Keep within the loop with our weekly crypto digest as we get you on top of things on the most well liked developments and occasions within the crypto house.

Right here’s what occurred in crypto this week:

Michael Saylor’s ‘Technique’ Fails To Be Listed In The S&P 500

Technique (previously MicroStrategy), regardless of assembly all standards, was handed over for S&P 500 inclusion within the newest rebalancing, with Robinhood taking a shock spot as an alternative.

The S&P 500 committee missed MicroStrategy, even with its huge Q2 income and $10 billion internet revenue. Robinhood’s inclusion as an alternative has raised eyebrows within the crypto and finance communities.

This snub may dampen investor enthusiasm for MicroStrategy as a Bitcoin proxy. In the meantime, conventional finance’s hesitance to embrace crypto publicity by fairness indices stays evident.

Robinhood To Be part of S&P 500

Robinhood Markets has been added to the S&P 500, marking a brand new part for the retail buying and selling platform that helped outline the pandemic-era growth in particular person investing. The corporate will be a part of the benchmark within the newest quarterly rebalance.

AppLovin, an advert know-how agency, may even exchange MarketAxess Holdings, whereas Robinhood, a inventory buying and selling app operator, will take the spot of Caesars Leisure.

AppLovin and Robinhood will be a part of the S&P 500 index earlier than buying and selling begins on September twenty second.

Nasdaq Approves SOL Methods Itemizing

Nasdaq has greenlit SOL Methods for itemizing, a serious win for Solana publicity in conventional markets. This transfer bridges the hole between crypto and TradFi, doubtlessly boosting institutional curiosity in $SOL.

SOL Methods, typically dubbed the “MicroStrategy of Solana,” holds vital $SOL in its treasury and operates validators. Its Nasdaq itemizing below the ticker $STKE indicators a pivotal step for regulated crypto funding autos.

Tokenizing shares on Solana through platforms like Opening Bell hints at 24/7 buying and selling and international entry. This might redefine market infrastructure, aligning TradFi with blockchain’s effectivity and accessibility for next-gen traders.

If SOL ETFs face delays, SOL Methods may stay a major avenue for regulated publicity.

Ledger CTO Says NPM Assault Had Minimal Affect

Ledger CTO Charles Guillemet confirmed the current NPM provide chain assault concentrating on the corporate’s software program failed, with “virtually no victims” reported.

The exploit sought to compromise developer instruments however was swiftly detected and neutralized, stopping harm. Ledger careworn that person wallets and funds have been by no means in danger.

The incident highlights the rising sophistication of cyberattacks in crypto but in addition exhibits the effectiveness of fast protection and monitoring methods.

SOL Methods Debuts On Nasdaq With $94M Solana Treasury

SOL Methods, a Canadian agency centered on Solana infrastructure, has joined the Nasdaq World Choose Market below ticker STKE, whereas additionally retaining its Canadian itemizing as HODL.

The corporate holds 435,064 SOL tokens in its treasury, valued at roughly $94 million, making it the primary Solana-native treasury to debut on Wall Road.

This transfer highlights Solana’s rising institutional visibility and additional bridges crypto infrastructure with conventional finance.

Hyperliquid Stablecoin Proposals Face ‘Backroom Deal’ Allegations

Hyperliquid’s push to launch a local stablecoin, USDH, has ignited controversy after its name for proposals drew scrutiny from the neighborhood.

A bid from Native Markets raised questions when observers famous its funding was secured simply 5 hours earlier than the announcement, suggesting uncommon timing.

Competing mission Hyperstable alleged that Native Markets had been tipped off, intensifying accusations of insider benefit.

The controversy has solid doubt on Hyperliquid’s decentralized governance, with critics warning that transparency points may erode neighborhood belief.

Kraken Launches xStocks With Tokenized U.S. Equities On Solana

Kraken has unveiled xStocks, a brand new product providing tokenized variations of over 50 U.S. shares and ETFs, together with Apple, Tesla, and Nvidia, to European and international markets.

Every token is issued on Solana and backed 1:1 by actual shares by Backed Finance, making certain full collateralization and transparency.

The launch permits 24/5 buying and selling entry for non-U.S. traders, together with self-custody and DeFi integration choices.

This rollout marks a big step in merging conventional equities with blockchain, increasing international entry to U.S. monetary markets.

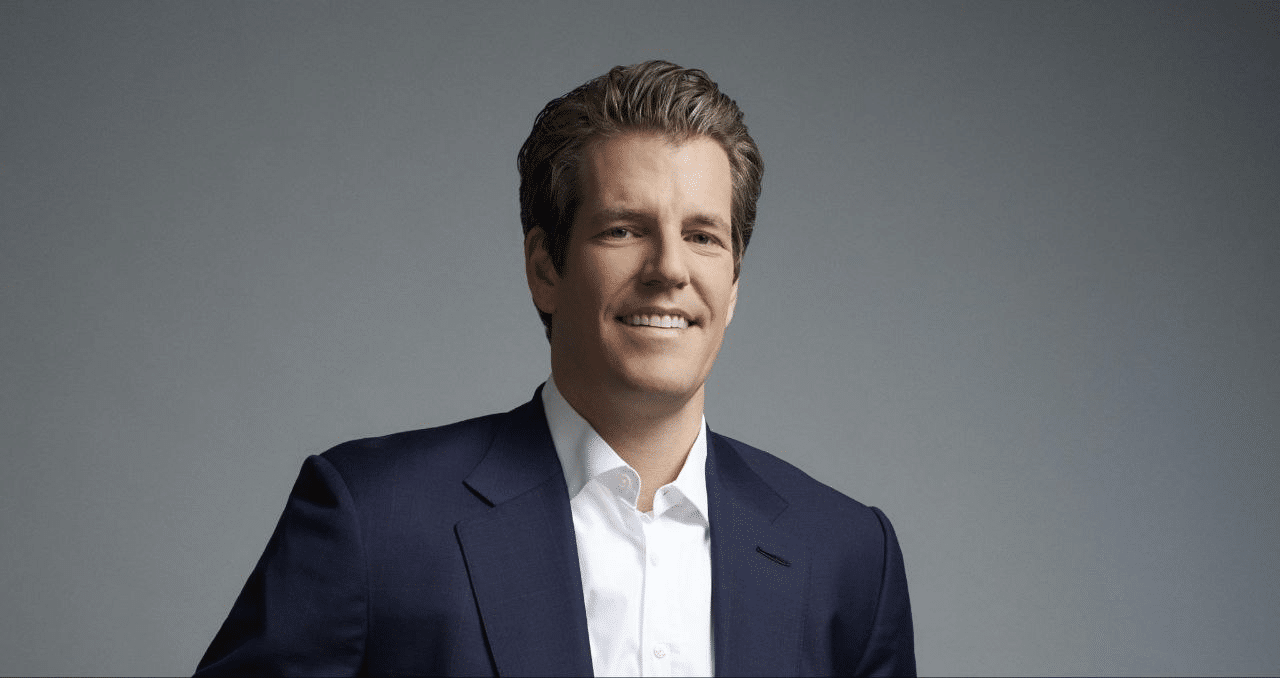

Trump’s CFTC Nominee Says Winklevoss Tried To Affect Appointment

President Trump’s nominee to steer the Commodity Futures Buying and selling Fee disclosed textual content messages alleging Gemini co-founder Tyler Winklevoss tried to sway his appointment.

The exchanges have been submitted in an ethics submitting, drawing scrutiny over potential conflicts of curiosity between crypto executives and federal regulators.

Winklevoss has but to concern a public response, leaving questions in regards to the function of business lobbying in U.S. regulatory appointments.

Dogecoin Contributor Warns Of Volatility Amid ETF Hypothesis

Dogecoin contributor Mishaboar cautioned that current value surges tied to ETF hypothesis may carry heightened volatility within the weeks forward.

He pointed to media hype, institutional flows, and social momentum as key drivers of potential sharp swings in DOGE’s worth.

Mishaboar urged merchants to handle danger fastidiously, take income, and keep away from leverage, stressing solely to take a position what they’ll afford to lose.

U.S. Inflation Rises 2.9% in August, In Line With Forecasts

The Shopper Value Index climbed 2.9% year-over-year in August, precisely matching economists’ projections of a modest pickup.

The rise displays the affect of President Trump’s tariffs filtering by the economic system, including upward stress to client costs.

The info suggests inflation stays manageable however highlights how commerce insurance policies proceed to form prices throughout key sectors.

Ultimate Ideas

In order that’s it for this week!

To remain forward of the sport with the freshest crypto information and insights delivered straight to your inbox, contemplate subscribing to UseTheBitcoin’s publication at the moment.

Have a unbelievable week forward!