Bitcoin is exhibiting important volatility heading into Wednesday’s FOMC.

Nevertheless, consultants level out that the Federal Reserve is extremely prone to proceed with a 25-basis-point charge lower, a call that’s already priced in.

Whereas Fed Chair Jerome Powell’s post-FOMC remarks might transfer markets, good cash traders are paying even nearer consideration to Friday’s quad witching, a quarterly occasion with main repercussions for shares and, by extension, crypto.

Quadruple witching happens when 4 forms of derivatives expire concurrently: inventory index futures, inventory index choices, single-stock choices, and single-stock futures. This typically ends in a surge in buying and selling quantity and elevated volatility within the broader monetary markets.

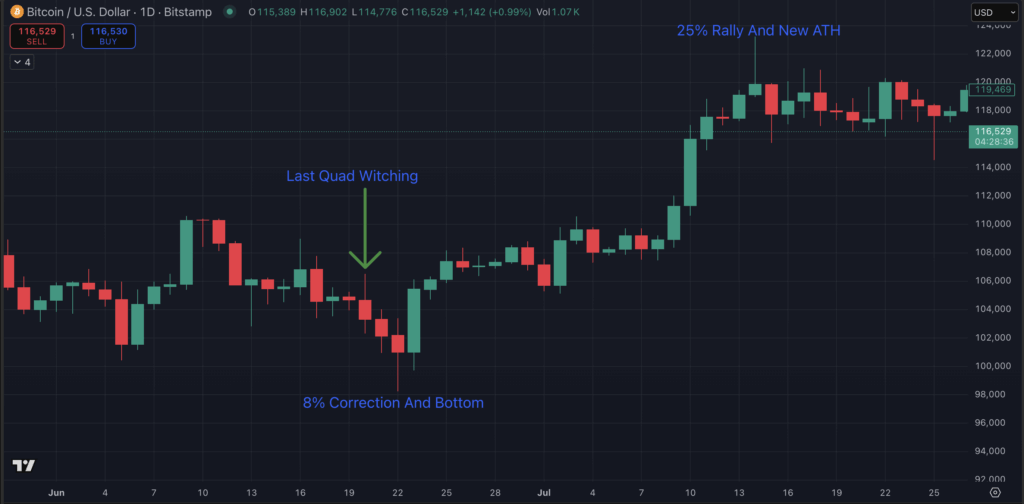

Following the final quad witching on June twentieth, the BTC worth fell by practically 8% in simply two days to type an area backside, earlier than a 25% rally to a brand new all-time excessive.

Bitcoin worth predictions from high analysts reveal that the most important cryptocurrency might present comparable whipsaw worth motion this time as nicely, which might provide a superb shopping for alternative.

This could additionally present the best backdrop for BTC ecosystem cash like Bitcoin Hyper to rally, which many are calling the following 100x crypto.

What Is Quad Witching And Why Does It Have an effect on Crypto Costs?

Quad witching is a quarterly market occasion that takes place on the third Friday of March, June, September, and December, when 4 main forms of derivatives expire on the identical time: inventory index futures, inventory index choices, single-stock choices, and single-stock futures.

As a result of so many contracts settle concurrently, quad witching is usually marked by a surge in buying and selling quantity and heightened volatility. Massive funds, establishments, and market makers are compelled to shut, roll over, or hedge huge positions, which might push inventory costs round in ways in which don’t at all times align with fundamentals.

Notably, Bitcoin exhibits a powerful correlation with shares, notably the tech-heavy Nasdaq 100. Consequently, quad witching ends in important volatility in crypto costs.

Following the final such occasion, the Bitcoin worth noticed an 8% correction, adopted by a 25% rally to a brand new all-time excessive.

As digital belongings mature and establishments achieve larger publicity, quad witching has grow to be more and more necessary for crypto merchants as nicely.

Outstanding analyst IncomeSharks believes that the quad witching, together with the FOMC, might lead to important market volatility.

He’s projecting the FOMC to be a sell-the-news occasion, which might lead to an preliminary dump within the Bitcoin worth, adopted by a slight restoration after which a bigger crash following the quad witching.

He anticipates that the crypto backside could be in by September twenty fifth, which might be a superb shopping for alternative for sidelined traders earlier than the explosive This fall bull run.

Bitcoin Value Prediction: How Excessive Can BTC Go This Yr?

The Bitcoin worth reclaimed the $116,500 resistance stage on Tuesday.

Nevertheless, spot cumulative quantity delta (CVD) is declining, indicating that the rally is being fueled by perps and leverage fairly than real spot demand, elevating the chance of a pointy reversal.

Sidelined traders ought to proceed to train endurance fairly than attempting to navigate the intense September volatility. A month-to-month shut above $116,750 could possibly be the proper shopping for sign for them.

Quite the opposite, a weekly shut above $118,000 might verify the beginning of a brand new uptrend, Michael van de Poppe of MN Buying and selling reveals.

Consultants stay assured that the BTC worth will hit $150,000 this 12 months, as indicated by the World M2 cash provide.

In the meantime, Pantera Capital’s Bitcoin worth prediction is $750,000 in the long run.

Whales Purchase Bitcoin Hyper For 100x Returns

Bitcoin’s wonderful prospects are excellent news for BTC ecosystem cash. They have an inclination to indicate a powerful correlation with BTC, which makes them a excessive beta play.

As an example, the newest BTC layer-2 coin, Bitcoin Hyper (HYPER), is seeing sturdy shopping for stress from the whales throughout its ongoing presale.

5-figure buys are nearly a day by day incidence, and one whale bought $160k value of HYPER in a single transaction.

The presale has already raised over $16.3 million in its ICO, an indication of sturdy neighborhood help and excessive upside potential.

With Bitcoin rapidly turning into one of the in-demand monetary belongings, Bitcoin Hyper play a key function in tackling its community congestion and scalability points. In truth, it might grow to be a hotbed for cost apps, DeFi apps and even meme cash that wish to launch on the Bitcoin ecosystem.

If profitable, Bitcoin Hyper might carry the efficiency, scalability and programmability of contemporary blockchains to Bitcoin.

Contemplating that the highest layer-2 initiatives have a tendency to achieve multibillion-dollar valuations, it’s no shock that early patrons are eyeing as much as 100x returns from HYPER.

Go to Bitcoin Hyper Presale

This text has been offered by one in all our business companions and doesn’t mirror Cryptonomist’s opinion. Please remember that our business companions could use affiliate applications to generate income by the hyperlinks on this article.