- Solana jumped previous $228 after Chinese language style model MOGU invested $20M in BTC, ETH, and SOL, whereas Security Shot added $5M in BONK.

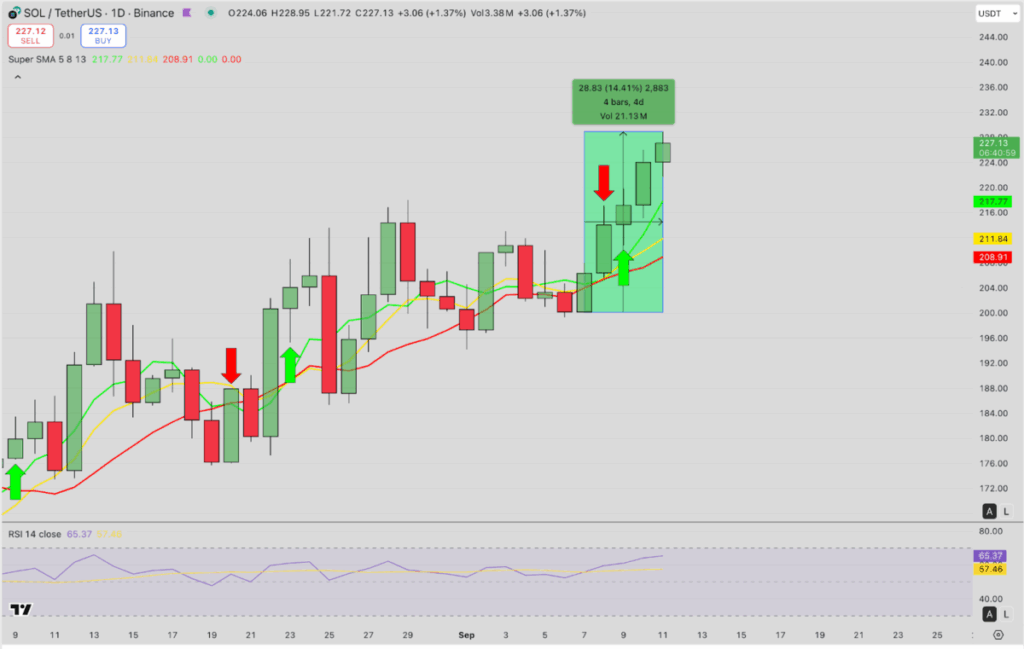

- A golden cross on the each day chart fueled a 14% rally in 4 days, with RSI at 65 displaying extra room to run.

- Key help sits at $217–$208, whereas upside targets stay at $240–$250 if momentum holds.

Solana simply retains climbing. After 4 straight inexperienced days, SOL tacked on one other 2% Thursday, nudging previous $228 for the primary time since February. The spark this time? A shock $20M treasury allocation from Chinese language style group MOGU—and, on high of that, Nasdaq-listed Security Shot threw $5M into BONK, Solana’s meme darling. Momentum feels heavy, and with a golden cross flashing on the each day chart, merchants are already eyeing the $240–$250 vary.

Company Money Goes World

MOGU confirmed in a press launch that its board authorised as much as $20M in digital belongings—spreading throughout Bitcoin, Ethereum, and naturally, Solana. It’s a powerful sign that the company treasury development isn’t simply U.S. corporations anymore. In the meantime, Security Shot created a subsidiary to handle its digital belongings and stacked $5M price of BONK, boosting its holdings to over $63M. Between China’s company entry and U.S. public companies doubling down, Solana’s ecosystem feels prefer it’s in the midst of a critical adoption wave.

Golden Cross Fuels the Rally

On the charts, issues look simply as bullish. Earlier this week, Solana’s 5-day transferring common crossed above the 8-day and 13-day averages—your basic golden cross. Since then, SOL has surged 14% in 4 days, whereas RSI hangs at 65—sturdy however not overheated but. Value is holding effectively above help at $217, maintaining the bullish setup intact. If momentum retains rolling, $240 is the near-term wall, with $250 looming as the subsequent huge take a look at.

Key Ranges to Watch

Nonetheless, it’s not all upside. If SOL slips again under $217, bears may drag it towards $208 the place the 13-day common sits. However with quantity up 4% intraday—outpacing the precise worth transfer—speculative longs are sniffing round. The takeaway? Company inflows + technical alerts = a recipe for merchants to remain lengthy, except the market throws a curveball.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.