Thai SEC probes “The BIG Secret” crypto hack

Thailand’s Securities and Trade Fee (SEC) mentioned it’s reviewing stories circulating on social media that declare a serious native cryptocurrency change was hacked.

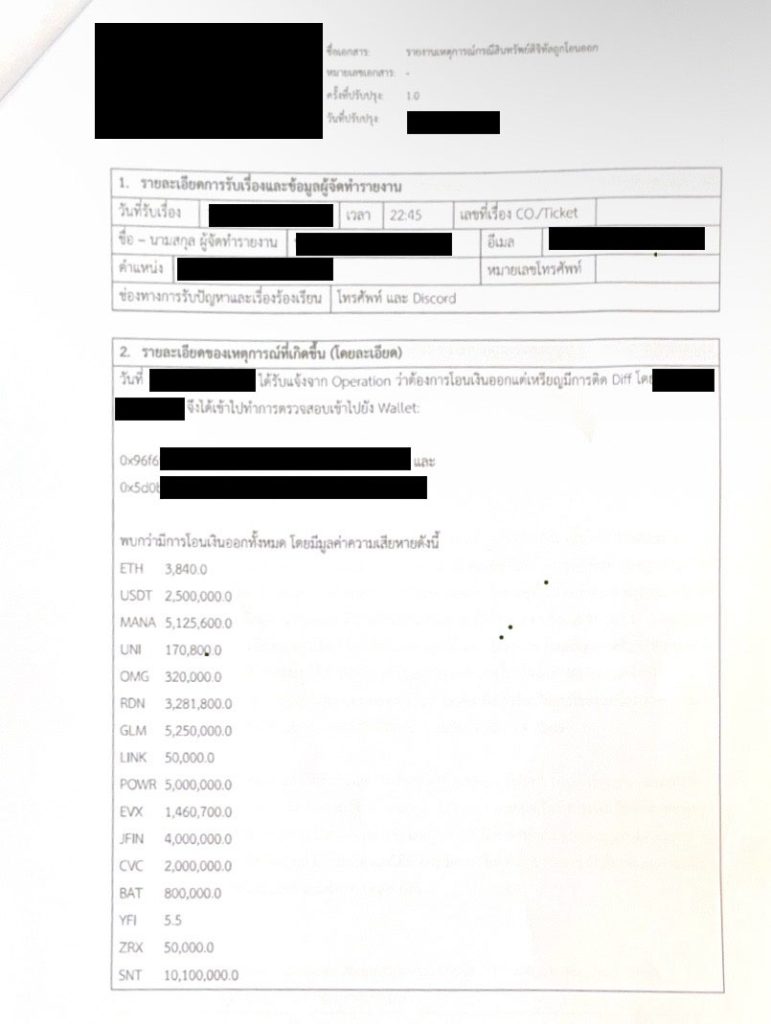

On Sunday, Thai social media channel The Large Secret posted a picture of what it described as an inside doc detailing a large-scale breach. The doc, which has not been verified, had its date and associated blockchain addresses redacted.

Following the submit, a number of exchanges issued statements assuring clients that their property stay protected. The change allegedly concerned has not been publicly recognized.

In a livestream on Monday morning, the operator of The BIG Secret mentioned the paperwork had been obtained from an undisclosed supply and acknowledged they require additional verification. He added that the leaked recordsdata contained a number of pages, some dated way back to 4 years.

Learn additionally

Options

‘Be certain Ethereum wins’ — Steve Newcomb reveals zkSync’s prime directive

Crypto Metropolis Guides

Rich, remoted, and unbelievable seashores: Perth Crypto Metropolis Information

“The query is about what occurred again then. If this incident actually occurred 4 years in the past, why didn’t we learn about it? Did a Thai change really get hacked again then?” he requested.

In accordance with the influencer, the paperwork prompt the hack would have been valued at round 7.7 billion baht ($242 million) on the time. Utilizing at this time’s costs, the identical basket of property could be price greater than $41 million.

Nudge desires to launch Japan’s first bank card repayments in JPYC stablecoins

Japanese fintech startup Nudge mentioned it is going to enable customers to repay bank card payments within the yen-backed JPYC stablecoin ranging from October.

Japan’s established its regulatory framework for stablecoins beneath the revised Fee Companies Act (efficient mid-2023), which requires issuers to register as funds switch service suppliers and to keep up full reserve backing. JPYC obtained its registration final month, changing into the primary entity in Japan formally approved to difficulty a yen-denominated stablecoin.

With the tie-up, purchases made with the Nudge card at any of Visa’s retailers can successfully be paid again later in stablecoin, avoiding the necessity to rely solely on financial institution transfers. Nudge mentioned it plans to broaden reimbursement assist to further stablecoins and tokenized deposits sooner or later.

Xinyuan’s last-ditch blockchain rebrand

Chinese language actual property large Xinyuan Group will restart its blockchain program to discover real-world asset tokenization (RWA), the agency introduced on its official WeChat account.

The corporate’s blockchain program returns to a method it toyed with years in the past however by no means absolutely dropped at market. Again in 2016, it partnered with Tsinghua College’s PBC Faculty of Finance — established by the Folks’s Financial institution of China — to create a fintech analysis heart with blockchain as a core space of examine. By 2018, it was incubating blockchain startups and piloting purposes reminiscent of onchain property registration and token economic system fashions.

Regardless of experimenting with tokenization ideas internally, Xinyuan by no means issued tradable actual property tokens or performed onchain fundraising — steps that might doubtless have triggered regulatory scrutiny in China, the place token issuance has been tightly restricted since 2017.

The current blockchain revival additionally comes as Xinyuan faces mounting enterprise challenges. On Sept. 3, the New York Inventory Trade introduced it had begun delisting proceedings towards the corporate after its common market capitalization fell beneath $15 million over 30 consecutive buying and selling days.

Xinyuan’s return to blockchain reframes its effort beneath the worldwide RWA narrative, which has gained momentum as main establishments experiment with tokenized treasuries, credit score, and actual property. The corporate says it is going to pursue partnerships with worldwide blockchain suppliers, compliance specialists, and buyers to launch its first tokenized property tasks. It additionally flagged plans to discover onchain financing as a substitute for conventional actual property funding, pitching RWA as a method to enhance liquidity and effectivity in its asset portfolio.

Learn additionally

Options

Slumdog billionaire: Unimaginable rags-to-riches story of Polygon’s Sandeep Nailwal

Options

‘AI has killed the business’: EasyTranslate boss on adapting to alter

Stablecoins are starting to enter mainstream funds in Japan simply as the worldwide business faces heightened scrutiny and recent regulation. Within the US, lawmakers have handed the GENIUS Act to manage dollar-pegged stablecoins, whereas in Europe, the MiCA framework for euro-denominated tokens is already in drive.

South Korean school district sells crypto to gather tax

A district in South Korea’s capital has collected overdue taxes by liquidating cryptocurrency seized from tax delinquents.

The sale was made doable by a rule change earlier this 12 months that permits native governments and establishments to open accounts at cryptocurrency exchanges, which was beforehand restricted to retail buyers.

Seodaemun District mentioned it has been seizing crypto since 2021, however was unable to transform them into money as a result of lack of a authorized liquidation mechanism. This marks the primary time one in all Seoul’s 25 districts has settled tax arrears via the sale of seized crypto.

Conventional delinquent tax measures in South Korea have targeted on property reminiscent of financial institution deposits, wages, and actual property. Authorities say utilizing cryptocurrency may speed up the restoration of unpaid taxes.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.