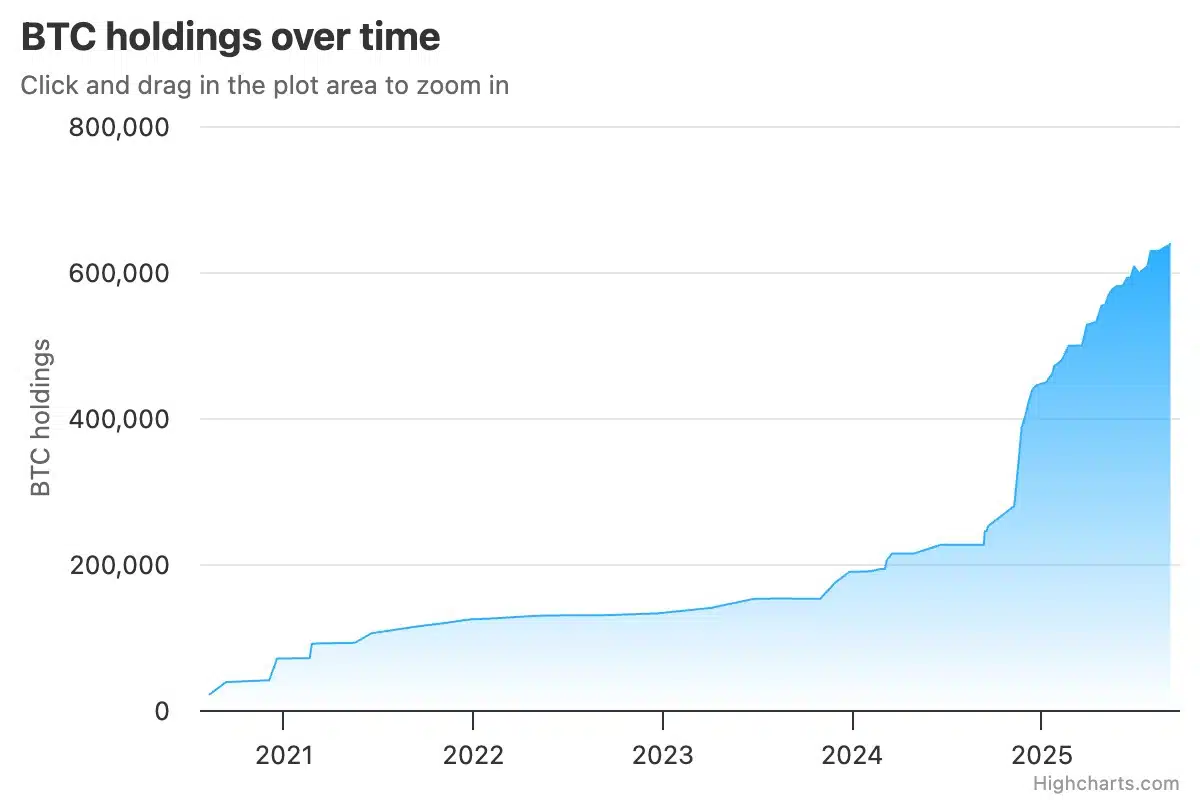

For a very long time, the large monetary companies watched from a budget seats, scared off by murky laws and the headache of truly holding crypto. The U.S authorities’s approval of Spot Bitcoin ETFs in early 2024 modified the whole lot. It gave them a well-recognized, regulated, and straightforward manner to purchase in.

Supply: Coinglass

Instantly, giants like BlackRock and Constancy weren’t simply curious. They have been hosts to a celebration that noticed their ETF merchandise swell with money. BlackRock’s iShares Bitcoin Belief (IBIT) alone now manages a staggering $83 billion. This new, institution-friendly plumbing, full with regulated futures and insured custody, has made Bitcoin really feel protected for the large gamers.

This flood of money made a 1-5% Bitcoin allocation really feel much less like a wild gamble and extra like commonplace process. Particularly because it doesn’t dance to the identical tune as shares and bonds.

Provide crunch meets a requirement firehose

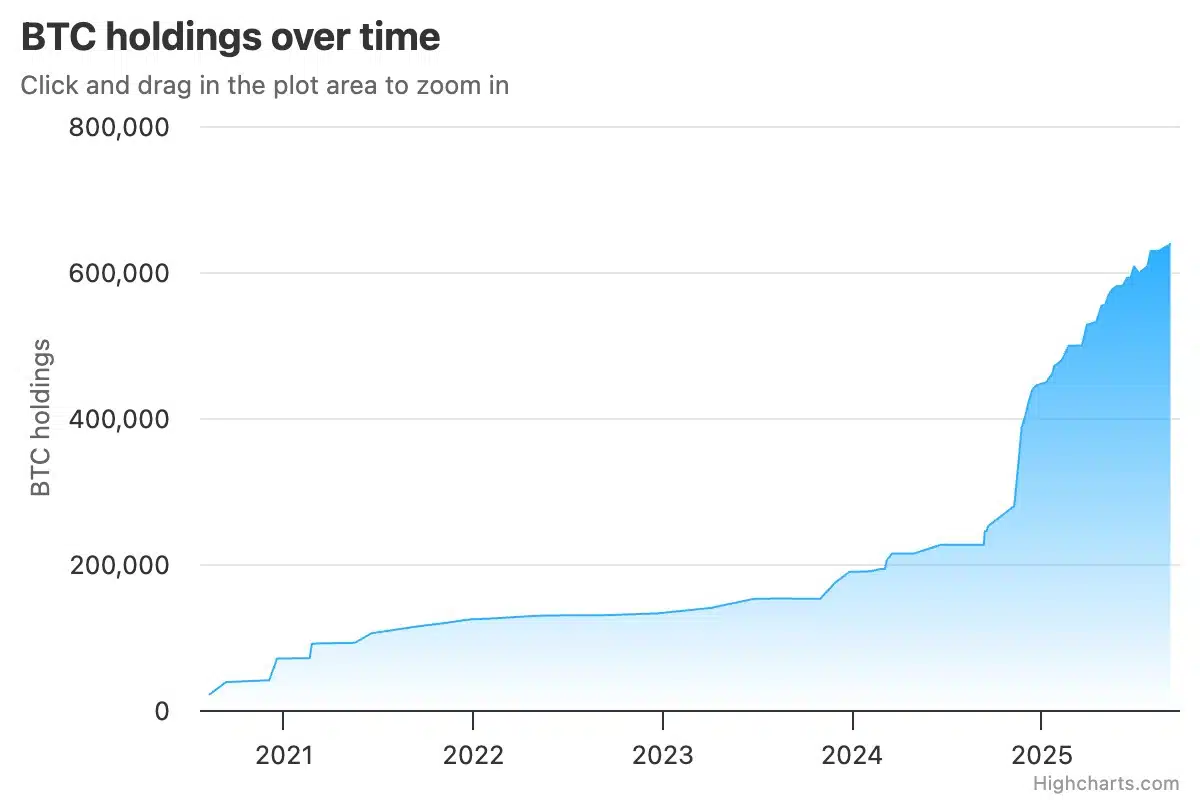

Probably the most aggressive worth predictions boil all the way down to simple arithmetic – A hard and fast provide is assembly an explosion of latest consumers. The Bitcoin code has a built-in “halving” about each 4 years, which mechanically cuts the creation of latest cash in half. This predictable provide squeeze is now operating headfirst into a requirement shock from company steadiness sheets and big funds.

MicroStrategy, now rebranded as Technique Inc., went all-in, hoarding over 632,000 BTC by August 2025. Their wager, mixed with the billions pouring into ETFs, is giving life to fashions that see an virtually vertical worth climb.

Supply: MicroStrategy’s Bitcoin holdings/Bitbo

The previous Inventory-to-Circulate fashions have been typically criticized for being too easy, however their primary thought—that shortage plus demand equals the next worth—is taking part in out in actual time. Cathie Wooden’s ARK Make investments took this logic to its excessive, floating a possible $2.4 million worth by 2030, with institutional cash as the principle rocket gasoline.

Supply: S2F Charts/Bitno

Last boss – Governments and sovereign wealth

The final piece of the puzzle might be nations themselves. To get out from beneath the U.S greenback’s thumb and defend towards political fallout, some nations are beginning to purchase Bitcoin.

El Salvador’s authorized tender regulation and Bhutan’s secret mining farms have been the canaries within the coal mine. The actual information is quieter – Huge sovereign funds in locations like Norway and Abu Dhabi at the moment are dipping their toes in, shopping for Bitcoin straight or via different corporations and ETFs.

This begins a harmful sport. As extra nations take part, the chance of not proudly owning any Bitcoin goes up, probably kicking off a world scramble.

What may kill the million-dollar dream?

Nevertheless, this climb is a minefield. The trail to a million-dollar Bitcoin isn’t assured.

- Governments may nonetheless spoil the get together – Whereas guidelines like Europe’s MiCA and pleasant U.S. payments just like the GENIUS Act are constructive, the hazard of a coordinated world crackdown hasn’t vanished. If the world’s main powers determine to show hostile, they may cease this pattern chilly.

- Crowded discipline and central financial institution copies – Bitcoin isn’t alone. It’s competing with hundreds of different digital property. Extra importantly, Central Financial institution Digital Currencies (CBDCs) may steal the present for on a regular basis funds, leaving Bitcoin as only a digital collectible for the wealthy.

- Ghost within the machine and a unclean footprint – Bitcoin’s huge power urge for food stays a PR nightmare for traders who care about ESG requirements. On high of that, there’s the looming, long-term menace of quantum computer systems that might at some point be highly effective sufficient to crack the entire system, a worry even Ethereum’s Vitalik Buterin has identified.

Nonetheless, the dialog has essentially shifted. Bitcoin’s institutional period is right here. The confluence of its inflexible provide, a Wall Avenue-approved on-ramp, and a chaotic world financial system has made the unattainable really feel believable. The S-curve is in movement, and a seven-figure price ticket now not looks like a fantasy, however an endpoint.