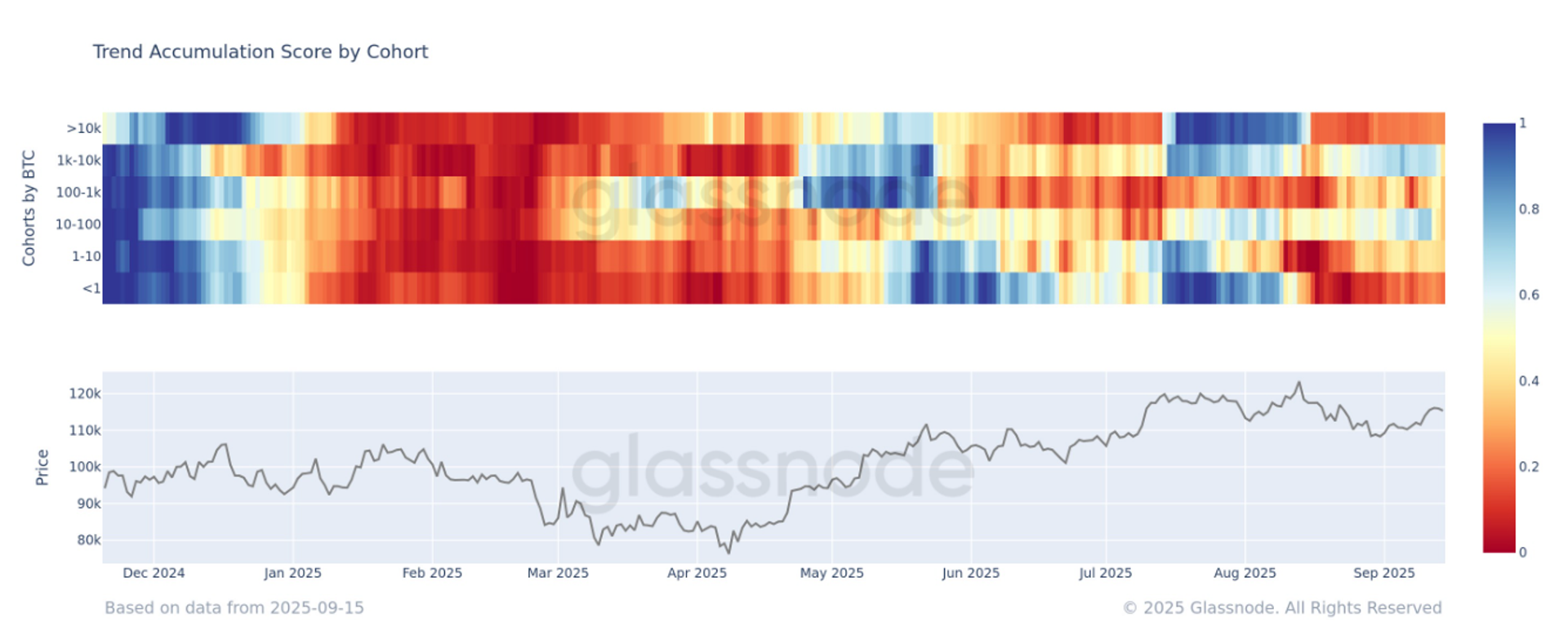

Glassnode knowledge exhibits that every one pockets cohorts have returned to distribution mode, with a web promoting of bitcoin, in accordance with the Accumulation Development Rating breakdown by pockets cohort.

This metric disaggregates the Accumulation Development Rating to point out the relative conduct of various teams of pockets. It measures the power of accumulation for every steadiness measurement based mostly on each the entities’ measurement and the amount of cash acquired over the previous 15 days. (For extra particulars on the methodology, see this Academy entry.)

- A price nearer to 1 indicators accumulation by that cohort.

- A price nearer to 0 indicators distribution.

Exchanges, miners and different comparable entities are excluded from the calculation.

Presently, all cohorts, from wallets holding lower than one bitcoin to these holding greater than 10,000, are web sellers. This follows final week’s rally, when some whales — most notably the 10-100 BTC and 1,000-10,000 BTC cohorts had been shopping for. They’ve since flipped again to promoting.

Bitcoin was not too long ago hovering close to $117,000 after Asia’s buying and selling session pushed it up from $115,000 {dollars} over the weekend. Over the previous three months, Asia has constantly pushed bitcoin roughly 10 p.c larger, in accordance with Velo knowledge. In distinction, the European buying and selling session has been marked by pullbacks, which has been seen on Monday thus far. As well as, bitcoin is down greater than 10% within the EU market over the previous three months.

General, the market stays in consolidation, a development more likely to persist by way of September. On present knowledge, the $107,000 marked firstly of September nonetheless seems to be probably the most possible backside.