Multicoin Capital co-founder Kyle Samani believes Solana-native Digital Asset Treasuries (DATs) have a structural benefit over Bitcoin-focused automobiles—and that the mechanics underpinning these DATs may turn into a sturdy, price-positive flywheel for SOL. Talking on Blockworks’ Empire podcast days after Ahead Industries closed a $1.65 billion PIPE led by Galaxy, Bounce, and Multicoin, Samani argued that Solana’s yield, composable DeFi, and on-chain company operations create money flows and optionality that Bitcoin merely can’t match.

Why Solana DATs Beat Bitcoin

“We’re constructing a brand new monetary system from the bottom up,” Samani mentioned, framing Ahead as each a proof-of-concept for “web capital markets” and a scaled steadiness sheet that may systematically convert Solana’s technical and monetary primitives into shareholder worth.

The fast differentiator in his view: yield. “Saylor is paying roughly 9% [on MicroStrategy’s perpetual preferreds], however his core enterprise produces successfully no money stream… our automobile will produce money stream by way of two mechanisms at a naked minimal. The primary… is the native SOL staking yield… roughly 8%. And the second is by doing this credit score unfold arbitrage,” he mentioned.

Associated Studying

By borrowing {dollars} from conventional lenders at single-digit charges and deploying into on-chain venues yielding “12–20% relying on what you’re doing,” Ahead intends to make use of that unfold, plus staking rewards, to service perpetual coupons—one thing a Bitcoin treasury can not replicate as a result of BTC is non-yielding. “You’ll be able to truly objectively present the place the earnings are coming from to pay the coupons,” he added, suggesting Solana DATs may even safe higher phrases than Bitcoin automobiles over time.

Samani solid the $1.65 billion increase as a beginning gun for a broader re-architecture of company finance on Solana. Ahead plans to “be the guinea pig” that runs core operations on-chain—“payroll, paying distributors… fairness issuance, elevating cash, dividends, inventory splits… shareholder votes”—with the primary milestone being tokenizing a portion of the corporate’s fairness.

Notably, he expects a “fairly good chunk” of PIPE contributors to “take supply on-chain,” and mentioned Ahead will finally lean into real-time transparency: “I’m optimistic we’ll in some unspecified time in the future publish all the corporate’s addresses… so dashboards [can] replace in actual time.”

A lot of the thesis rests on scale and the flexibility to transform that scale into accretive economics—each inside Solana’s DeFi and throughout the rising DAT panorama. Galaxy Asset Administration will function staking and DeFi deployments; Bounce contributes infrastructure and efficiency—“all the nodes that we’re operating are operating Firedancer”—and proprietary transaction-ordering know-how.

Samani was express that Ahead is not going to purchase locked or liquid SOL from Multicoin, Bounce, or Galaxy steadiness sheets, and that sponsor economics are cut up one-third every among the many three companies, with Multicoin’s share accruing to its hedge fund LPs, to not him personally.

On the DAT market itself, Samani expects consolidation and cross-chain roll-ups, with Solana primed to dominate: “The market’s not going to maintain 20 Solana DATs… I can see a world wherein it sustains like three or 4.” He referred to as mNAV arbitrage “a really huge alternative,” arguing that automobiles buying and selling at premiums can accretively purchase these at reductions, whereas Solana’s liquidity, service-provider depth, and credit score acceptance put it forward of smaller ecosystems. “I’m very skeptical that [sub-scale] mNAVs will maintain in any respect,” he mentioned, singling out non-SOL, non-ETH DATs as most weak.

Solana DATs Vs. ETFs

Samani additionally contends that pending US spot ETFs for SOL—particularly with staking enabled—would amplify the Solana DAT benefit quite than dilute it. “I’m very optimistic” staking seems in SOL ETFs “quickly… someday by the top of the 12 months,” he mentioned. In his telling, interchangeable wrappers—spot on exchanges, ETFs for brokerage rails, and corporate-wrapper DATs—develop the investor base whereas leaving Solana’s intrinsic yield engine intact. Ahead, for its half, “expects the [vehicle] might be staking the substantial majority” of its SOL.

Associated Studying

Underpinning the value angle is Samani’s view that Solana DATs manufacture persistent demand for SOL whereas routing money flows again to fairness holders. Locked-token acquisitions at reductions, systematic staking, bank-line funded DeFi methods, and bespoke liquidity offers with main protocols collectively create what he describes as structural accretion.

The distinction with Bitcoin is stark in his framework. With out native money flows, BTC-based treasuries depend on exterior financing and worth appreciation; Solana DATs, he argued, can fund themselves. “Bitcoin can’t compete” on this dimension as a result of it lacks staking yield and composable on-chain markets to arbitrage credit score at institutional scale. That hole broadens, he maintained, if banks more and more settle for staked SOL as collateral and if ETF buildings normalize staking.

Ahead is already “speaking with a bunch of counterparties” about routing by way of banks with entry to the Fed window to safe the most affordable attainable greenback financing towards SOL collateral, although he cautioned that none of that is assured.

For now, the scoreboard is concrete. The increase closed “in about two weeks,” with Samani estimating a roughly 40/60 crypto-native to TradFi cut up amongst contributors. He personally invested $25 million; Multicoin contributed “$114–115 million.” Galaxy’s distribution pulled in “lots” of PIPE orders; Bounce’s technical edge targets incremental yield. Ahead plans to be an energetic consolidator of DATs “each SOL and non-SOL,” whereas constructing out a devoted government crew to run the Solana treasury line alongside the corporate’s legacy enterprise.

The implication for worth, Samani insisted, is easy: Solana’s yield engine plus institutional credit score and ETF rails create sustained, programmatic demand for SOL. “On reflection it was inevitable,” he mentioned of the consortium behind Ahead. Whether or not that inevitability interprets into Samani’s headline declare—Solana DATs “beating” Bitcoin automobiles and setting SOL as much as surge—will rely on execution, market liquidity, and the tempo at which banks, ETF issuers, and regulators bless staking-based buildings.

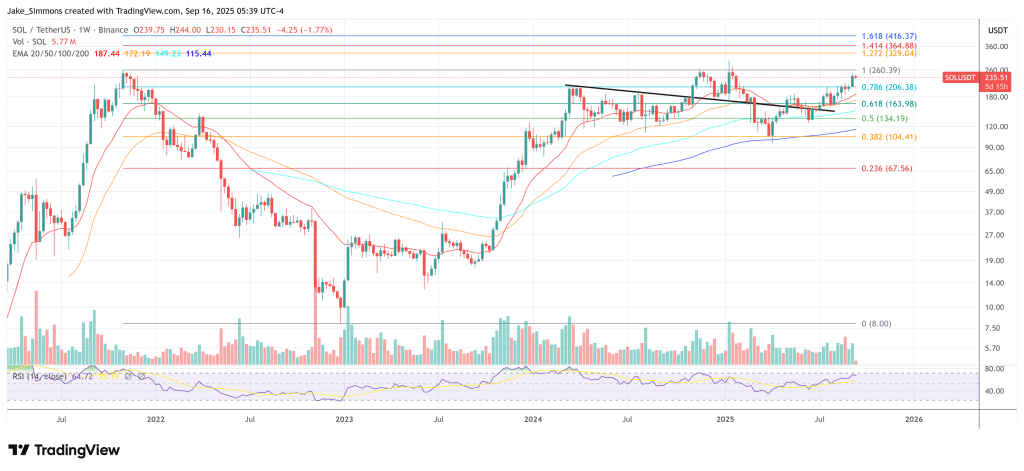

Notably, Ahead Industries accomplished the large buy of 6,822,000 SOL tokens price $1.58 billion at $232 common yesterday. The corporate has solely $67 million left to buy further SOL. At press time, SOL traded at $235.

Featured picture created with DALL.E, chart from TradingView.om