Merchants are utilizing leverage in an try to elevate bitcoin again to report highs, making a high-risk atmosphere that would end in a derivatives unwind to the draw back if value begins to shift the opposite approach.

Market analyst Skew warned one dealer intent on opening a nine-figure lengthy place to “perhaps watch for spot to hold the shopping for so it would not create poisonous flows.”

Bears are additionally including leverage, with a separate dealer presently coping with a $7.5 million unrealized loss after shorting BTC to the tune of $234 million with an entry at $111,386. That dealer added $10 million value of stablecoins to take care of their place, with the liquidation presently standing at $121,510.

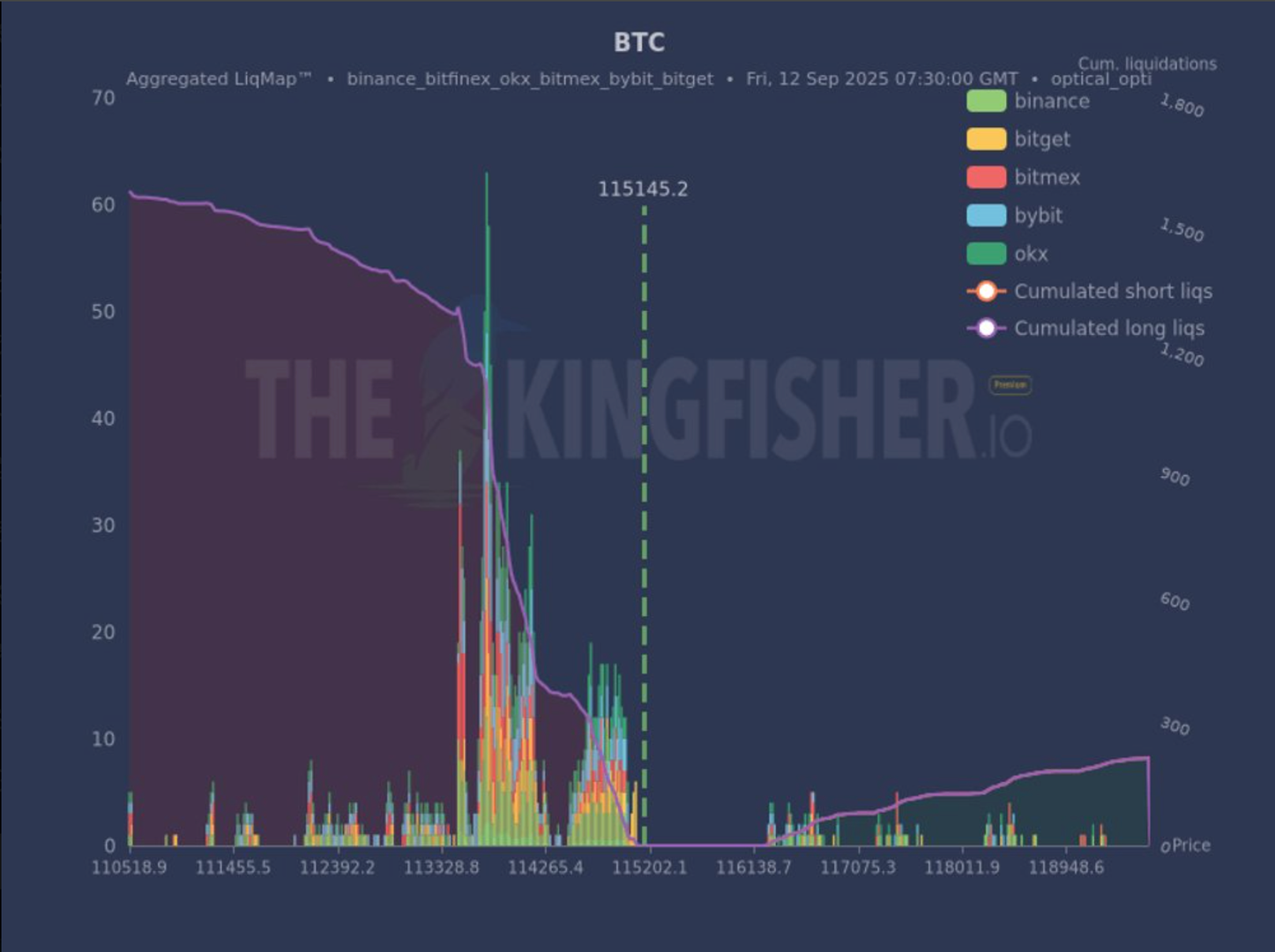

However the main liquidation threat is current to the draw back, with knowledge from The Kingfisher displaying a big pocket of derivatives might be liquidated between $113,300 and $114,500, which may doubtlessly immediate a liquidation cascade again to the $110,000 stage of assist.

“This chart reveals the place merchants are over-leveraged,” wrote The Kingfisher. “It is a ache map. Value tends to get sucked into these zones to filter positions. Use this knowledge so you do not find yourself on the mistaken aspect of an enormous transfer.”

Bitcoin is presently buying and selling quietly round $115,000 having entered a interval of low volatility, failing to interrupt out of its present vary for greater than two months.