Digital Asset shares break up this week as spot costs stayed flat, with sharper alerts rising from public corporations holding digital property.

Analysis agency 10x Analysis mentioned the sector is dividing between constrained incumbents and new winners. Premiums that when fueled development have compressed, elevating stress dangers as liquidity shifts.

Sponsored

Sponsored

Treasuries Down, Companies Rebound

Bitcoin’s flat efficiency contrasts with widening splits, which 10x Analysis warned may precede a extra dramatic rotation.

“What seems as consolidation could, the truth is, be the calm earlier than a pointy rotation.”

MicroStrategy, as soon as essentially the most aggressive purchaser of bitcoin, now faces limits. Its internet asset worth (NAV) a number of fell from 1.75x in June to 1.24x in September, curbing new purchases. The inventory slid to $326 from $400, displaying how the treasury mannequin weakens with out premium assist.

The skepticism is echoed exterior analysis desks.

“My finest monetary recommendation continues to be that you need to simply purchase bitcoin in order for you publicity to it and that you need to keep as far-off from $MSTR as attainable — as a result of it’s sophisticated, layered and also you lose management.”

The remark, from investor and podcaster Jason, underscored issues that treasury shares can add complexity somewhat than direct publicity.

Metaplanet, usually referred to as “Japan’s MicroStrategy,” plunged 66% amid tax coverage worries this summer time. Regardless of buying and selling close to 1.5x NAV, volatility stays excessive, with retail flows conserving it unstable.

Sponsored

Sponsored

Circle, in contrast, rebounded 19.6% since September 9 after USDC adoption expanded via a Finastra partnership. 10x Analysis reaffirmed a bullish stance, calling Circle extra engaging than Coinbase as a liquidity beneficiary.

Choices Reset, Pressuring Treasury Companies

Alongside these fairness shifts, the derivatives market signaled calm. 10x reported that BTC implied volatility fell 6% and ETH 12% on September 12 expiries after softer producer costs and in-line CPI. Merchants bought volatility aggressively, treating situations as steady. But 10x warned that compressed premiums and low choice pricing may set the stage for a sharper squeeze if flows reverse.

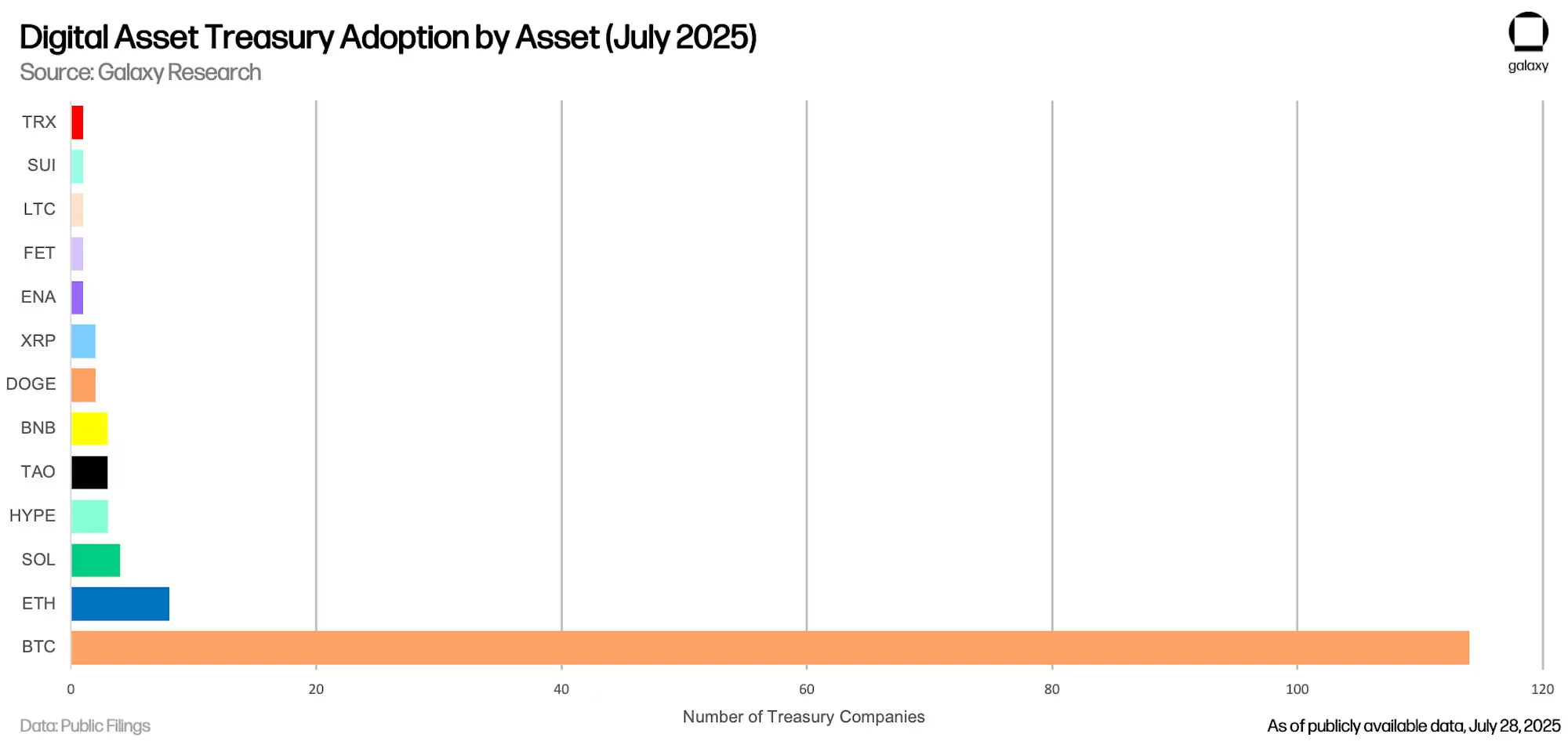

Galaxy Analysis estimated that digital asset treasury corporations (DATCOs) now maintain over $100 billion in crypto, led by Technique (previously MicroStrategy), Metaplanet, and others. The mannequin thrives on fairness premiums, however collapsing valuations threaten capital entry. Galaxy cautioned that At-the-Market choices and PIPEs gas development in bull cycles however can backfire in downturns.

The Month-to-month Outlook from Coinbase Institutional described the sector as coming into a “PvP stage” the place success will depend on execution, not imitation. It argued that the easy-premium period is over, although DAT flows nonetheless assist Bitcoin into late 2025.

BeInCrypto reported that treasury companies’ shopping for has slowed, and several other ETH-focused corporations now commerce under mNAV, limiting fundraising and elevating dangers of compelled gross sales. It additionally famous that smaller gamers counting on debt face heightened vulnerability, with liquidation cascades a looming risk.

The end result for bitcoin could hinge on whether or not Circle’s rebound builds confidence or whether or not NAV compression throughout incumbents sparks stress. For now, choices counsel calm, however the divergence amongst treasury shares exhibits a cycle beneath pressure.