- Bitwise simply filed for an Avalanche ETF, becoming a member of VanEck and Grayscale, sparking bullish sentiment.

- Avalanche community exercise is climbing, with TVL at $2.09B and stablecoin market cap up practically 5%.

- AVAX should shut above $30.37 to substantiate a breakout, with $35.22 as the following upside goal.

Avalanche (AVAX) has been hovering just below the $30 line, slipping about 1% on Tuesday. Value motion seems to be indecisive, however the temper out there is shifting due to a brand new ETF submitting. Bitwise formally submitted its S-1 type with the U.S. SEC, aiming to launch an Avalanche ETF—an announcement that’s already acquired merchants buzzing a couple of potential breakout. On-chain exercise and technical charts are each flashing indicators of optimism, giving bulls one thing to carry onto.

Avalanche ETF Information: Bitwise Joins the Race for Approval

Bitwise is increasing its crypto ETF portfolio, and now Avalanche is within the combine. With this S-1 submitting, Bitwise steps into the identical ring as VanEck, 21Shares, and Grayscale—massive names already positioning themselves for an AVAX-backed product. The reasoning is easy: U.S. buyers have been piling into Bitcoin and Ethereum ETFs, so demand for an Avalanche fund may comply with that very same path. If permitted, it would present the spark that AVAX must maintain a breakout above cussed resistance ranges.

Avalanche Community Progress: TVL, DEX Quantity, and Stablecoin Demand

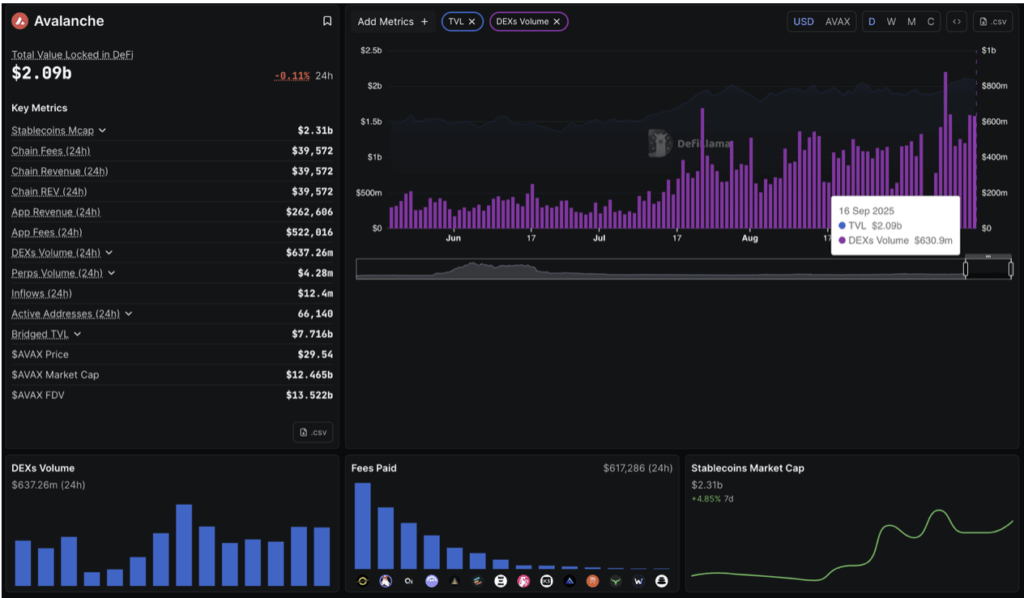

Behind the charts, Avalanche’s ecosystem is alive and effectively. Information from DeFiLlama exhibits its Whole Worth Locked (TVL) climbed to $2.09 billion, up from $1.92 billion only a week earlier. Liquidity is transferring again into the chain, and that’s not the one metric turning larger.

DEX volumes have now stayed above $2 billion for eight straight weeks, pointing to sticky buying and selling exercise throughout Avalanche protocols. In the meantime, stablecoin market cap on the community has risen practically 5% to $2.31 billion. Extra liquidity and extra lively customers normally translate into one factor—stronger demand for AVAX tokens over time.

AVAX Value Prediction: Can Avalanche Break the $30 Resistance?

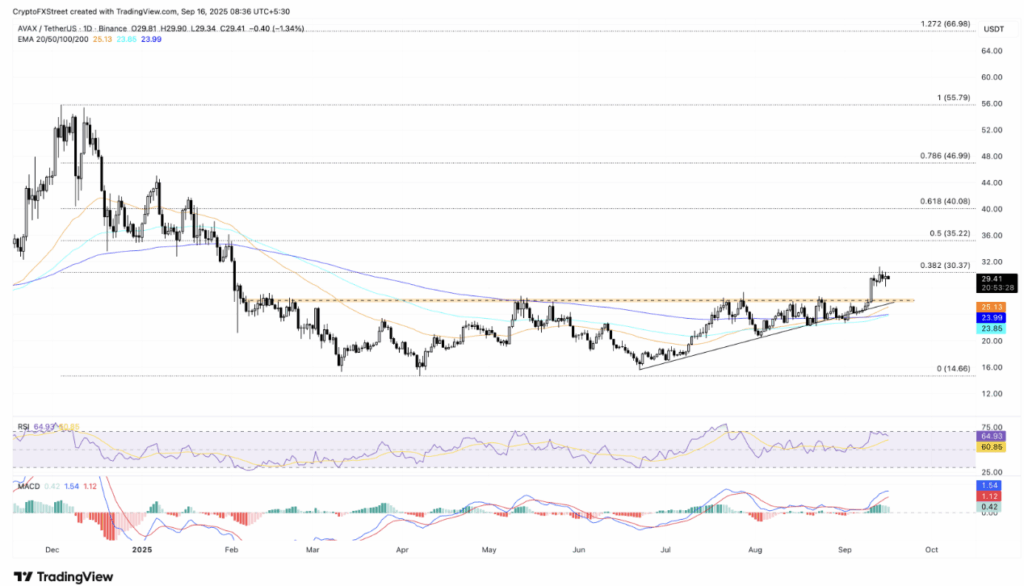

For now, the important thing degree sits round $30.37, which occurs to line up with the 38.2% Fibonacci retracement degree from December’s $55.79 excessive right down to April’s $14.66 low. AVAX has knocked on this door a couple of instances however hasn’t closed above it, leaving merchants cautious. If it lastly does, technical projections level towards the $35.22 degree as the following upside checkpoint.

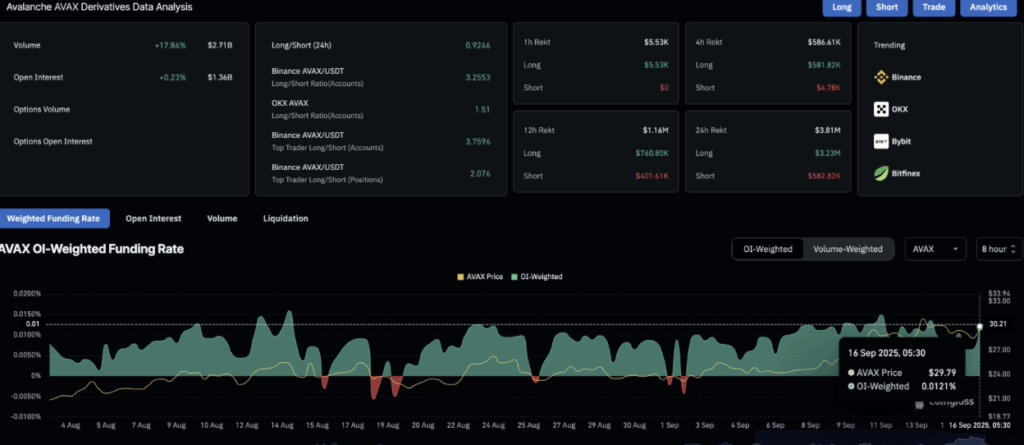

Open Curiosity knowledge provides to the case for energy. CoinGlass exhibits OI has edged as much as $1.36 billion, reflecting extra capital transferring into futures markets. The funding price has additionally doubled, leaping to 0.0121% from 0.0064% only a day in the past, which means bulls are paying a premium to maintain lengthy positions open.

Momentum indicators lean bullish as effectively, however not with out caveats. The each day RSI has cooled off to 64, out of the overbought zone however nonetheless firmly above impartial. The MACD can be above its sign line, protecting the development tilted to the upside.

Avalanche Value Outlook: Assist and Danger Ranges to Watch

After all, pullbacks are at all times attainable in this kind of setup. If AVAX can’t maintain above $30, then eyes will shift decrease towards the 50-day EMA round $25.13. That space may act as a security internet earlier than bulls regroup.

For now, the image is combined however leaning constructive: robust ecosystem development, institutional ETF curiosity, and bullish technicals all working in Avalanche’s favor. The one lacking piece? A clear breakout above $30 to show the transfer has legs.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.