Regardless of tighter oversight from South Korea’s monetary authorities, leverage-driven “crypto lending” companies resurface throughout home exchanges.

Platforms like Upbit, Bithumb, and Coinone are reviving or reshaping the controversial merchandise below newly issued authorities pointers, signaling a cautious however notable comeback.

Sponsored

Sponsored

Coinone Launches “Coin Borrowing”

On Monday, Coinone, South Korea’s third-largest cryptocurrency alternate, launched its new cryptocurrency buying and selling service, “coin lending.” The rollout comes simply two months after opponents Upbit and Bithumb launched related companies in July.

The product lets customers borrow cryptocurrency in opposition to Korean received collateral, enabling leverage-driven buying and selling methods. In follow, this consists of short-selling—borrowing crypto, promoting at market costs, and repurchasing later at a reduction if costs fall.

Coinone emphasised that the service strictly follows the Authorities’s, i.e., Monetary Companies Fee (FSC), lending pointers. Beneath the principles, particular person borrowing limits mirror fairness short-selling frameworks—$22,000 (KRW 30 million) to $51,000 (KRW 70 million), relying on the consumer.

Prospects can pledge as little as $37 by means of the service and borrow as much as 82% of their collateral, topic to the $22,000 cap. At launch, solely Bitcoin is supported.

Upbit and Bithumb Modify Their Companies

Business chief Upbit reinstated its lending program final week, modifying phrases to satisfy the FSC’s necessities. Its most collateral cap fell by 25%—from $37,000 to $28,000.

Sponsored

Sponsored

Bithumb, the nation’s second-largest alternate, continues working below its previous construction however confirmed ongoing revisions.

“We absolutely perceive the intent of the FSC and the DAXA pointers,” a Bithumb spokesperson stated, referring to the Digital Asset eXchange Affiliation. “We’re reviewing borrowing limits, ratios, and liquidation necessities to make sure investor safety and market stability. Our precedence is to transition the service easily whereas minimizing consumer disruption.”

Regulators Push Stronger Safeguards

The FSC launched its pointers earlier this month in response to considerations over investor danger and extreme leverage. Regulators clarified that lending companies should not function as unchecked, high-risk merchandise.

Exchanges should now present loans solely from their reserves and restrict borrowing to large-cap cryptocurrencies. Borrowing limits are capped for every particular person, and customers should full on-line education schemes and go suitability checks earlier than accessing the service. To guard retail merchants, authorities additionally set a most annualized rate of interest of 20 p.c and strengthened disclosure obligations.

Officers stated the framework is designed to strike a stability—permitting innovation in digital asset markets whereas making certain client safety and curbing reckless hypothesis.

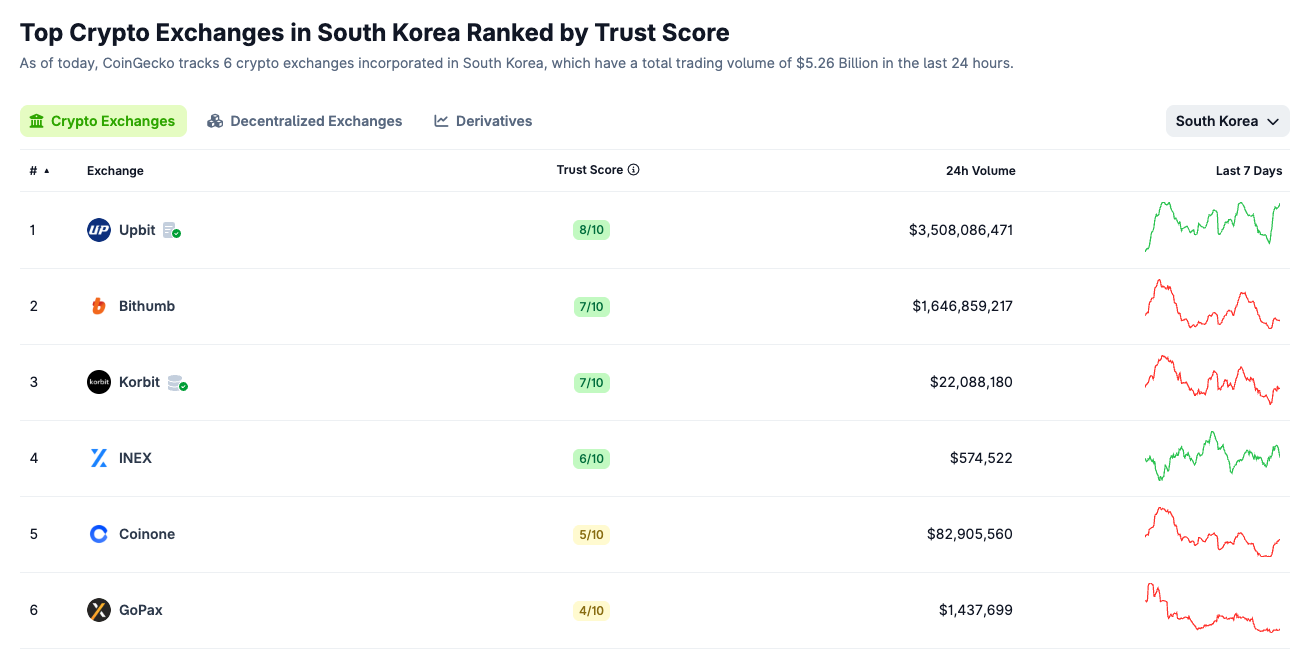

Based on CoinGecko, six South Korean-based exchanges—together with Upbit, Bithumb, and Coinone—collectively course of $5.26 billion in each day buying and selling quantity.