- Ahead Industries raises $1.65B for Solana-focused treasury technique.

- Backed by Galaxy Digital, Soar Crypto, and Multicoin Capital.

- Analysts say the transfer might make Ahead the main Solana public firm.

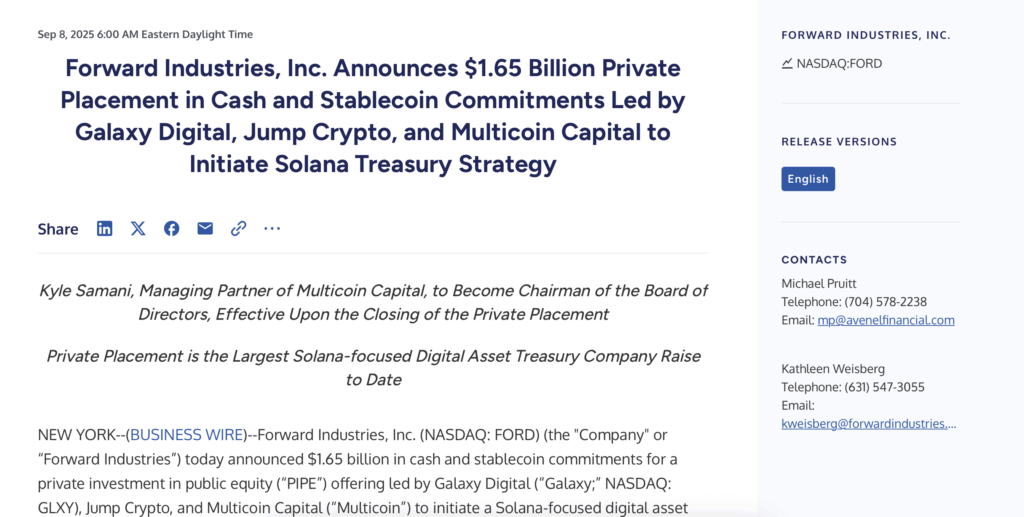

Ahead Industries, Inc. (NASDAQ: FORD) has introduced a $1.65 billion personal placement in money and stablecoin commitments, marking the biggest Solana-focused elevate ever by a public firm. The funding, led by Galaxy Digital, Soar Crypto, and Multicoin Capital, highlights institutional confidence in Solana’s long-term development.

Galaxy Digital, Soar Crypto, and Multicoin Lead Solana Funding

The deal consists of participation from C/M Capital Companions, LP, considered one of Ahead’s high shareholders. As a part of the settlement, Multicoin co-founder Kyle Samani will take over as chairman of the board. Chris Ferraro of Galaxy Digital and Saurabh Sharma of Soar Crypto will be a part of as board observers.

Ahead’s CEO Michael Pruitt emphasised the significance of the transfer: “Solana has emerged as one of the vital progressive and broadly adopted blockchain ecosystems. Our lively Solana treasury program underscores our conviction in SOL’s potential and dedication to shareholder worth.”

How the Solana Treasury Mannequin Will Function

Galaxy Digital, already a serious Solana validator, will deal with buying and selling, staking, lending, and threat administration for Ahead’s treasury. Soar Crypto is contributing engineering experience by means of its Firedancer validator consumer, designed to spice up Solana’s velocity and resilience. Multicoin, an early Solana seed investor, believes this lively treasury strategy will outperform passive holding.

Solana Ecosystem Progress and ETF Developments

The funding comes amid broader momentum for Solana. Studies recommend Galaxy, Soar, and Multicoin could pursue a separate $1 billion Solana acquisition to safe liquidity. In the meantime, builders are advancing Alpenglow, a proposal to slash Solana block finality occasions from 12.8 seconds to beneath 200 milliseconds.

Regulators are additionally reviewing a number of Solana ETF functions, signaling mainstream adoption might speed up even additional.

Dangers and Challenges for Crypto Treasury Fashions

Regardless of the thrill, treasury fashions in crypto face skepticism. Many companies commerce beneath their managed web asset worth, sparking fears of dilution and liquidation dangers. Some critics warn the strategy appears to be like like a “Ponzi-style guess” reliant on fixed fundraising. Nonetheless, advocates argue that disciplined firms with robust backers can thrive in the long term.

Globally, firms are experimenting with crypto in treasury reserves. Japan’s Metaplanet and Convano expanded Bitcoin holdings to hedge yen weak point, whereas Eightco pivoted towards a Worldcoin technique—driving a rally in its inventory.

Ahead Industries Positioned as Solana’s Main Public Firm

Cantor Fitzgerald & Co. is serving because the lead placement agent, with Galaxy Funding Banking appearing as co-agent and advisor. Authorized assist comes from Skadden, Arps, Slate, Meagher & Flom LLP and DLA Piper LLP.

Galaxy CEO Mike Novogratz referred to as the transfer a milestone: “Ahead Industries will rapidly separate itself because the main publicly traded firm within the Solana ecosystem. This deal strengthens Solana’s adoption and reinforces its position in the way forward for finance.”

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.