Be part of Our Telegram channel to remain updated on breaking information protection

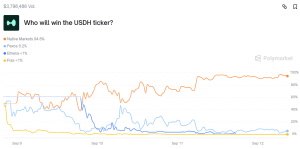

Polymarket odds that Native Markets will win the bid for Hyperliquid’s USDH stablecoin have soared to 94.8% after Ethena Labs withdrew its software.

That’s after the percentages on the favored decentralized betting platform that Native Markets will win the bid jumped over 25% within the final 24 hours.

USDH bidding odds (Supply: Polymarket)

In a contract that requested which of the bidding issuers will win, merchants on Polymarket additionally mentioned there’s a 5.2% vote that Paxos, a widely known stablecoin issuer that helped launch PayPal’s PYUSD token, will win the Hyperliquid stablecoin bid.

Ethena Labs Withdraws From USDH Bidding

The hovering confidence that Native Markets will win the Hyperliquid stablecoin bid comes after the founding father of Ethena Labs, Man Younger, mentioned his group “will respectfully be withdrawing” its proposal for the stablecoin launch.

In an X submit, the founder mentioned that the choice adopted “direct discussions with people locally and validators.”

Throughout these discussions, issues round Ethena not being a Hyperliquid native group, Ethena’s different product traces outdoors of USDH, and Ethena’s ambitions that “lengthen past working with only one accomplice change,” popped up, which Younger mentioned finally led to the choice.

In its proposal, Ethena had mentioned that it might make USDH 100% backed by its personal USDtb stablecoin. The token is presently issued by way of Anchorage Digital Financial institution and is collateralized by BlackRock’s BUIDL fund, which the group mentioned would give USDH institutional credibility.

Ethena Labs had additionally pledged 95% of internet income that was generated from the USDH reserves to the Hyperliquid group by way of HYPE token buybacks, contributions to the Help Fund and distributions to validators. The venture additionally dedicated at the very least $75 million for ecosystem improvement and incentives.

Earlier than Ethena Labs withdrew its proposal, Arthur Hayes had additionally added to his holdings within the venture’s native ENA token.

Earlier this week, he purchased 1.34 million tokens for 1.02 million USD Coin (USDC), in keeping with on-chain knowledge cited by Lookonchain in a Sep. 12 X submit.

Arthur Hayes(@CryptoHayes) spent 1.02M $USDC to purchase 1.34M $ENA once more previously 8 hours and presently holds 4.45M $ENA(3.48M).https://t.co/eSqihcbm6e pic.twitter.com/qahbRH28Sh

— Lookonchain (@lookonchain) September 9, 2025

ENA noticed its value drop a fraction of a proportion within the final 24 hours as some buyers doubtless bought after the USDh proposal was scrapped. As of three:15 a.m. EST, ENA trades at $0.7814, in accordance to CoinMarketCap knowledge. Regardless of the minor pullback, the altcoin continues to be sitting on a weekly acquire of greater than 17%.

Crypto Group Says There Is Some Bias In Voting Course of

Native Markets is a comparatively newcomer available in the market. It was based by Max Fiege, who’s a outstanding early advocate, investor and builder throughout the Hyperliquid ecosystem.

Given how odds that Native Markets, though it’s a newcomer, surged, some within the crypto group argue that the USDH voting course of was set as much as favor the venture given its founder’s ties to the Hyperliquid ecosystem.

Earlier this week, Dragonfly co-founder Haseeb Qureshi mentioned the method was “a little bit of a farce,” and added that it appeared like Hyperliquid insiders had already decided that Native Markets would win the bid.

Beginning to really feel just like the USDH RFP was a little bit of a farce.

Listening to from a number of bidders that not one of the validators are taken with contemplating anybody moreover Native Markets. It isn’t even a severe dialogue, as if there was a backroom deal already achieved.

Native Markets’… pic.twitter.com/qrc9xChv6z

— Haseeb >|< (@hosseeb) September 9, 2025

In the meantime, OAK Analysis chief working officer and co-founder Lilian Aliaga additionally advised there may very well be some “bias at play,” and questioned how the comparatively newcomer to the market was capable of submit a bid so rapidly after Hyperliquid first opened the USDH RFP that garnered the vast majority of the validator vote.

Aliaga went on to say that he’s not that assured that Native Markets would be capable of “flip USDH right into a multi-billion stablecoin,” including that there appears to be a “huge hole between the ambitions round USDH and what’s truly occurring.”

Native Markets co-founder Max Fiege responded to the group issues in a current X submit.

“We’ve spent the previous six days participating with validators and members of the group, new and outdated, addressing questions and issues that they had about our imaginative and prescient and the way we’ll see it by means of,” Fiege wrote within the submit.

“We all know we’re a brand new group and don’t take the burden to show ourselves evenly,’ the co-founder added.

You additionally addressed the criticism round Native Markets, and mentioned “no person cares how huge you’re, your background, pedigree or monetary assets.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection