Bitcoin is buying and selling simply above the $113,000 resistance stage however has up to now did not maintain additional upside momentum. The market finds itself in a tense and unsure section, leaving buyers cautious because the short-term outlook stays unclear. Whereas bulls managed to reclaim a crucial stage, the dearth of follow-through has created hesitation amongst merchants in search of stronger affirmation of development course.

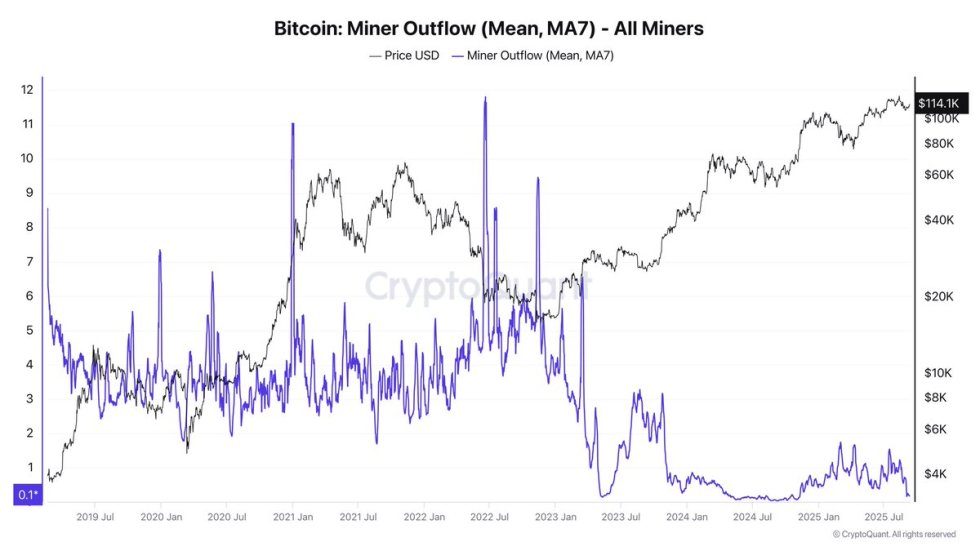

Including complexity to the image, prime analyst Darkfost highlights recent onchain knowledge exhibiting BTC outflows from miners, measured on a 7-day common. These flows recommend miners are transferring cash out of reserves—a transfer usually interpreted as preparation for promoting, although it may possibly additionally mirror inner administration or safety changes. What makes this second notably notable is the file low in BTC inflows from miners.

All through this cycle, miner inflows have remained weak in comparison with earlier durations, signaling that miners are holding onto extra of their reserves. Nonetheless, these muted inflows underscore the broader uncertainty available in the market: whereas miner conviction seems sturdy, buyers stay divided on whether or not Bitcoin’s subsequent main transfer might be increased or decrease.

Bitcoin Miners Are Holding Sturdy

In response to analyst Darkfost, the file low in BTC inflows from miners displays a deeper shift in how mining operations are approaching this cycle. He factors to a number of causes, however an important is that Bitcoin’s worth and general market capitalization proceed to develop in tandem with real-world adoption.

Governments and huge companies are more and more integrating Bitcoin into their monetary methods, lending it a stage of legitimacy that reinforces confidence amongst miners. With the asset maturing and institutional demand rising, miners are extra inclined to carry their reserves as a substitute of dashing to liquidate them.

One other issue is the sheer value appreciation Bitcoin has achieved. Miners now not have to promote giant quantities of BTC to cowl operational bills. Even modest liquidations are ample to safe capital for gear, vitality, and overhead prices. This dynamic enormously reduces the fixed promote stress that characterised earlier market cycles, permitting extra cash to stay off exchanges and strengthening Bitcoin’s shortage narrative.

Darkfost additionally highlights the resilience miners have proven throughout stress durations on this cycle. Whereas volatility has examined the market, Bitcoin’s drawdowns have been comparatively delicate in comparison with earlier eras. The truth is, compared with previous cycles, miners may very well be experiencing the best circumstances they’ve ever confronted. Sturdy fundamentals, increased valuations, and rising world adoption have all mixed to create a cycle the place miners can climate downturns with far much less pressure.

Finally, this evolving conduct underscores how Bitcoin has matured. Miners are now not pressured sellers at each dip however quite strategic holders who can afford to assume long run.

Value Reclaims Vital Stage

Bitcoin is buying and selling at $113,819 after a gentle climb from early September lows close to $110,000. The 4-hour chart reveals BTC pushing right into a crucial resistance zone outlined by the 200 SMA at $113,781, which has capped upside makes an attempt in latest weeks. A profitable breakout and consolidation above this stage may verify bullish momentum and pave the best way for a transfer towards $116,000 and finally the important thing resistance at $123,217.

The 50 SMA at $111,668 and 100 SMA at $110,891 are trending upward beneath present value motion, providing dynamic assist and reflecting the bettering short-term construction. So long as BTC holds above $112,000, the near-term bias stays constructive, with consumers regularly regaining management after weeks of sideways buying and selling.

Nevertheless, the rejection danger on the 200 SMA stays vital. If BTC fails to determine assist above this stage, it may slip again towards $112,000, with a break decrease exposing the $110,000 assist zone as soon as once more.

The chart highlights a pivotal second for Bitcoin. Bulls have constructed momentum, however reclaiming and holding above the 200 SMA is crucial to unlock additional upside. Till then, BTC stays rangebound, caught between rising assist and heavy overhead resistance.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.