Wall Road veteran Jordi Visser informed reporters that US conventional finance corporations are more likely to increase their Bitcoin allocations earlier than the tip of the yr.

He expects demand to choose up in This fall as portfolio managers set positions forward of 2025. Some managers will make small strikes; others may shift bigger slices of their holdings into BTC, Visser stated.

Institutional Survey Indicators Sturdy Bitcoin Curiosity

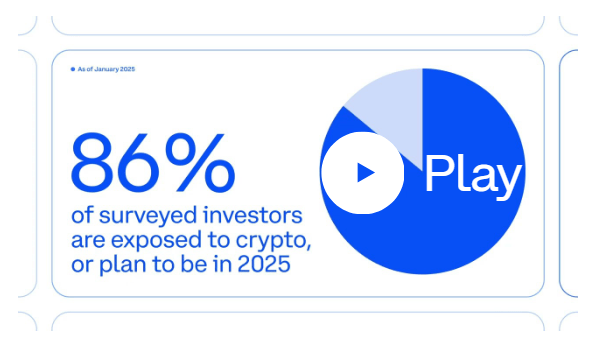

In line with a joint Coinbase and EY-Parthenon survey, a big share of institutional buyers plan so as to add crypto publicity in 2025.

The survey discovered 83% of respondents intend to extend allocations, and 59% anticipate to place greater than 5% of belongings beneath administration into crypto or associated merchandise.

These figures recommend that many corporations are making ready for wider crypto use in portfolios.

Intentions Do Not At all times Equal Motion

Plans by cash managers can change. Regulation, market swings, and macro shocks can gradual or halt buys. Nonetheless, when a lot of establishments say they’ll act, it raises the chances that actual flows will comply with. That stated, timing and measurement of the strikes stay unsure.

ETF Flows Feeding Demand

Spot Bitcoin ETFs have pulled heavy inflows this yr, giving establishments a neater on-ramp into the market.

Latest day by day internet inflows reached about $642 million on one buying and selling day, and cumulative ETF internet inflows since launch are roughly $57 billion, lifting complete ETF belongings to about $153 billion.

Supply: Coinbase

These flows can present a gradual supply of demand for BTC in the event that they proceed.

How ETFs Change The Recreation

ETFs give large funds a well-known product to purchase. That reduces some obstacles to entry. If allocations rise in This fall as Visser suggests, ETF channels are the place a lot of that purchasing may present up first.

Company Holdings Add One other Layer

Private and non-private corporations are already holding Bitcoin on their books. Knowledge trackers present public firms’ treasury BTC holdings are valued at roughly $112 billion throughout many corporations.

Huge patrons just like the Michael Saylor-led Technique proceed so as to add to their piles, and company buys make headlines once they occur. Such company demand can add to general market urge for food for BTC.

The Interval To Watch

Based mostly on stories and the surveys, late This fall would be the interval to observe. If establishments transfer as deliberate, Bitcoin may see significant help.

However buyers ought to anticipate bumps, because it’s the character of crypto: coverage shifts, charges, or a sudden liquidity squeeze may minimize quick flows.

In brief, the indicators level towards extra allocation from TradFi, but execution will rely upon a number of transferring components.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Supply: Coinbase

Supply: Coinbase