Be part of Our Telegram channel to remain updated on breaking information protection

Following the success of its spot Bitcoin and spot Ethereum ETFs (exchange-traded funds), asset administration large BlackRock is reportedly trying to tokenize its ETFs on the blockchain.

In response to a Bloomberg report that cited sources aware of the matter, the agency is contemplating tokenizing funds that provide publicity to real-world belongings (RWA). Nevertheless, this transfer could be topic to “regulatory issues,” the report added.

BlackRock Crypto ETFs Entice Billions Of {Dollars} At Report Tempo

BlackRock already presents a number of crypto-related merchandise. These embody ETFs that observe the digital asset market leaders Bitcoin (BTC) and Ethereum (ETH), the iShares Bitcoin Belief and the iShares Ethereum Belief.

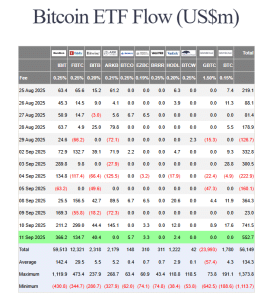

Knowledge from Farside Buyers exhibits that BlackRock’s spot Bitcoin ETF leads the market by way of cumulative inflows, with its complete flows so far standing at $59.513 billion. That is significantly greater than the second-largest fund by way of this metric, which is Constancy’s FBTC with its $12.321 billion in cumulative inflows.

US BTC ETF flows (Supply: Farside Buyers)

Whereas BlackRock’s spot Ethereum ETF has been one of the best performer of all US spot ETH ETFs, it hasn’t gained as a lot traction because the asset supervisor’s BTC product. Thus far, the ETH ETF has seen $12.721 billion in cumulative inflows.

Each BlackRock’s spot Bitcoin and spot Ethereum ETFs reached $10 billion in belongings underneath administration in a single 12 months or much less. This makes them two of solely three such merchandise to hit this milestone.

Along with these ETFs, BlackRock additionally presents lesser-known “thematic” funds just like the iShares Blockchain and Tech ETF, which invests in an index of crypto-related corporations.

BlackRock Already In The Nascent Tokenization House

The reported plans to tokenize its ETFs comes as BlackRock already manages the world’s largest tokenized cash market fund referred to as the BlackRock USD Institutional Digital Liquidity Fund (BUIDL).

That fund crossed the $1 billion mark In March, and now accounts for over $2 billion in managed belongings.

Tokenized equities, together with shares and ETFs, are nonetheless a nascent market regardless of a current uptick in curiosity. Whereas a number of main gamers equivalent to Robinhood and Kraken are presently out there, there’s lower than $500 million value of those belongings in circulation, knowledge from RWA.xyz exhibits.

Prior to now 30 days, there has additionally been a greater than 40% drop within the variety of month-to-month energetic addresses to round 23,940. Month-to-month switch volumes have slid over 22% throughout this era as nicely.

Whereas the reported transfer by BlackRock to tokenize its ETFs will carry the funds on-chain, Bloomberg Intelligence ETF analyst Eric Balchunas questions the “worth add” for shoppers.

In an X publish, he mentioned that tokenization might assist make the “again workplace (plumbing)” within the conventional finance (TradFi) house “extra environment friendly” by way of the utilization of blockchain expertise.

We have to outline the development higher: If by ‘tokenization’ you imply the again workplace (plumbing) of TradFi can be barely extra environment friendly by using blockchain expertise? Then certain, advantageous, most likely will however zzzz. What’s implied tho by the hype is getting precise buyers to promote… https://t.co/SzXROTB9oi

— Eric Balchunas (@EricBalchunas) September 11, 2025

“What’s implied tho by the hype is getting precise buyers to promote $VOO et al and purchase a token a la the way in which ETFs stole from MFs,” he wrote.

“I don’t see the worth add for the buyer,” Balchunas added.

In a follow-up remark, he mentioned BlackRock’s transfer to tokenize its ETFs continues to be “a giant raise,” including that it is sensible to tokenize stuff for those that are already on-chain.

“However the on chain ppl are such a small fraction of the worldwide cash which is why the hype typically feels too heavy for the influence (no less than medium time period),” he wrote.

TradFi Companies Transfer To Safe Dominance Amid Stablecoin Growth, Liquidity Shift

BlackRock is just not the one conventional finance agency that’s rising its presence within the blockchain house.

In April, the Depository Belief & Clearing Company (DTCC) introduced an progressive new platform for tokenized collateral administration utilizing its AppChain infrastructure.

A few months after that in July, Goldman Sachs and BNY Mellon partnered to launch a tokenized cash market funds answer.

Earlier this month, the Nasdaq additionally filed a proposal with the US Securities and Change Fee (SEC) to permit buying and selling of listed securities on its predominant market in tokenized kind.

The push into the tokenization house is a part of a broader effort by tradFi corporations to keep up their dominance because the adoption of stablecoins grows and liquidity begins shifting on-chain.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection