Goldman Sachs CEO David Solomon has forecasted a 25-basis-point rate of interest lower by the US Federal Reserve at its upcoming September 17 assembly. He additionally expressed warning a few bigger 50-basis-point discount.

These remarks come as market expectations for a price lower proceed to develop following weaker-than-expected jobs information.

Goldman Sachs CEO Sees Fed Chopping Charges in September

Sponsored

Sponsored

In an interview with CNBC, Solomon famous current job information exhibits ‘some softening’ within the labor market. He urged shut consideration to financial alerts because the 12 months progresses. BeInCrypto just lately reported that the US labor market might have been considerably weaker than beforehand believed.

In accordance with the Labor Division’s Bureau of Labor Statistics, a preliminary annual revision to payroll information indicated the financial system doubtless added 911,000 fewer jobs within the 12 months by March than earlier estimates advised.

The revision factors to common month-to-month payroll development being lower than half of the 147,000 jobs initially reported. This additional evidences the weakening indicators within the labor market.

Whereas Solomon mentioned the financial system remains to be chugging alongside, he emphasised that indicators of weakening have gotten extra evident.

“I’m fairly assured that we’ll have a 25 foundation level lower. Whether or not or not we have now a 50 foundation level lower, I don’t assume that’s most likely within the playing cards,” Solomon informed CNBC.

He additionally left open the potential for one or two extra cuts later, relying on how circumstances develop.

“However there’s no query we’re going to see a slight change, , within the coverage price as we transfer into the autumn. And I feel it’ll be actually information depending on how issues evolve as we undergo the remainder of the autumn as to how that performs,” he added.

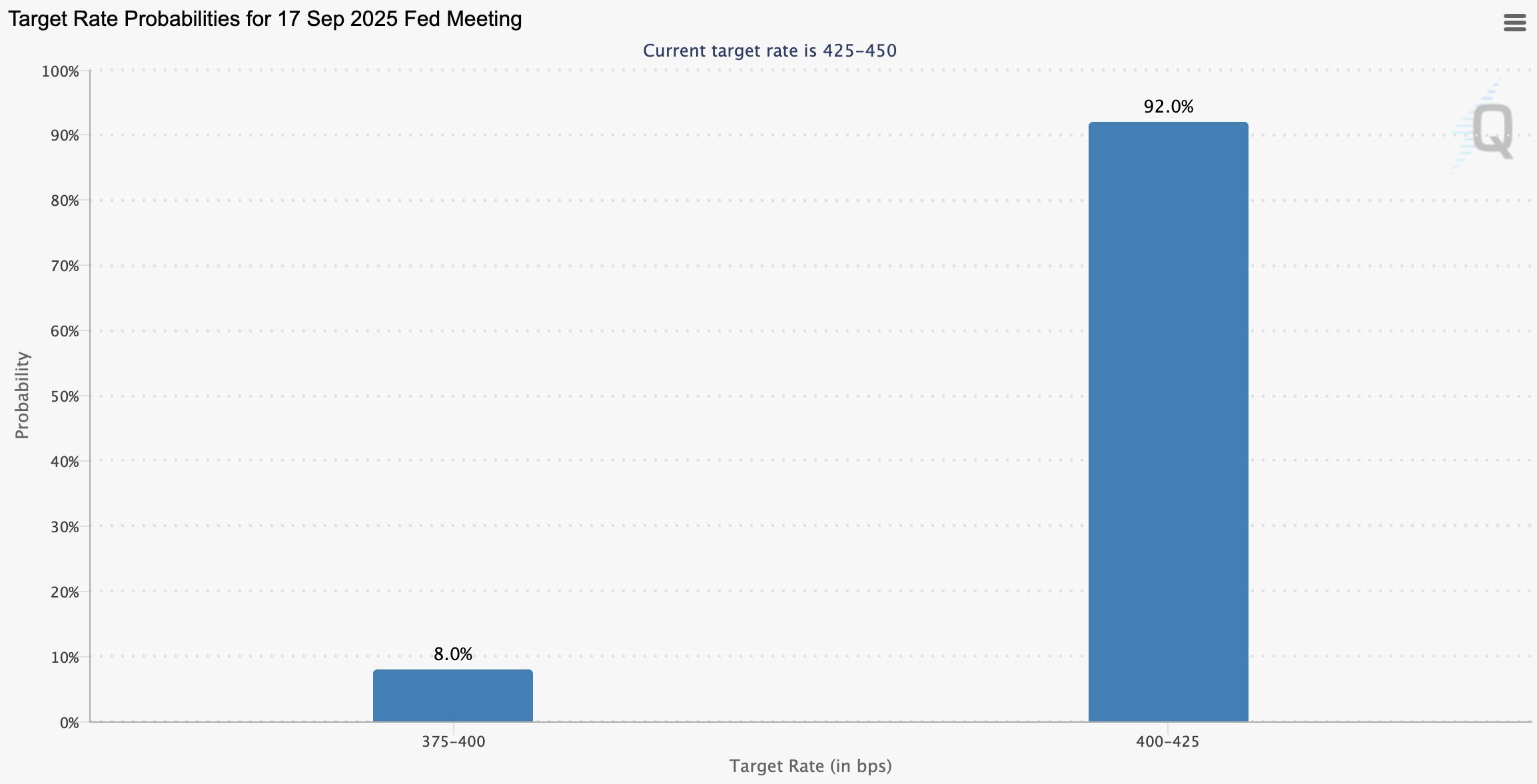

In the meantime, markets seem to share Solomon’s outlook. The CME FedWatch Instrument exhibits a 92% likelihood that the Fed will lower charges by 25 foundation factors subsequent week. In the meantime, the percentages of a bigger 50 foundation level transfer stand at simply 8%.

Sponsored

Sponsored

Regardless of this, Commonplace Chartered has diverged from this view. In accordance with a Reuters report, the worldwide banking group anticipates a extra aggressive 50 foundation level lower after the August jobs report.

Market watchers are additionally advocating for the same lower, citing comparable causes.

“If the Fed knew how unhealthy the labor market actually was, it could have lower 25bps in March and one other 25bps in June/July. There may be each case to be made for a 50bps price lower in Sept,” Zerohedge wrote.

In any case, whether or not the Fed opts for a 25- or 50-basis-point lower, the transfer is broadly anticipated to be bullish for crypto markets, with decrease charges seen as supportive of danger belongings. Whereas a 25 foundation level lower may spark a worth rally, a 50 foundation level transfer would doubtless amplify the affect, offering even stronger momentum for crypto markets.

“There may be now a 100% probability of a Fed price lower in September. 10% probability it’s a 50bps lower. If that occurs, crypto will explode by earlier ATHs!” Mister Crypto commented.

One other analyst famous that no less than a 25-basis-point lower is virtually assured. A 50-basis-point transfer, the analyst added, can be a real shock. This might doubtless unlock extra liquidity throughout Ethereum, decentralized finance (DeFi), altcoins, non-fungible tokens (NFTs), and blockchain gaming.

Because the September 17 assembly approaches, traders and policymakers alike will intently watch incoming financial information.