Bitcoin is consolidating across the $115,000 stage as markets brace for tomorrow’s extremely anticipated Federal Reserve assembly. After weeks of volatility, the market has entered a cautious holding part, with merchants and establishments alike ready for readability on the Fed’s subsequent steps. The choice to chop rates of interest will set the tone for threat belongings, however buyers are equally centered on whether or not quantitative easing insurance policies will return to the dialogue. Each outcomes might considerably reshape the macroeconomic outlook and dictate Bitcoin’s subsequent transfer.

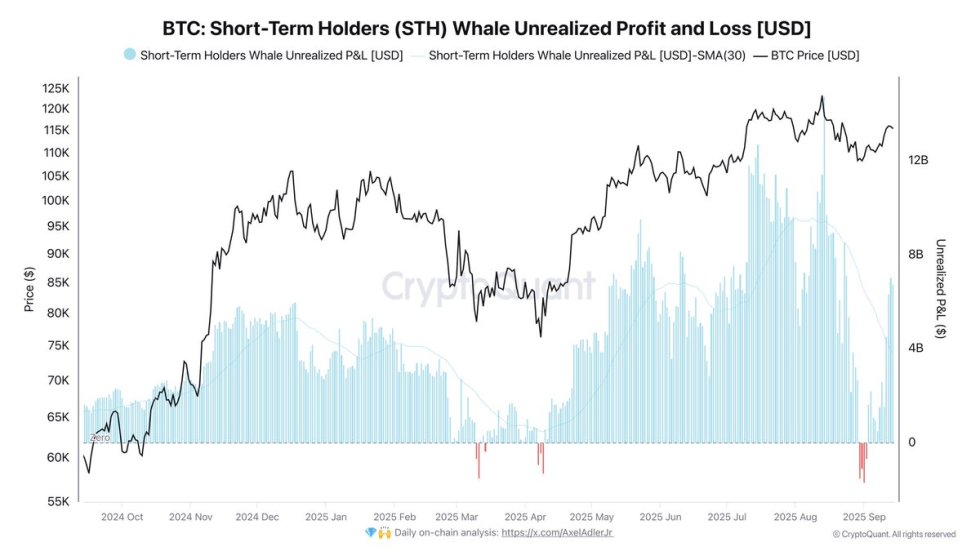

High analyst Darkfost highlighted an essential on-chain growth that provides additional context to the present consolidation. In response to his knowledge, Quick-Time period Holder (STH) whales, who got here beneath strain through the small correction originally of September, are actually again in unrealized revenue. That correction quickly pushed STH whales into loss territory, testing their conviction. Nonetheless, historical past reveals that related pullbacks have been short-lived and well-defended, typically paving the best way for Bitcoin to renew its upward trajectory.

The convergence of macroeconomic choices and bettering onchain well being units the stage for a decisive week. With the $115K vary performing as a pivot, the Fed’s announcement might be the catalyst that determines Bitcoin’s breakout path.

Quick-Time period Holders Defend Vital Ranges

In response to Darkfost, the small correction originally of September positioned Quick-Time period Holders (STH) beneath notable strain, because it straight challenged their unrealized revenue zone. This important space, which fluctuates round $108,000–$109,000, has turn into an essential battleground for bulls and bears. For now, STH whales proceed to defend this zone efficiently, stopping losses from widening and offering stability to the broader market construction.

Historic precedent helps this resilience. Earlier corrections of comparable nature, which briefly pushed STH whales into unrealized losses, had been short-lived and well-defended. Every time, Bitcoin managed to stabilize after which resume its bullish trajectory shortly after. This sample means that the present protection might once more act as a springboard, reinforcing confidence amongst merchants who view the $108K–$109K vary as a structural line of protection.

Nonetheless, the broader context can’t be ignored. This week is shaping as much as be pivotal for Bitcoin and threat belongings, with the Federal Reserve set to announce its rate of interest choice tomorrow. Whereas technical and on-chain alerts recommend underlying power, macroeconomic forces might introduce sharp volatility. Darkfost notes that tomorrow’s choice will present much-needed readability, probably setting the tone for whether or not Bitcoin extends its rally or faces a deeper consolidation part.

Bitcoin Consolidates Round Key Stage

Bitcoin (BTC) is holding regular round $115,482, displaying resilience because the market braces for tomorrow’s Federal Reserve choice. On the day by day chart, BTC is consolidating close to a important stage after recovering from its early-September lows. Value is hovering simply above the 50-day shifting common ($114,355), which now acts as rapid help, whereas the 100-day common ($112,782) supplies a further security web. The 200-day common at $102,810 stays far under, reinforcing the broader bullish construction regardless of short-term uncertainty.

Resistance lies within the $116,000–$117,000 zone, the place BTC has confronted repeated rejections in latest weeks. A breakout above this vary would doubtless open the door for a retest of the $123,217 resistance, a stage that capped the final main rally. On the draw back, failure to defend the 50-day shifting common might invite a pullback towards $113,000 and even $112,000.

BTC is consolidating inside a tightening vary, awaiting macroeconomic readability. If the Fed delivers the anticipated fee minimize with out stunning the market, Bitcoin might acquire momentum for an additional push greater. Till then, sideways motion and elevated volatility stay the bottom case.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.