Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

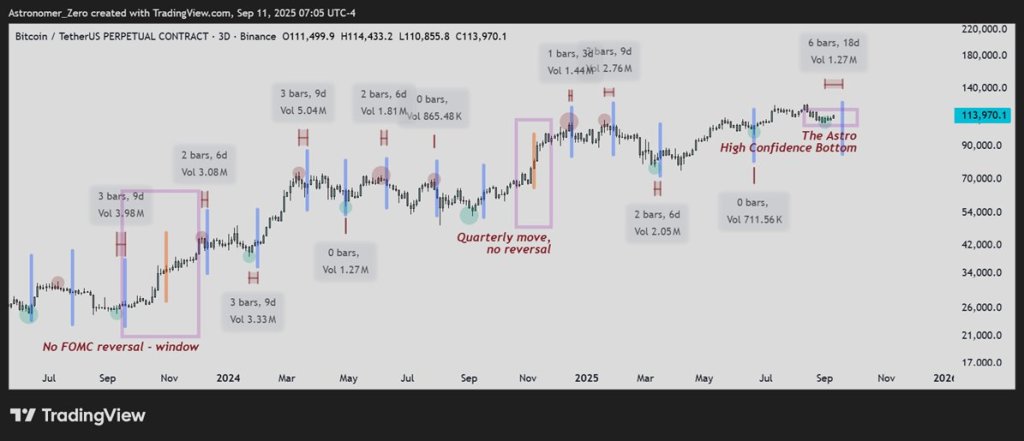

Bitcoin’s present rebound off the $107,200 low has sparked renewed debate over whether or not the market has already set its native backside and is positioned to rally increased.. Unbiased analyst Astronomer (@astronomer_zero) argues that the likelihood is “90%+” that the low has been planted, citing each value construction and his recurring “FOMC reversal confluence” framework as affirmation.

Analyst Claims 90% Likelihood The Bitcoin Backside Is In

Astronomer, who publicly documented his short-term bearish name from $123,000 all the way down to the $110,000–$111,000 zone, revealed that he flipped lengthy because the goal was reached in late August. “Alright, as if the confluences of my confidence within the backside being within the $110k space on the finish of August weren’t robust sufficient … there now could be one other confluence lining up,” he wrote. In response to him, the Federal Reserve’s coverage assembly cycle has traditionally functioned as a turning level for Bitcoin tendencies.

Associated Studying

He defined: “The FOMC assembly knowledge reverses the continuing pattern at minimal 0 bars (on the date), or 6 bars at most earlier than the date, and it has finished that accurately 90%+ of the occasions. The few occasions it hasn’t, was as a result of our quarterly lengthy took over (which has extra energy).” In apply, Astronomer argues, markets front-run the occasion, as insiders and well-capitalized gamers set the post-FOMC route earlier than retail sentiment digests the result.

With the subsequent FOMC scheduled for September 18, he contends the downtrend from $123,000 to $110,000 already exhausted itself forward of schedule. “Now with FOMC developing … the low is probably going already planted, and the pattern reversed to up once more,” he mentioned.

The analyst contrasted his methodology with the broader crypto commentary ecosystem, the place many influencers proceed to forecast additional draw back and a “purple September.” He known as such views “utter nonsense” rooted in surface-level seasonality. “Each time it does work, it crops its backside earlier than the precise assembly to entrance run the anticipation … insiders have already got set the put up FOMC value route, whatever the end result,” he wrote, stressing that counting on generic “watch out” warnings forward of central financial institution occasions misses the structural shift.

Associated Studying

After his lengthy entry at $110,000, Bitcoin has since climbed above $115,000, prompting Astronomer to declare September’s bearish thesis already invalid. “ September will shut inexperienced. Yup, Septembears formally 6% within the incorrect now. As September opened at 108,299, and value is now at 115,000. That places September within the higher historic quartile of how inexperienced it’s in the intervening time,” he famous.

He additional pointed to the final two years as proof that September’s fame as a seasonally weak month for Bitcoin has misplaced statistical edge. “A sure month certainly doesn’t should be inexperienced. ‘Seasonality’ is only a cookie cutter model of correctly utilizing cycles. Take a look at final two years, September has additionally been inexperienced and imply to the bears,” he wrote.

For Astronomer, the conclusion is obvious: “When many confluences level in the identical route, it normally means you could have solved the rubik’s dice accurately and so can confidently consider.” Nonetheless, he tempered the conviction with danger administration self-discipline, stating: “In fact, I may at all times be incorrect, though it has been a very long time we misplaced a commerce, by no means go all in. Take a good measurement danger and sleep sound.”

With Bitcoin holding above $115,000 and the FOMC assembly days away, the market’s near-term verdict on whether or not a sustainable backside has shaped might arrive sooner slightly than later.

Featured picture created with DALL.E, chart from TradingView.com