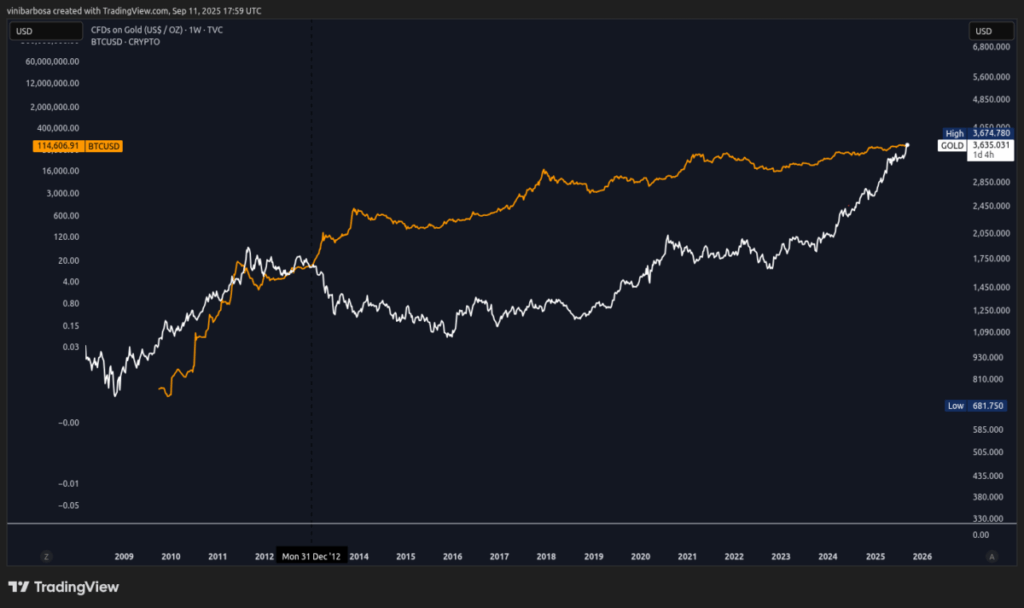

- Gold simply smashed an inflation-adjusted document above $3,635 per ounce, pushed by rising inflation, weak USD, and central financial institution reserve buys.

- Bitcoin is holding close to $114,600, traditionally shifting in sync with gold, and might be organising for its personal breakout.

- With the Fed eyeing fee cuts and Tether minting $2B USDT, liquidity could gasoline BTC’s subsequent huge rally.

Gold simply pulled off one thing it hasn’t executed for the reason that Eighties—hit an inflation-adjusted document above $3,635 an oz. The timing is uncanny too, with inflation nonetheless biting and whispers of Federal Reserve fee cuts on the horizon. In the meantime, Bitcoin is cruising round $114,600, and lots of are questioning if the so-called “digital gold” could be able to comply with the identical trajectory.

Gold’s Dream Setup

So how did we get right here? Inflation-adjusted pricing is principally a option to measure gold’s actual worth towards at present’s greenback. And proper now, it’s at ranges not seen in over 4 many years. The most recent CPI numbers got here in hotter than anticipated—2.9% in August in comparison with 2.7% in July. That uptick, blended with stubbornly excessive core inflation, has turned gold into each central financial institution’s favourite hedge.

Rising market giants like China, India, Russia, and Turkey are scooping up gold reserves, all making an attempt to chop down reliance on the US greenback. Add in a weaker greenback index and ongoing geopolitical messes—commerce wars, Center East flare-ups, even election-year drama—and also you’ve obtained the right storm for gold’s run.

Bitcoin’s Shadow Play

Now, right here’s the place Bitcoin slides into the image. Traditionally, BTC and gold transfer in sync throughout these cycles, each pitched as hedges towards inflation and uncertainty. The kicker is, Bitcoin doesn’t simply shadow gold—it tends to overshoot as soon as it will get momentum. Proper now, BTC sits at $114,600, consolidating whereas gold rips larger, however some analysts suppose the lag is momentary.

Tether simply minted $2 billion in USDT, a transfer not seen since late 2024, and that type of liquidity injection usually precedes a crypto surge. Market watchers say Bitcoin seems prefer it’s gearing up for its personal breakout second, particularly if fee cuts arrive and threat property catch one other bid.

For now, gold is clearly carrying the crown, however Bitcoin’s nonetheless ready within the wings. And if historical past’s any information, the handoff won’t be distant.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.