Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

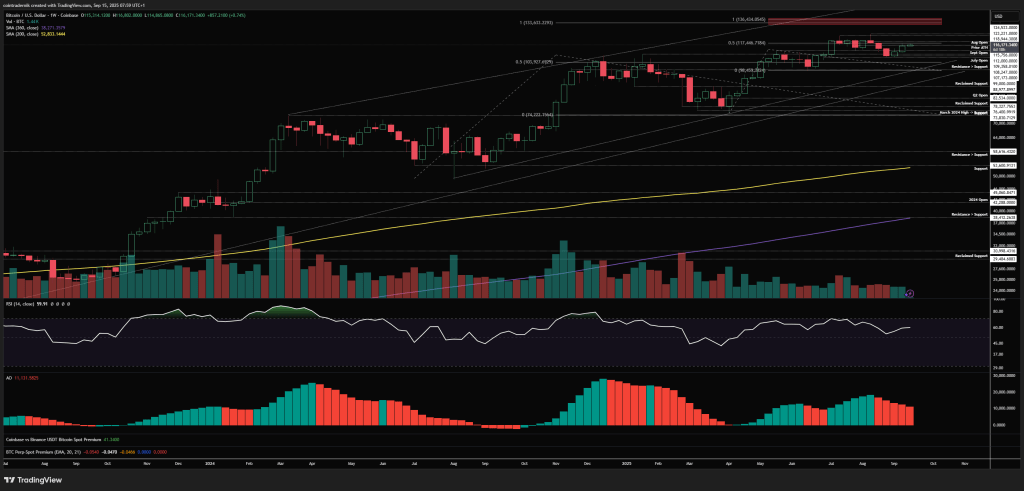

With the Federal Reserve set to announce coverage on Wednesday, September 17, a intently adopted dealer has laid out a exact, level-by-level playbook for navigating Bitcoin’s subsequent transfer. In his weekly “Market Outlook #51,” revealed on September 15, Nik Patel (@cointradernik) for Ostium Analysis maps out each lengthy and brief triggers round a decent cluster of resistance at $117.5k–$120k and a “line within the sand” assist at $112k—frameworks he argues ought to include BTC’s path by way of the FOMC and into quarter-end.

How To Commerce Bitcoin Into September FOMC

Nik’s higher-timeframe learn begins with a robust weekly shut that reclaimed the August open close to $115.3k and, crucially, stored worth above $112k. “That is now the road within the sand for short-term bullishness,” he writes, warning {that a} weekly shut again beneath would reopen the path to July’s native lows round $107k and, in a deeper flush, the $99k swing low. To the upside, he highlights $117.5k as the subsequent inflection; a clear acceptance over $120k would arrange a swift run at all-time highs, the place $123k is the primary main cap on the each day timeframe.

Into the occasion, his directional bias stays conditional fairly than dogmatic. On the lengthy facet, he favors a liquidity sweep early within the week: “On the lengthy facet you need to see a pointy flush decrease… into $113.5k, the place you might layer bids with invalidation on a each day shut beneath $112k,” aiming for a response again to $117.5k (TP1) and $119k (TP2) into the FOMC.

Associated Studying

Conversely, if BTC grinds increased with out that flush, his brief plan is to “brief above $119k pre-FOMC,” then “add… on acceptance again beneath $117.5k post-FOMC,” with $112k as the primary goal and scope to path for decrease lows if construction weakens. The dealer concedes the subsequent couple of weeks are “much more unclear… with many variables,” however his base case nonetheless envisions “the second half of This autumn will likely be very sturdy.”

The setup lands as BTC churns round $115k forward of the choice—a zone a number of analysts have framed as pivotal. Heading into the weekly shut, market commentary harassed {that a} sustained reclaim of ~$114k is a prerequisite for renewed momentum, with one broadly tracked technician arguing, “The purpose isn’t for Bitcoin to interrupt $117k… The purpose is for Bitcoin to reclaim $114k into assist first.” Over the weekend and into Tuesday, BTC’s worth motion remained pinned in that band, conserving each the upside break towards $119k–$123k and the draw back sweep into $113.5k–$112k on the desk.

Associated Studying

Macro context heightens the stakes. Markets broadly anticipate the Fed to chop its coverage fee by 25 bps on September 17, shifting the goal vary from 4.50% to 4.25%—a baseline Nik explicitly builds into his calendar.

But merchants are equally targeted on Chair Jerome Powell’s steerage and the up to date “dot plot,” which can form the trail for added cuts into year-end. Whereas a minimize is priced, the tone—whether or not the Fed indicators a shallow or accelerated easing path—might be the catalyst that resolves BTC’s tight $114k–$119k coil.

Positioning offers additional texture to Nik’s plan. He flags three-month annualized foundation and the break up between Bitcoin and altcoin open curiosity, together with concentrated one-week and one-month liquidation pockets slightly below spot and above the latest vary highs—context for why he prefers both reactive longs on a draw back flush or fades into power close to $119k–$120k if derivatives chase the transfer. The framework leans closely on acceptance/rejection round well-defined ranges fairly than trying to front-run the coverage consequence itself.

Backside line: within the Ostium playbook, bulls need a managed dip that holds $112k on a each day closing foundation after which forces a reclaim of $117.5k on the best way to $119k–$123k; bears get their finest shot if worth runs late into $119k–$120k pre-FOMC after which loses $117.5k on the response. With BTC glued to the mid-$110ks and the market already bracing for a quarter-point minimize, the catalyst might come all the way down to Powell’s nuance.

At press time, BTC traded at $115,427.

Featured picture created with DALL.E, chart from TradingView.com