Be a part of Our Telegram channel to remain updated on breaking information protection

US CPI inflation knowledge landed proper on track Thursday, cementing expectations of a Federal Reserve charge minimize subsequent week and triggering a modest dip in crypto costs.

The Client Value Index (CPI) rose 2.9% year-on-year in August, consistent with forecasts, whereas core CPI (excluding risky meals and power costs) superior 0.4% from July, barely above estimates, knowledge from the Bureau of Labor Statistics confirmed.

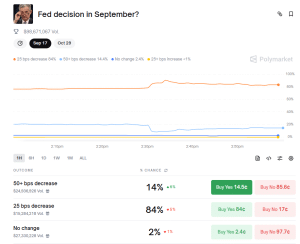

Polymarket bettors shortly priced in a September charge minimize, with odds of a 25 foundation level minimize surging from 79% earlier than the information to as excessive as 91%, earlier than falling again to close 84%.

Polymarket September charge minimize contract (Supply: Polymarket)

Conversely, odds of fifty bps charge minimize plummeted from 18.9% to 9.1% earlier than rising to 14%. A tender jobs report on Friday and Wednesday’s weak PPI numbers had boosted bets on a bumper charge minimize this month.

The CME FedWatch instrument additionally displays near-unanimous expectations, with analysts assigning a 90.8% likelihood the Fed trims charges by 25 foundation factors at its Sept. 17 assembly.

“The core was as anticipated however CPI beat on the headline quantity, and we predict that retains a 25-bp minimize subsequent week locked in and doesn’t preclude additional cuts in October and December,” mentioned Bloomberg Intelligence chief US charges strategist Ira Jersey.

Nicely-known Bitcoin investor Lark Davis additionally mentioned that “charge cuts are confirmed!”

𝗝𝗨𝗦𝗧 𝗜𝗡: US CPI is available in at 2.9%, as anticipated.

Price cuts are confirmed! pic.twitter.com/iiEVtDi5AK

— Lark Davis (@TheCryptoLark) September 11, 2025

An rate of interest minimize will decrease borrowing prices and enhance liquidity, and sometimes encourages extra bets on riskier asset courses akin to cryptocurrencies.

Bitcoin Slides After The CPI Launch

Regardless of that, the crypto market ticked decrease within the hour after the information, with Bitcoin (BTC) sliding 0.6%, from $114,300 to $113,516. Most of the prime 10 cryptos pulled again as a lot as 1% as properly.

High ten cryptos’ worth efficiency (Supply: CoinMarketCap)

Information from CoinMarketCap exhibits that altcoin chief Ethereum (ETH), Ripple’s XRP, main meme coin Dogecoin (DOGE), and Charles Hoskinson’s Cardano (ADA) took the largest knocks within the prime ten record after the CPI knowledge was launched.

ETH corrected 1.13% to commerce at $4,395.26, whereas XRP, DOGE and ADA, fell 1.13%, 1.83% and 1.67%, respectively.

Greenback Index Drops As Confidence In The USD Weakens

The US Greenback Index (DXY) dropped over 0.3% in the identical interval. The index is a measure of the US greenback relative to a basket of foreign currency echange.

TradingView knowledge exhibits that the index had been in a gentle uptrend over the previous 24 hours. Throughout this era, it rose from 97.627 to a excessive of 98.036. Nevertheless, the most recent inflation launch erased the 24-hour positive factors.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection