Ethereum’s rally towards the $5,000 mark is reframing its position in international markets. The asset is transitioning from a speculative token right into a reserve selection for establishments and large-scale traders.

A CryptoQuant report revealed that surging ETF inflows, aggressive whale accumulation, and document staking ranges are driving this modification.

Ethereum ETFs Anchor Institutional Demand

Sponsored

In line with the report, Ethereum ETFs have emerged as a defining catalyst on this rally. The 9 US-listed funds now maintain roughly 6.7 million ETH—nearly double the extent seen when the market rally started in April.

This enlargement adopted document inflows of practically $10 billion between July and August. The surge cemented ETFs as the popular car for institutional publicity.

Whereas September has proven a slower tempo, the funds nonetheless attracted greater than $640 million in new capital final week, based on SoSoValue information.

That momentum alerts rising investor reliance on ETFs not solely as an entry level but additionally as a option to maintain long-term allocations within the crypto asset.

Sponsored

Furthermore, giant ETH holders seem like reinforcing this sample. CryptoQuant information reveals that wallets controlling between 10,000 and 100,000 ETH amassed roughly 6 million cash throughout the identical interval.

Their mixed reserves reached a document 20.6 million ETH, mirroring Bitcoin’s early trajectory after ETF approvals, when institutional gamers raced to ascertain positions.

Staking and Community Exercise Tighten Provide

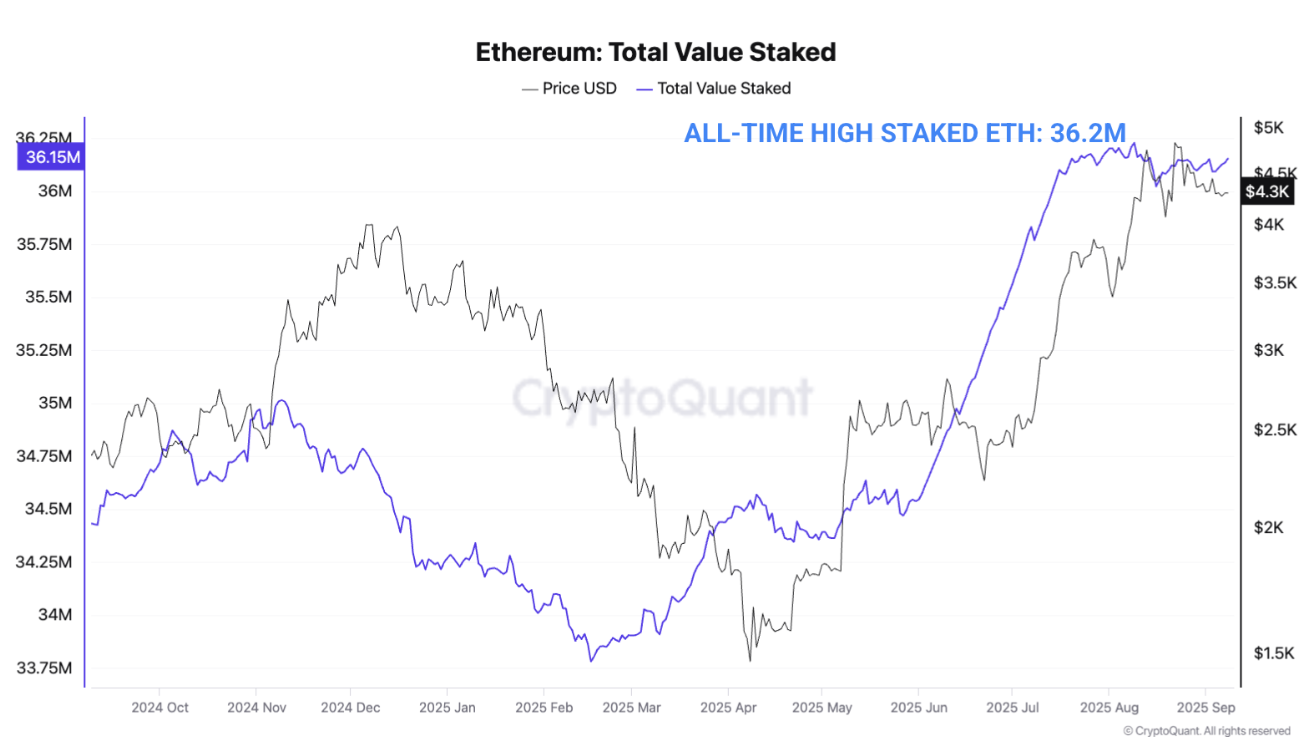

Other than the above elements, Ethereum staking exercise is locking up extra ETH than ever earlier than.

Knowledge from CryptoQuant confirmed that Ethereum traders have locked up an extra 2.5 million ETH since Might, pushing the full quantity of staked ETH to 36.2 million. In line with Dune Analytics information, this represents practically 30% of Ethereum’s complete provide.

Sponsored

This regular enhance reduces the highest crypto’s circulating provide and reinforces its upward worth stress. It additionally alerts that traders are dedicated to ETH for the long run and never short-term speculative performs.

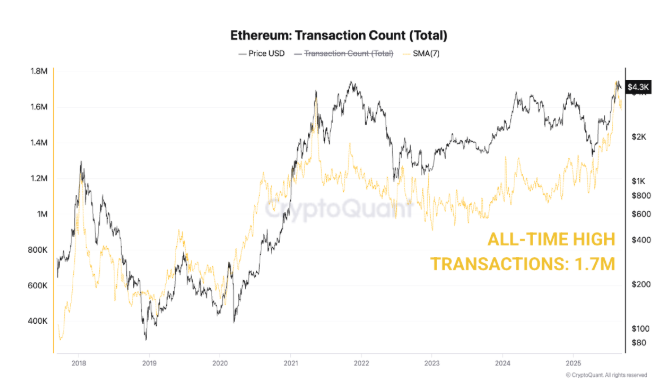

One other robust piece of proof displaying that Ethereum’s market position has considerably modified is the acceleration of its on-chain utility.

In line with CryptoQuant, Ethereum’s every day transactions spiked to 1.7 million in mid-August, and the variety of lively addresses on the community reached a excessive of 800,000.

Sponsored

On the similar time, sensible contract calls broke previous 12 million per day, which is an unprecedented degree in prior cycles.

This exercise degree underscores Ethereum’s rising position because the spine for decentralized finance, stablecoins, and tokenized property. Notably, the community has the best complete worth locked and adoption fee for every sector.

Taken collectively, these developments level to a structural realignment that reveals that Ethereum’s valuation rests on greater than market sentiment.

Certainly, it’s more and more positioned as a practical spine for digital commerce. On the similar time, it has turn out to be a strategic holding for large-scale traders looking for publicity to the rising crypto business.