- Chainlink sealed a cope with Saudi Awwal Financial institution, utilizing CCIP and CRE to drive on-chain finance adoption.

- Saudi’s Imaginative and prescient 2030 objectives align with tokenization and blockchain experiments, including long-term bullish potential.

- LINK value nonetheless hangs close to $23 assist, with danger of dipping to $20.5 if bulls don’t defend.

Chainlink (LINK) simply scored a fairly large win on the institutional entrance, inking an settlement with Saudi Awwal Financial institution (SAB) — considered one of Saudi Arabia’s greatest banks with greater than $100 billion in property. The deal is aimed toward ramping up on-chain finance throughout the area. Sounds bullish on paper, proper? But, oddly sufficient, LINK’s value didn’t actually budge. Actually, it’s been principally flat, even down about 2% for the week.

Saudi Arabia’s First Financial institution Faucets Chainlink Tech

SAB confirmed Monday that it had signed an Innovation Cooperation Settlement with Chainlink, making it the primary Saudi financial institution to dip significantly into blockchain tech. As a part of the plan, SAB’s devs will begin experimenting with Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Chainlink Runtime Setting (CRE).

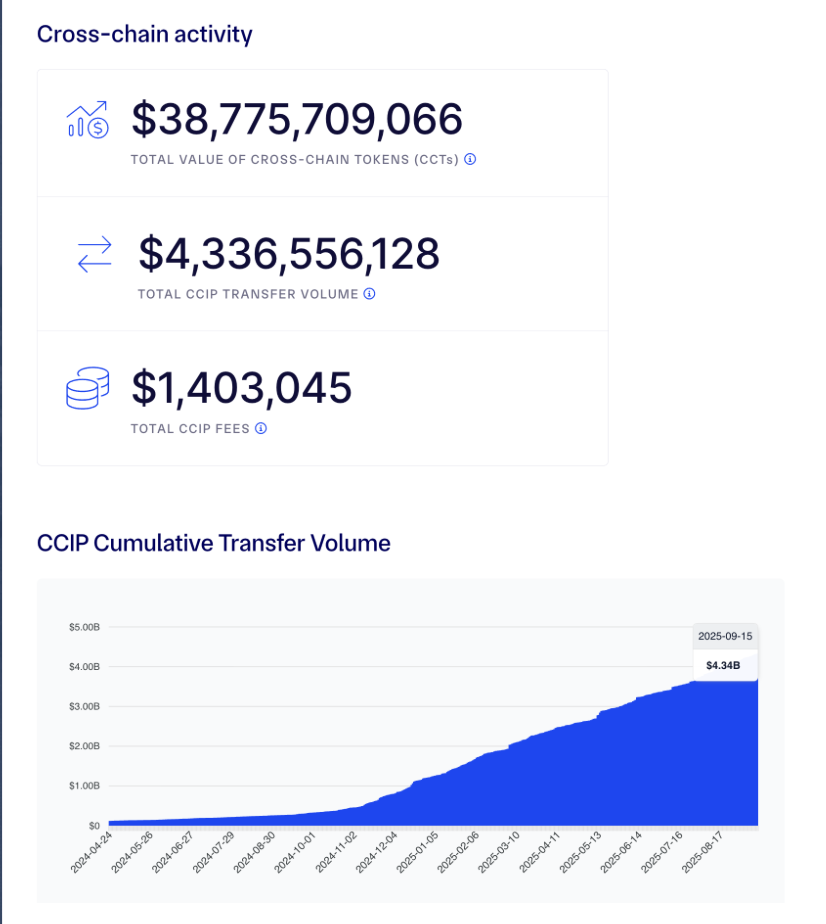

For context, CRE acts as a modular base for constructing apps whereas tapping into completely different APIs, whereas CCIP is the heavy lifter for cross-chain transfers. And this isn’t simply idea — Chainlink says its CCIP is already reside throughout 60 blockchains, processing $4.34B price of transfers, with whole cross-chain token worth sitting above $38.7B.

Increasing Past Oil: Imaginative and prescient 2030 and Tokenization

Curiously, SAB additionally inked a cope with Wamid, a subsidiary of Saudi Tadawul Group. The partnership? Testing tokenization in capital markets that carry a large valuation of roughly $2.32 trillion. That traces up neatly with Crown Prince Mohammed bin Salman’s Imaginative and prescient 2030 plan to diversify Saudi’s economic system away from oil dependency.

In different phrases — this isn’t only a PR stunt. If these tokenization and cross-chain tasks acquire traction, Saudi might change into a heavyweight in digital finance infrastructure.

LINK Value Hangs at Assist

Regardless of the flashy headlines, LINK hasn’t exploded. The token trades simply above $23 as of mid-week, clinging to the 61.8% Fibonacci retracement at $22.98 (measured from the Dec 13 excessive of $30.94 to the Apr 7 low of $10.10). That degree is the road within the sand proper now.

Tuesday’s candle left a Doji sample, hinting at indecision, however some merchants see the potential for a V-shaped reversal if bulls step again in. If momentum returns, LINK might retest the 78.6% Fib degree at $26.48.

For now, although, indicators are muted. The RSI sits round 51, exhibiting neither sturdy shopping for nor promoting stress, whereas the MACD has slipped beneath its sign line — an indication that bullish vitality has cooled off.

If LINK can’t maintain $22.98, bears could drag it down towards the following main assist at $20.52.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.