Key Takeaways

- In keeping with Nakamoto CEO David Bailey, the digital asset treasury narrative is being “muddled” by firms that add “failed altcoins” and “poisonous financing” to their stability sheets.

- The feedback spotlight a rising philosophical divide between firms that see Bitcoin as a singular treasury asset and people which might be exploring a broader vary of cryptocurrencies.

- This pattern, fueled by “narrative-driven theses,” is being examined, with some analysts predicting a “demise spiral” for firms which might be poorly executing their treasury methods.

The narrative round digital asset treasuries is turning into more and more advanced and “muddled,” in keeping with David Bailey, CEO of Bitcoin treasury firm Nakamoto.

His feedback come as extra publicly traded firms are trying past Bitcoin so as to add a various vary of cryptocurrencies to their stability sheets.

The Evolution of the Treasury Narrative

The unique “Bitcoin treasury narrative,” pioneered by firms like MicroStrategy, was centered on a single, core thesis: Bitcoin is probably the most safe, decentralized, and inflation-resistant asset to carry on a company stability sheet.

The technique was to transform an organization’s money reserves into Bitcoin as a technique to hedge towards financial debasement and create a long-term retailer of worth. Nevertheless, this narrative has developed. Because the crypto market has matured, many firms at the moment are trying “down the chance curve” so as to add different belongings.

These “narrative-driven theses,” as famous in a latest report from Galaxy Digital, have led to firms holding tokens like Ether, Solana, XRP, and even HyperLiquid (HYPE) of their treasuries.

Whereas this diversification might be a technique to generate earnings (as with staked Ether) or capitalize on particular market developments, Bailey and others argue that it dilutes the core message and dangers the corporate’s monetary stability.

The Check of the Treasury Sector

In keeping with Bailey, all the digital asset treasury sector is “being examined.” He believes that firms that execute their technique effectively—by constructing and monetizing their stability sheets successfully—will thrive.

Conversely, he warns that people who execute poorly will “commerce at a reduction and be consumed by somebody who can do it higher.”

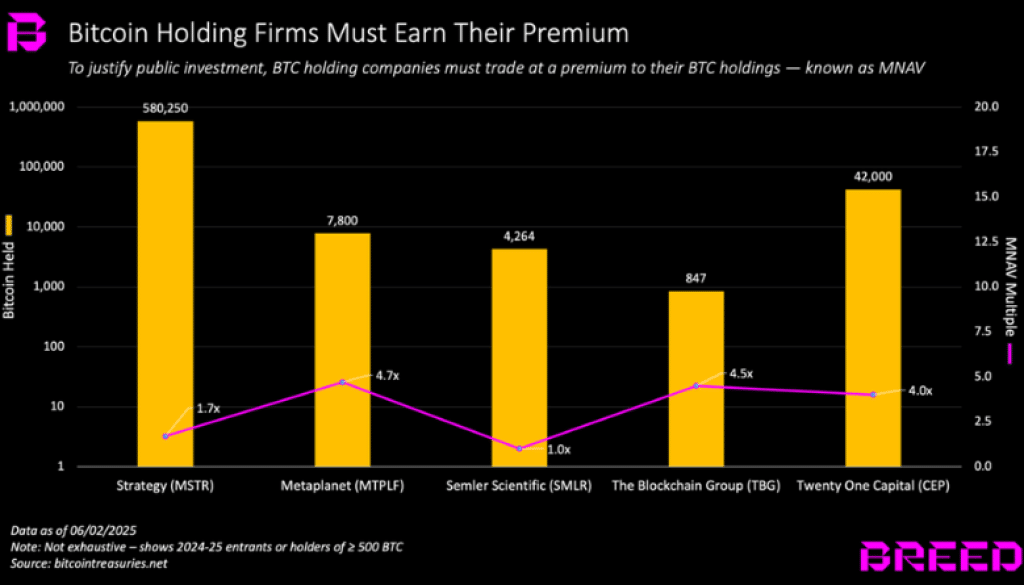

Enterprise capital agency Breed, has warned that many of those companies might face a “demise spiral” in the event that they proceed to commerce near their web asset worth (NAV).

A “demise spiral” refers to a vicious cycle the place an organization’s inventory trades at a reduction to its belongings, making it more durable to boost capital and forcing it to promote its belongings at a loss, additional miserable its inventory worth.

This danger is even larger for firms holding risky and less-liquid altcoins.

Ultimate Ideas

David Bailey’s feedback are an important contribution to the continued debate about the way forward for company crypto adoption. Whereas the pattern of firms including digital belongings to their treasuries is plain, the query of which belongings and why stays.

Ceaselessly Requested Questions

What’s a “digital asset treasury firm”?

A digital asset treasury firm is a publicly traded agency that holds a big quantity of cryptocurrencies on its stability sheet as a core a part of its enterprise technique.

Why does David Bailey consider the narrative is “muddled”?

Bailey believes the narrative is “muddled” as a result of firms are including “failed altcoins” and utilizing “poisonous financing” to fund their acquisitions, which he argues dilutes the unique Bitcoin-focused technique.

What’s a “demise spiral” for a treasury firm?

A “demise spiral” is a vicious cycle the place an organization’s inventory trades at a reduction to its web asset worth (NAV), making it more durable to boost capital and forcing it to promote its belongings at a loss.