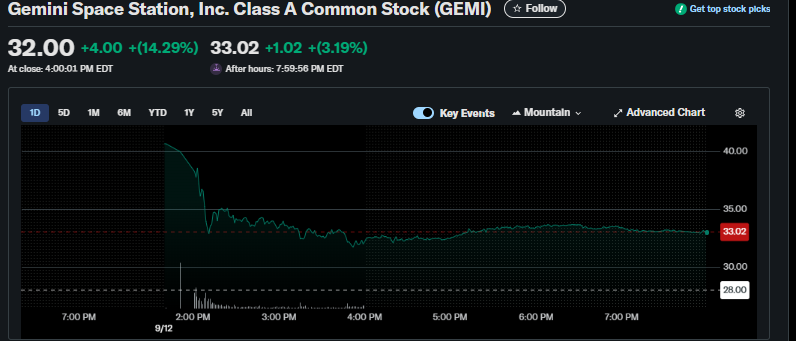

- Gemini (GEMI) surged 24% in its Nasdaq debut, elevating $425M at $28 per share, effectively above its preliminary goal vary.

- The IPO valued Gemini at $1.3B, highlighting robust institutional demand for crypto-related equities.

- Gemini’s itemizing joins a wave of sizzling crypto IPOs in 2025, with Circle and Determine additionally seeing large first-day good points.

Gemini (ticker GEMI) made a loud entrance on Wall Road, kicking off its Nasdaq debut with fireworks as shares spiked greater than 24% on day one. The Winklevoss twins’ alternate raised a hefty $425 million, including gasoline to what’s rapidly turning right into a full-blown crypto IPO growth.

At one level Friday morning, GEMI shot previous $40 earlier than cooling off to round $35 by the afternoon. Even with the dip, the contemporary itemizing nonetheless locked in a market cap close to $1.3 billion—strong numbers for a platform that isn’t even one of many prime exchanges by buying and selling quantity. Buyers, clearly, are shopping for the story.

IPO Frenzy and Investor Starvation

Gemini priced its IPO at $28 a share, effectively above the $17–$19 whispers from earlier drafts. Demand was so robust the ultimate vary was pushed to $24–$26, and but the inventory nonetheless overshot. With 15.2 million shares floated, the twins walked away with $425 million raised, exhibiting there’s no scarcity of urge for food for regulated U.S. crypto performs.

The timeline was quick, too. Gemini filed its S-1 with the SEC on September 2 and was buying and selling on the Nasdaq simply 10 days later. A dash like that solely occurs when markets are sizzling, and proper now, traders appear desirous to latch on to something tied to digital property.

Extra Than Simply Gemini—Crypto IPO Wave

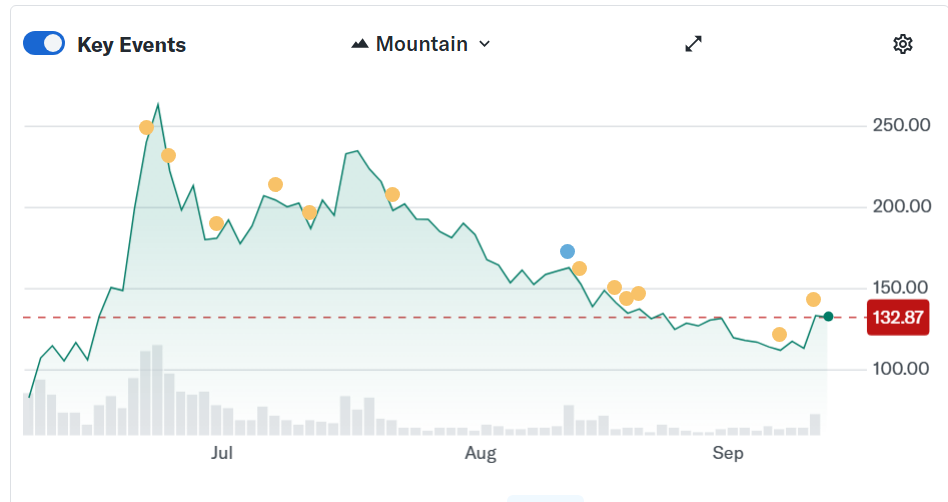

This isn’t an remoted case. Crypto IPOs have been red-hot in 2025. Stablecoin big Circle (CRCL) has been the most important headline grabber, with its inventory hovering over 160% since launch and now buying and selling above $60. That offers it a market cap north of $33 billion, placing it in uncommon firm.

Then there’s Determine Know-how Options (FIGR), which popped 24% on its first day, including one other 12% the following session. And even exterior of straight IPOs, firms like Mega Matrix (MPU) are pivoting exhausting into crypto, unveiling multi-billion-dollar plans round stablecoins. Its inventory has been whipsawing however continues to be up 150% prior to now six months.

The Larger Image

For Gemini, the robust debut underscores two issues: investor religion in regulated exchanges and the broader starvation for crypto fairness publicity. Whereas Bitcoin, Ethereum, and different tokens stay unstable playgrounds, public markets are signaling they need in on the upside too—solely with ticker symbols and quarterly filings connected.

The Winklevoss twins may not run the most important alternate, however Friday’s rally proved they’re nonetheless among the many loudest names within the sport.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.