Each blockchain grapples with one huge query – Tips on how to agree on the reality. Proof of Work (PoW) and Proof of Stake (PoS) are the 2 warring solutions to that query.

Bitcoin’s PoW is the unique, a brute-force strategy confirmed by time. And but, practically each new blockchain is betting on PoS, chasing a future that’s quicker and extra environment friendly.

Their core variations reveal what their creators worth most in safety, equity, and efficiency.

A combat for safety – Uncooked energy vs. chilly laborious money

Making an assault price greater than it’s price is the secret for any blockchain. PoW and PoS simply have fully alternative ways of elevating the worth of admission for cheaters.

Proof of Work makes attackers burn real-world power and purchase mountains of {hardware}. A 51% assault on Bitcoin means out-computing a worldwide community of specialised ASIC machines, an absurdly costly endeavor. The safety is tied on to consuming immense quantities of electrical energy.

Proof of Stake flips the script, forcing attackers to purchase up a majority of the community’s personal forex to achieve management. Validators should “stake” a big sum of crypto as collateral to get an opportunity to course of transactions. The killer function for PoS safety is “slashing.” In the event you’re a validator who tries to cheat, the community mechanically burns your staked cash. An attacker would actually be destroying their very own fortune within the course of.

PoW has its personal gremlins, like egocentric miners who sport the system to earn extra rewards. PoS, however, has to fret about “long-range assaults,” the place outdated keys may very well be used to try to rewrite historical past from manner again.

To cease this, PoS chains depend on checkpoints, primarily asking new customers to belief a current snapshot of the community’s state.

The decentralization paradox

The dream of decentralization has hit some laborious realities in each camps.

PoW mining was meant to be for everybody, however it’s change into a sport for giants. A number of huge mining swimming pools, like Foundry USA and AntPool, now management sufficient computing energy to threaten the community. Bitcoin’s Nakamoto Coefficient, the variety of gamers you’d must collude for an assault, is a surprisingly low three.

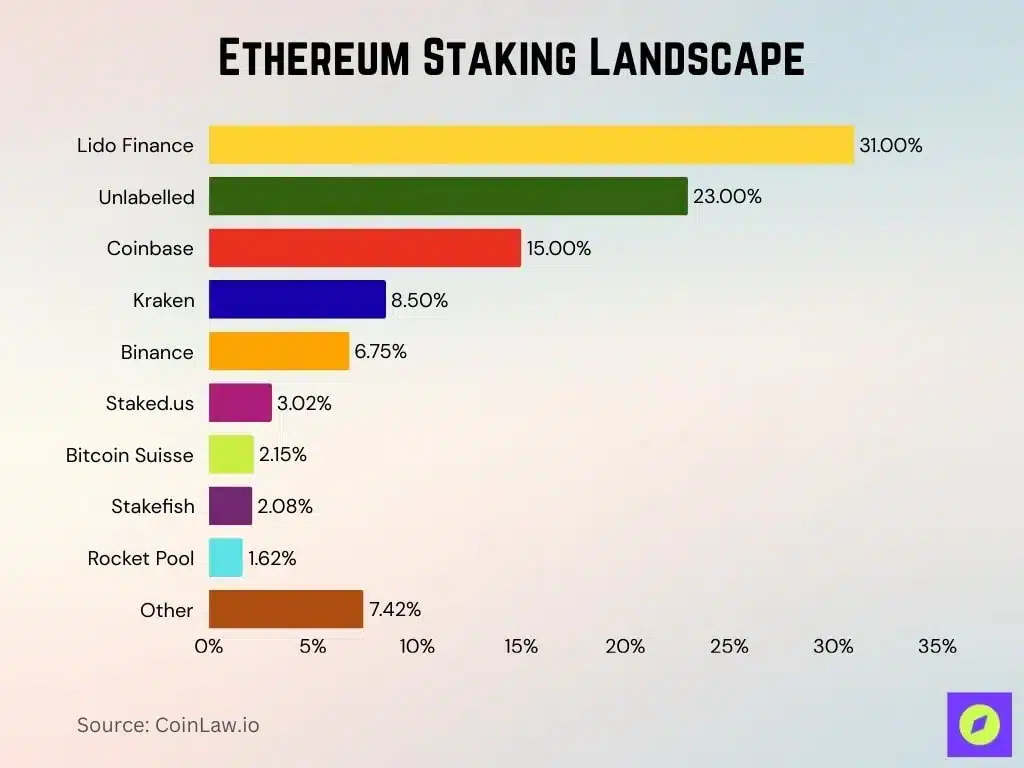

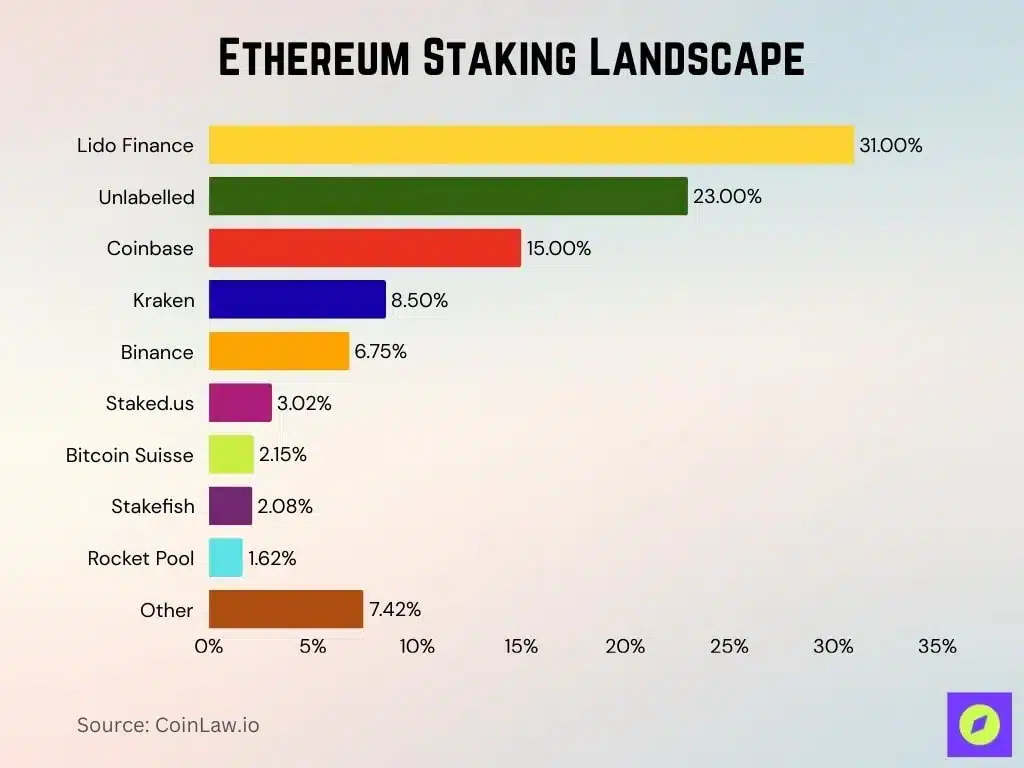

PoS tried to repair this by eliminating costly {hardware}, however cash nonetheless attracts cash. To be a solo validator on Ethereum, you want 32 ETH – A value that has pushed most individuals into staking swimming pools and liquid staking protocols. The large liquid staking service Lido now holds a lot ETH that it’s change into its personal level of centralization, dragging Ethereum’s Nakamoto Coefficient right down to a scary two.

Supply: CoinLaw.io

Efficiency and the brand new breed of blockchains

In the case of velocity, there’s no contest – New tasks have nearly universally deserted PoW.

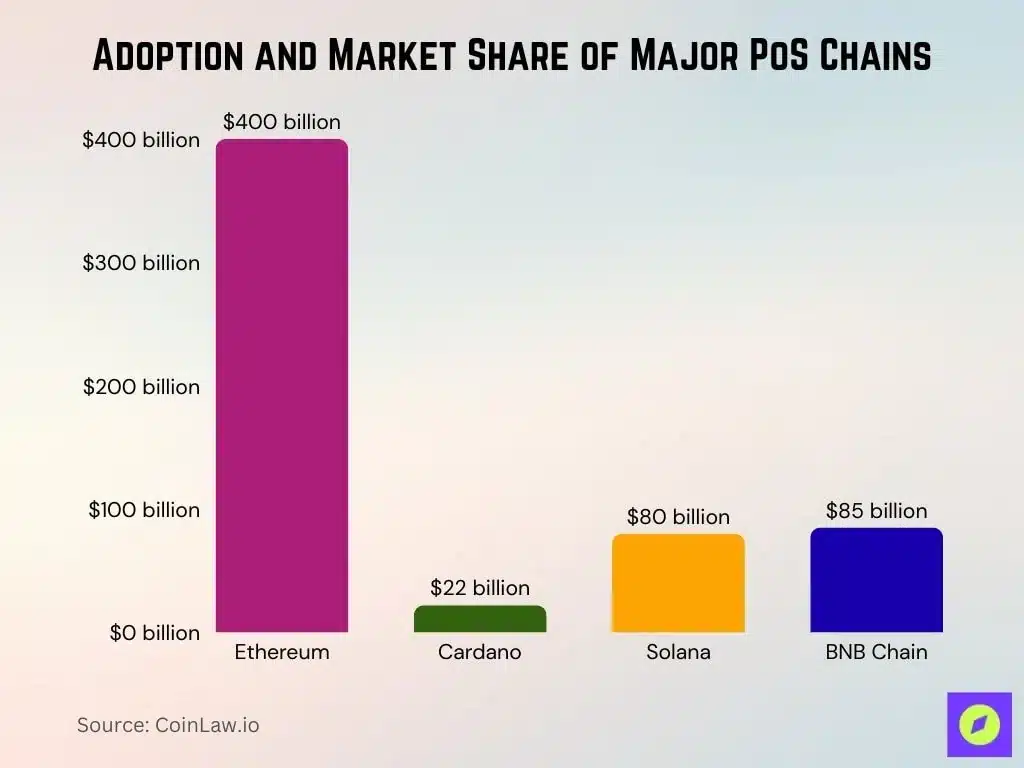

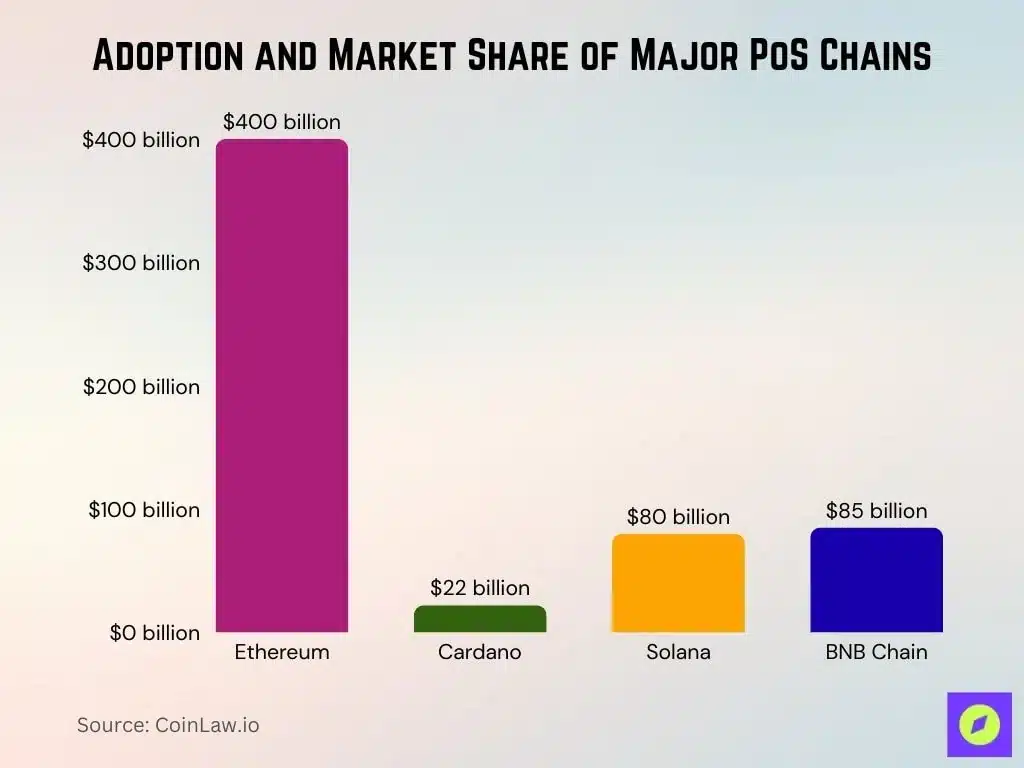

Bitcoin chugs alongside at about 5-7 transactions a second, with a ten-minute watch for a brand new block. PoS chains spit out blocks in seconds, which is why Ethereum’s swap to PoS was step one towards its aim of huge scaling.

Newer chains didn’t even hassle with PoW; Solana makes use of a ‘Proof of Historical past’ twist on PoS to hit hundreds of transactions per second, whereas tasks like Sui and Avalanche are constructed from the bottom up for high-speed makes use of.

Nevertheless, don’t rely PoW out simply but. A challenge referred to as Kaspa is utilizing a construction referred to as a blockDAG, a spin on the blockchain, that lets it course of blocks in parallel and hit speeds that rival PoS chains – An indication that the outdated mannequin nonetheless has some new methods.

Economics of safety – Who pays the guards?

The way you pay for safety over the lengthy haul is the place PoW and PoS actually diverge.

PoW chains like Bitcoin pay miners with new cash and transaction charges. Nevertheless, the brand new cash, the “block subsidy,” get reduce in half each 4 years in occasions referred to as “halvings.” Ultimately, the community should survive on transaction charges alone. Critics fear that if these charges aren’t excessive sufficient, the inducement to safe the chain may dry up.

PoS techniques normally simply construct in a small, regular fee of inflation to pay validators ceaselessly, supplemented by transaction charges. Whereas that sounds prefer it devalues the forex, methods like burning transaction charges, which Ethereum’s EIP-1559 made well-known, can really make the availability shrink over time.

Supply: CoinLaw.io

Environmental questions and the attention of the regulator

The elephant within the room for PoW is its gigantic power invoice.

Bitcoin’s electrical energy use rivals that of small nations, drawing hearth from environmentalists and politicians. Ethereum’s transfer to PoS, “The Merge,” slashed its power footprint by over 99.9% nearly in a single day. A single transaction on Ethereum is now worlds cleaner than one on Bitcoin.

Regulators have taken discover. The EU is now forcing crypto corporations to report their environmental harm beneath its MiCA regulation. And, New York has even put a short lived ban on some PoW mining operations.

PoS has its personal regulatory complications, largely centered on whether or not staking appears to be like like an funding contract. The U.S SEC gave the business some respiratory room in 2025, clarifying that some liquid staking providers aren’t securities. All whereas Europe’s MiCA guidelines are primarily involved with providers that maintain staked belongings for purchasers.

A conflict of philosophies

PoW versus PoS isn’t nearly code; it’s about two completely different worldviews. PoW believes safety should be earned with uncooked power and bodily work, an idea referred to as “unforgeable costliness.” PoS trusts that placing sufficient capital on the road creates a system the place everybody’s monetary self-interest retains the community sincere.

New tasks are clearly voting with their toes for the velocity and low power prices of PoS. However the sheer, battle-hardened resilience of Proof of Work means it isn’t going wherever. This isn’t a battle with a single winner.

We’re heading towards a future with an entire zoo of consensus fashions, every constructed for a special goal and trade-off.