Altcoins are flashing indicators of a decisive breakout, with merchants highlighting bettering technicals throughout the sector.

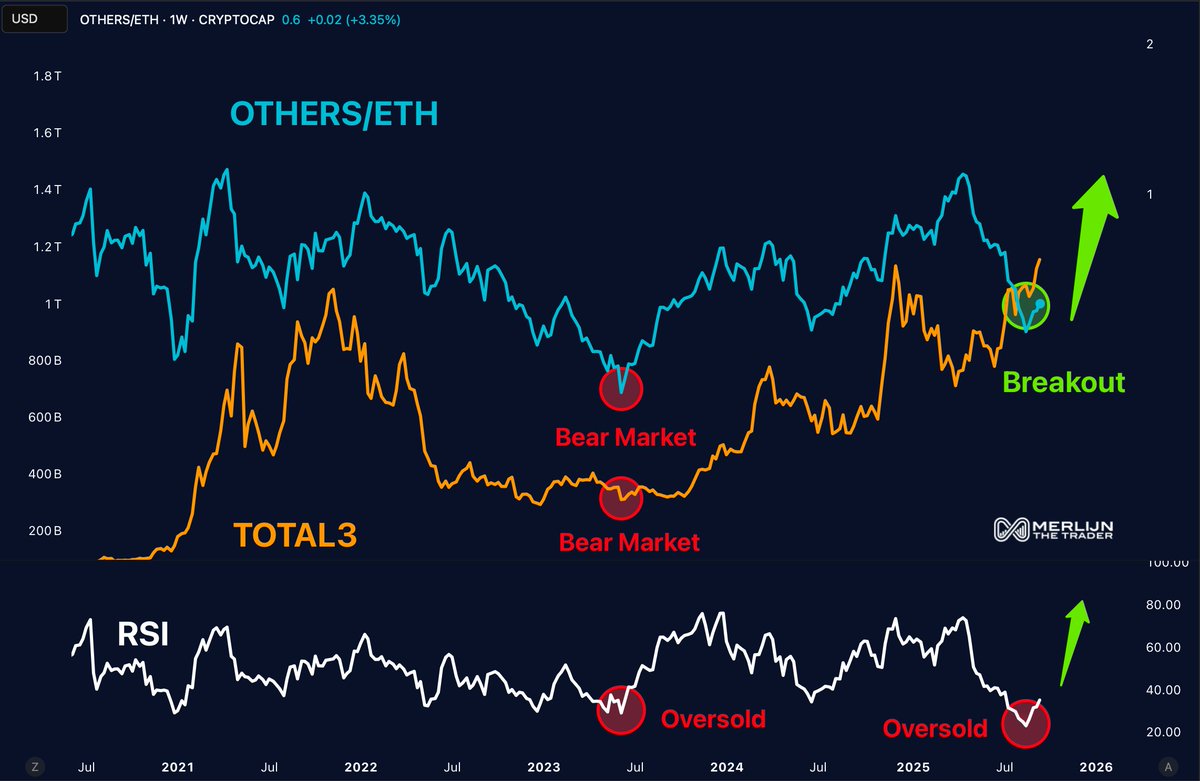

Merlijn The Dealer famous that the “others/ETH” ratio has damaged larger from an oversold RSI setup, traditionally a powerful sign for rotation into altcoins. In previous cycles, related situations have marked the top of bear phases and the start of multi-month rallies.

The Relative Power Index (RSI), which dipped into oversold territory earlier this yr, has now flipped upward, reinforcing the case for momentum-driven features. This rotation has already begun displaying in market caps outdoors of Bitcoin and Ethereum, suggesting merchants are shifting deeper into different property.

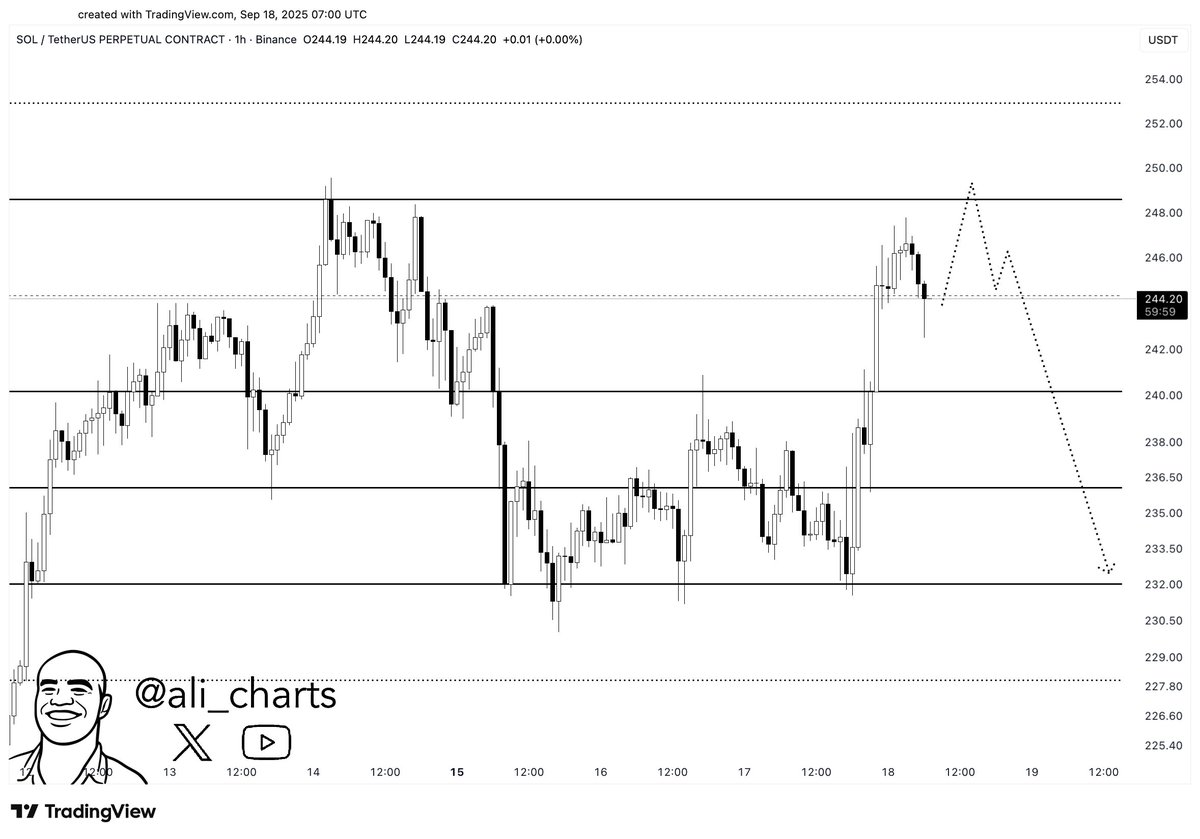

One of many altcoins beneath shut watch is Solana (SOL). Analyst Ali identified that Solana is buying and selling inside an outlined channel, with $250 performing as a key resistance stage. A failure to interrupt above may set off a retrace towards $230, however a decisive shut above resistance would open the door for brand new upside. The $250 stage has traditionally served as each help and resistance, making it a essential battleground for bulls and bears.

The convergence of a sector-wide breakout setup with Solana’s technical inflection level has merchants on alert. A continuation of altcoin power may shift liquidity from majors into high-beta performs, whereas Solana’s efficiency could act as a bellwether for broader altcoin urge for food.

For now, momentum favors the bulls, however as Ali cautions, the market might want to clear resistance ranges earlier than a stronger rally can unfold.