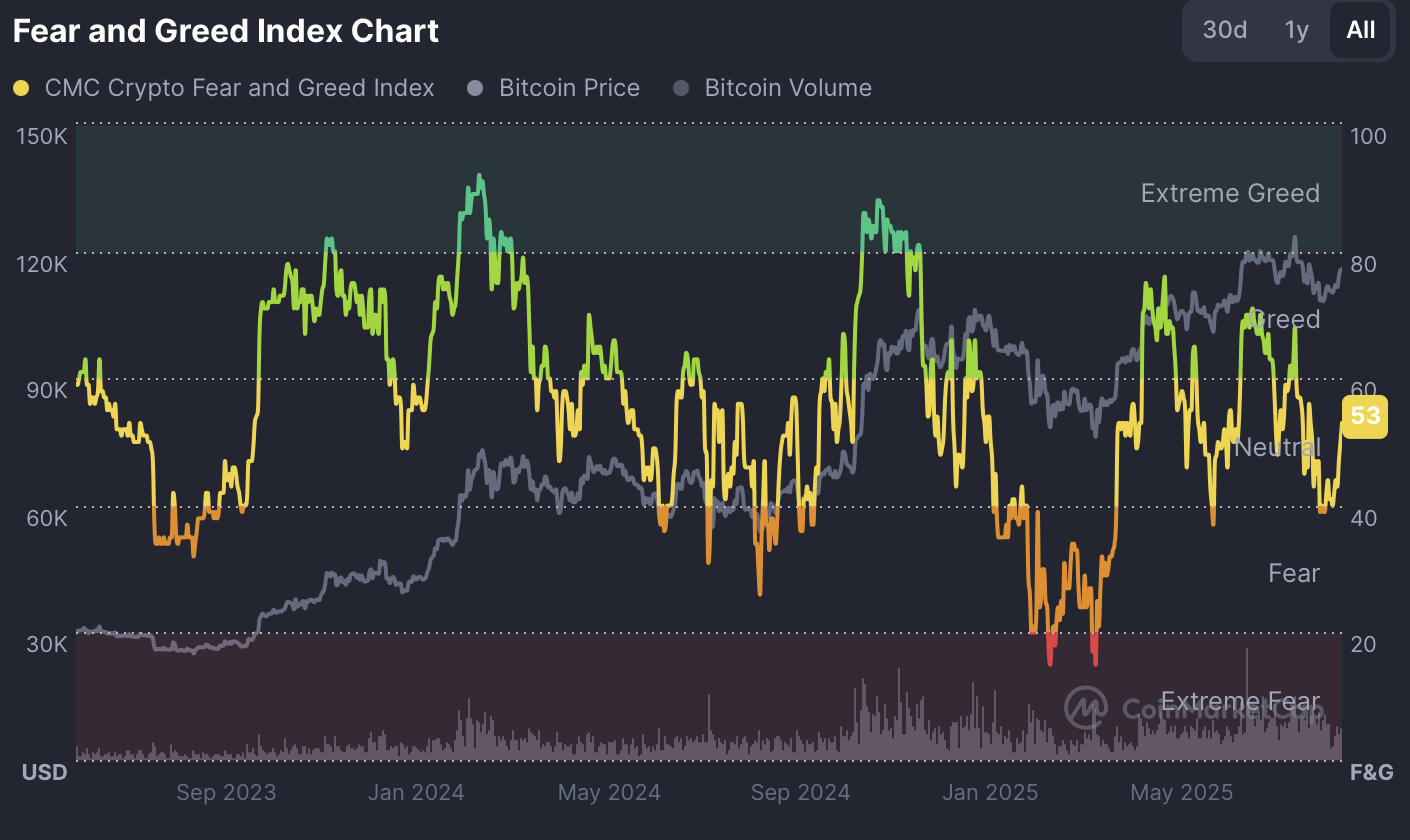

The crypto market is treading rigorously as sentiment steadies within the impartial zone, in accordance with the CoinMarketCap Concern & Greed Index, which printed 53/100 on Saturday.

That marks a climb of three factors in 24 hours and a 12-point achieve over the previous week, reflecting a shift away from worry, although not but into outright greed.

Sentiment lifts however warning lingers

The index’s rise from 41 final week to its present stage suggests a notable enchancment in danger urge for food. Whereas nonetheless beneath final month’s greed studying of 63, the market has exited the lower-neutral band for the primary time since August. Analysts see this as a neutral-leaning-bullish setup, supported by ETF inflows and rising altcoin participation.

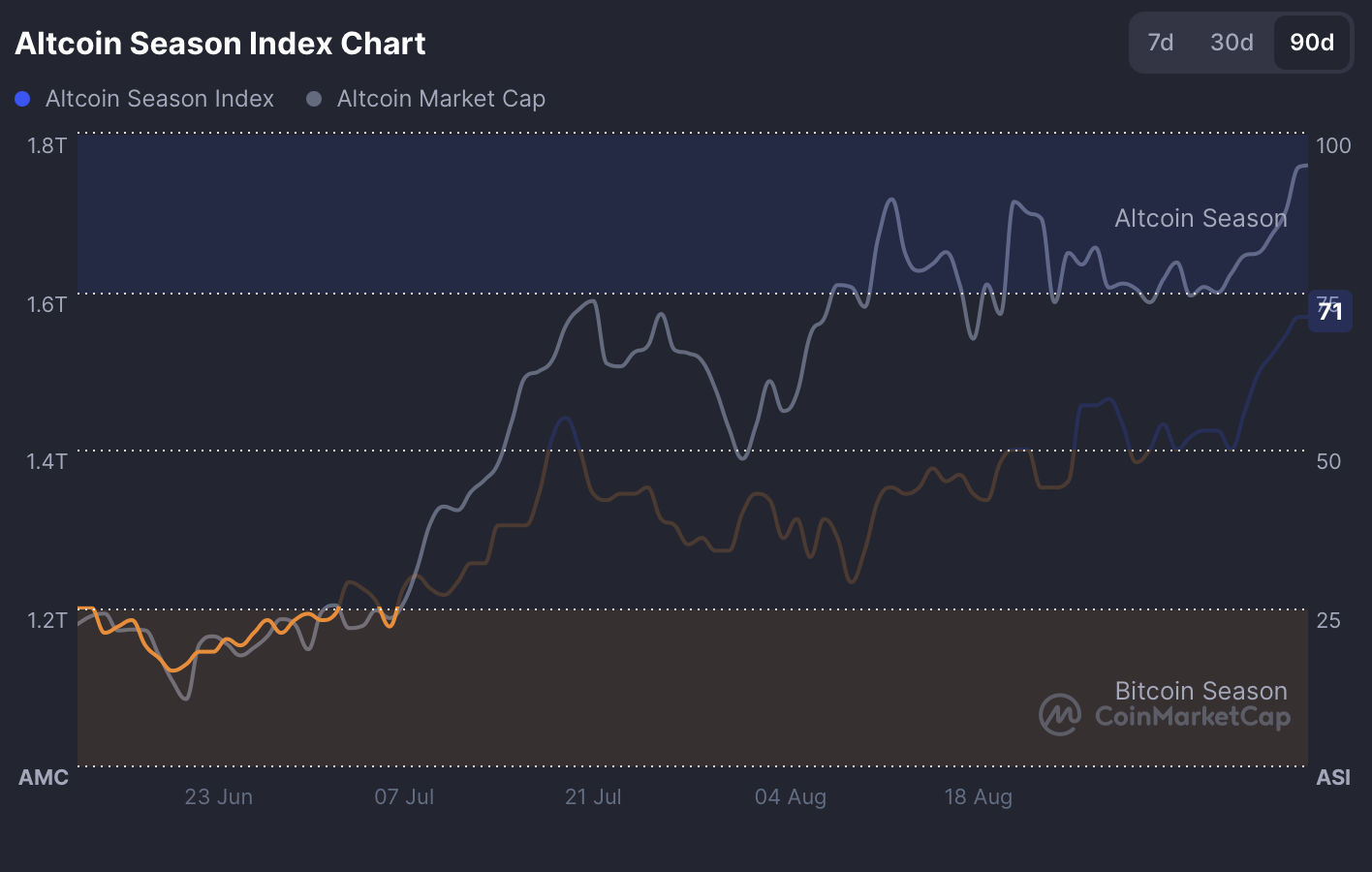

Altcoin rotation strengthens

Rotation into altcoins has accelerated sharply. The Altcoin Season Index surged to 71, up 34% in every week and shutting in on the 75 threshold that alerts a full-blown “altseason.” On the identical time, Bitcoin dominance slipped to 56.72%, down 1.1% on the week, as Ethereum and different massive caps gained floor.

Derivatives markets level to more healthy situations too, with open curiosity falling 6.7% in 24 hours, suggesting leverage is unwinding and lowering short-term volatility dangers.

Nonetheless, there are indicators of froth. The TOTAL2 index (altcoin market cap excluding Bitcoin) exhibits an RSI of 78.68, flashing short-term overbought situations.

Establishments drive inflows, retail stays cautious

The institutional narrative stays firmly bullish. Spot Bitcoin and Ethereum ETFs pulled in $1.05 billion of inflows on September 12, whereas Tether unveiled USAT, a U.S.-regulated stablecoin initiative led by former White Home official Bo Hines. Each developments underscore the rising foothold of conventional finance in digital property.

However retail issues linger. FTX-linked wallets moved $45 million in Solana (SOL) to exchanges, fueling sell-side danger, whereas scrutiny over reserves at exchanges corresponding to Gate continues to forged a shadow.

The underside line

The crypto market sits at a fragile crossroads. Sentiment has turned cautiously optimistic, with altcoins clearly benefiting from capital rotation and institutional flows reinforcing the bullish case. But overbought technicals and legacy dangers remind merchants that momentum can nonetheless reverse shortly.