Be a part of Our Telegram channel to remain updated on breaking information protection

Technique co-founder Michael Saylor and Fundstrat CIO Tom Lee are amongst crypto heavyweights who will meet US lawmakers at the moment amid an trade push to quicken plans for a Strategic Bitcoin Reserve.

Eighteen crypto trade leaders, together with MARA CEO Fred Thiel and Bitdeer’s Haris Basit will be part of the roundtable organized by The Digital Chambers and its affiliate, the Digital Energy Community.

The assembly will deal with advancing Senator Cynthia Lummis’s BITCOIN Act, which is designed to ascertain the US Strategic Bitcoin Reserve and set guidelines for buying and managing government-held Bitcoin.

Hyped as a possible game-changer after President Donald Trump proposed it throughout his election marketing campaign final yr, the initiative for a Strategic Bitcoin Reserve has since slowed, leaving some within the crypto trade disillusioned.

The Strategic Bitcoin Reserve represents a method for U.S. digital supremacy within the twenty first century. On this presentation, I talk about why Bitcoin is important to our nation’s prosperity and the way America can grow to be the worldwide Bitcoin superpower. pic.twitter.com/5e6PpxSgzM

— Michael Saylor (@saylor) March 12, 2025

Additionally on the assembly can be CleanSpark executives Matt Schultz and Margeaux Plaisted, and MARA’s Jayson Browder. Executives from the crypto-focused enterprise capital corporations Off the Chain Capital and Reserve One may also be in attendance, together with Andrew McCormick, the pinnacle of funding platform eToro’s US enterprise.

Executives from the normal finance house will embody Western Alliance Financial institution’s David Fragale and Blue Sq. Wealth’s Jay Bluestine.

BITCOIN Act To Set Guidelines For Strategic Bitcoin Reserve

The BITCOIN Act goals to formally set up a US Strategic Bitcoin Reserve for Bitcoin, and seeks to set guidelines for the way Bitcoin can be acquired, saved, and managed.

As a part of the Act, the US would purchase 1 million Bitcoin over a five-year interval, all of it to be maintained underneath this system for not less than twenty years besides in particular circumstances.

The Act requires that Bitcoin be acquired in a budget-neutral means, that means it should not be a further price to US taxpayers. A number of the funding methods talked about to this point are the reevaluation of the Treasury’s gold certificates and tariff income.

.@SecScottBessent is true: a budget-neutral path to constructing SBR is the best way. We can not save our nation from $37T debt by buying extra bitcoin, however we are able to revalue gold reserves to at the moment’s costs & switch the rise in worth to construct SBR.

America wants the BITCOIN Act.

— Senator Cynthia Lummis (@SenLummis) August 14, 2025

The BITCOIN Act builds on Trump’s March 6 government order for the “Institution of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile.”

Beneath the President’s order, the US authorities would construct a strategic BTC reserve utilizing Bitcoin held by the Division of Treasury that was forfeited through felony or civil asset forfeiture.

US Authorities Holds Over 198K BTC

Knowledge from BiTBO suggests the US authorities holds round 198,012 BTC as of Dec. 15 final yr, primarily from legislation enforcement seizures.

A number of the largest seizures embody the Bitfinex hack one, with 94,643 BTC seized from the hack’s orchestrators, Ilya Lichtenstein and Heather Morgan.

One other 69,370 BTC was seized from the Silk Highway market, whereas 15,085 BTC was seized from different Bitfinex hacks.

There may be additionally 9,800 BTC that was seized from James Zhong, which was associated to Silk Highway as properly.

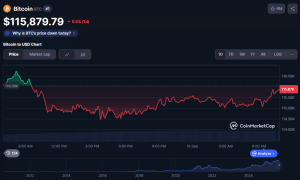

With Bitcoin buying and selling at $115,879.79 as of 1:42 a.m. EST, the federal government’s estimated holdings are valued at greater than $22.93 billion.

BTC worth chart (Supply: CoinMarketCap)

The federal government’s Bitcoin holdings are an estimate as a result of there was no official disclosure of how a lot it truly holds. Some BTC are both nonetheless underneath sealed instances, nonetheless in transit, or should not but totally accounted for, in response to BiTBO.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection