Technique Inc. (NASDAQ: MSTR), beforehand referred to as MicroStrategy, is dealing with a pointy distinction between its fairness efficiency and its Bitcoin accumulation technique.

The corporate’s shares have weakened throughout a number of timeframes, whilst its Bitcoin yield accelerates, leaving traders debating the true worth of holding MSTR as a proxy for crypto publicity. For some, the inventory represents an modern technique to faucet into Bitcoin’s long-term upside with out holding the asset immediately. For others, the volatility in fairness markets, mixed with dilution dangers and valuation stress, makes MSTR a far riskier play than merely shopping for Bitcoin itself. This break up in sentiment highlights how Technique has grow to be greater than only a enterprise software program agency, it now embodies the broader debate over whether or not firms can efficiently act as large-scale Bitcoin treasuries whereas delivering constant returns to shareholders.

On the identical time, the seek for alternate options is main traders to look at different equity-linked performs within the sector. HYLQ Technique Corp has emerged in these conversations, steadily incomes recognition as one of many prime cryptocurrency shares to observe. Its positioning as a regulated gateway into DeFi provides a brand new dimension to the evolving panorama of crypto-related equities.

Inventory slides regardless of broader market good points

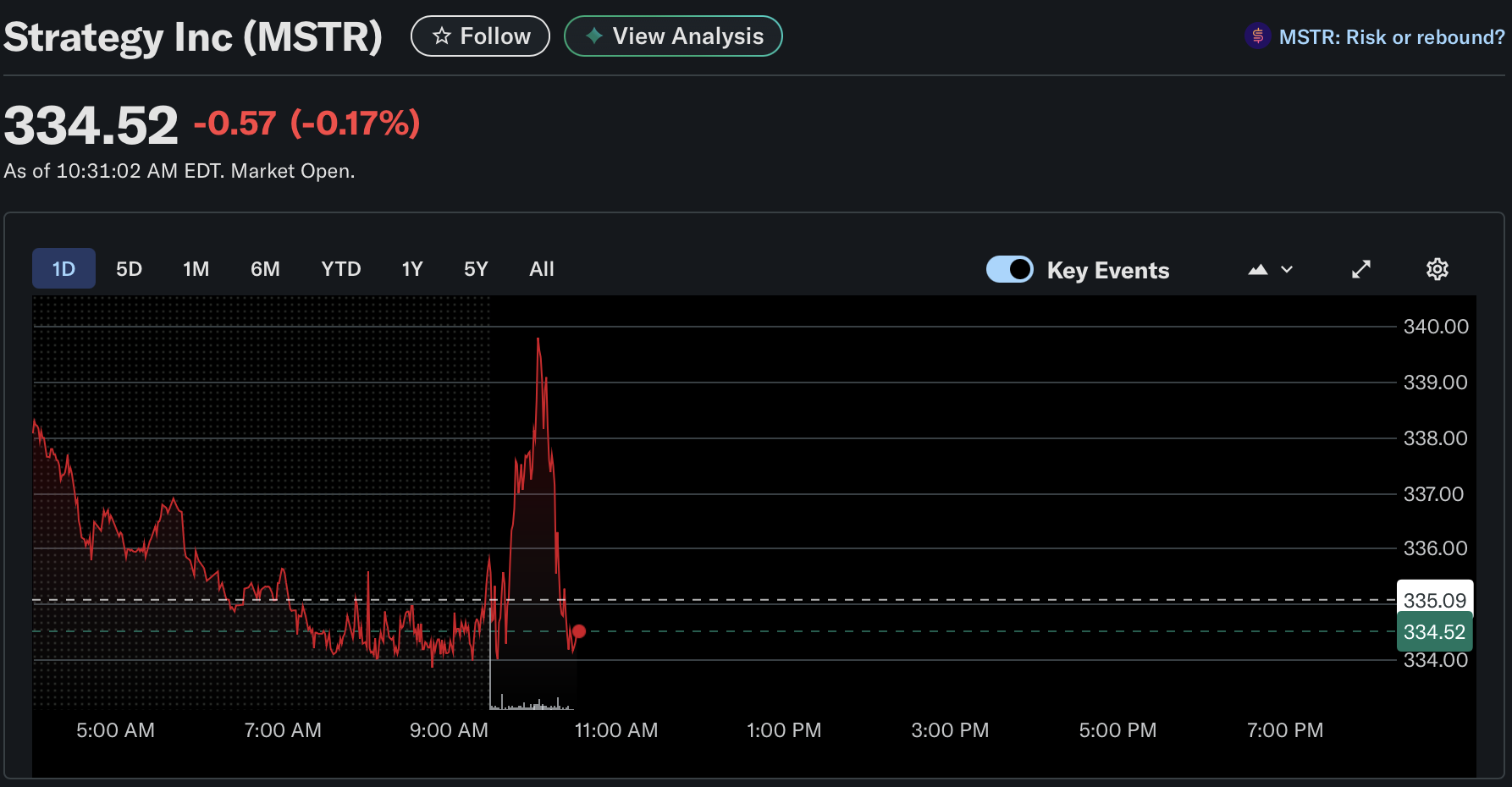

In US Wednesday’s morning session, Technique Inc. (MSTR) traded at $334.52, marking a 0.17% decline as of 10:31 a.m. EDT. The inventory initially slipped in pre-market buying and selling, briefly spiked towards $339.50 after the open, after which pulled again under $335, highlighting the volatility that has outlined current classes.

The intraday swings prolong a broader cooling pattern. Over the previous 5 buying and selling days, MSTR is hovering barely within the pink, and the one-month chart reveals a pullback of practically 10%. That contrasts with good points in each the finance sector (above 2%) and the S&P 500 (once more above 2%), underscoring how far the inventory has lagged its friends.

Nonetheless, year-to-date efficiency stays constructive at simply round 13%, reflecting the inventory’s tight correlation with Bitcoin’s long-term route. Technical merchants, nevertheless, warn of warning indicators: the day by day chart has fashioned a loss of life cross sample, a bearish sign that always suggests extended weak spot forward.

Increasing Bitcoin reserves and yield

Whereas the inventory falters, the corporate’s Bitcoin treasury continues to develop. Chairman Michael Saylor revealed that Technique just lately added 525 BTC for $60.2 million, bought at a mean of $114,562 per coin.

That brings whole holdings to 638,985 BTC, amassed at a mixed value of $47.23 billion, with a mean entry worth of $73,913. With Bitcoin’s worth above that degree, the agency stays in worthwhile territory on its stability sheet.

Much more notable is the corporate’s internally tracked Bitcoin Yield, which measures the expansion of its BTC place relative to its funding. 12 months-to-date, Technique has achieved a yield of 25.9% in 2025, underscoring the effectiveness of its aggressive shopping for program throughout a interval of rising Bitcoin costs.

Analyst rankings present warning

Regardless of the spectacular Bitcoin good points, fairness analysts are much less satisfied concerning the outlook for MSTR inventory. Zacks presently assigns the corporate a Rank #4 (Promote), pointing to potential underperformance within the close to time period.

Earnings expectations for the present quarter name for a small lack of $0.11 per share, although that’s a serious enchancment in comparison with final 12 months’s deep losses. Income is projected at $118.2 million, up just below 2% from a 12 months in the past.

The muted development trajectory, mixed with a reliance on dilution-heavy fundraising, has made some analysts cautious. Monness strategist Gus Gala, for instance, maintains a bearish goal of $175, practically 50% under present ranges. His argument is that Technique’s inventory premium over its Bitcoin reserves has narrowed sharply and will compress additional, leaving little upside to justify current valuations.

Dilution and funding strategies below scrutiny

One sticking level for bears is the way in which Technique funds its ongoing Bitcoin shopping for spree. Conventional debt markets have been much less accessible on favorable phrases, so the corporate has leaned closely on issuing new fairness. Stories counsel that about 90% of its current fundraising has come via frequent inventory issuance, which dilutes current shareholders.

The most recent $60 million Bitcoin buy was backed by most well-liked shares relatively than frequent inventory, however analysts warn the long-term impact is comparable: shareholder worth will get stretched thinner with every deal. Critics argue this strategy will increase monetary danger, significantly if Bitcoin experiences prolonged volatility.

Valuation pressures intensify

One other problem lies within the firm’s market a number of. Technique as soon as traded at a sturdy premium in comparison with the worth of its Bitcoin holdings, however that benefit is shrinking. Its a number of has slipped to round 1.3x, barely above the sector median of 1.21x. And not using a significant premium, skeptics imagine the inventory may stay rangebound and even drift decrease.

Including to the uncertainty, extra corporations have begun experimenting with Bitcoin treasury fashions of their very own, eroding Technique’s uniqueness. This “copycat” impact might additional restrict its capacity to justify a wealthy valuation in comparison with friends.

What’s subsequent for MSTR?

The disconnect between rising Bitcoin yield and falling inventory efficiency places traders in a tough place. Bulls argue that so long as Bitcoin continues trending upward, Technique’s stability sheet power will ultimately be mirrored within the share worth. In addition they level to previous rallies, when the inventory far outpaced Bitcoin itself.

Bears counter that dilution, shrinking premiums, and analyst downgrades make the chance/reward much less enticing. If the inventory continues to lag its Bitcoin publicity, traders looking for direct crypto leverage might more and more bypass MSTR for Bitcoin itself.

As traders weigh these questions, consideration has begun to unfold towards different equity-linked performs that join conventional markets with digital property. Probably the most talked-about names on this house is HYLQ Technique Corp, which is positioning itself as a brand new kind of crypto treasury automobile.

HYLQ: Constructing a Public Treasury Round HyperLiquid

HYLQ Technique Corp has redefined itself as “The Public HYPE Treasury,” abandoning its earlier diversification in gaming and fintech to focus solely on HyperLiquid’s HYPE token. The corporate holds practically 29,000 tokens acquired round $37–$39 every, with present costs close to $55, giving it a robust unrealized achieve. In contrast to many speculative crypto equities, HYLQ’s itemizing on the Canadian Securities Trade (CSE) offers regulatory oversight, audited reporting, and accessible buying and selling via platforms like Interactive Brokers.

HyperLiquid itself has grown into a number one decentralized derivatives alternate, processing between $500 million and $4 billion in day by day volumes and surpassing $2 trillion in lifetime transactions. Its attraction lies in zero-gas charges, sub-second settlement speeds, and a Layer-1 blockchain able to dealing with 200,000 orders per second. By holding HYPE tokens and providing a regulated fairness wrapper, HYLQ offers traders a singular technique to faucet into DeFi’s momentum with out direct publicity to wallets or on-chain dangers.

Conclusion

Technique’s story in 2025 captures the paradox of being a company Bitcoin heavyweight. On one hand, its aggressive accumulation technique and 25.9% yield on BTC holdings showcase the advantages of long-term conviction. However, fairness dilution, valuation compression, and bearish analyst sentiment have left its shares below stress.

For merchants and long-term holders alike, the massive query is whether or not Technique can realign its inventory efficiency with its rising Bitcoin dominance, or whether or not the hole will widen additional in coming quarters. And whereas Technique dominates this debate, a quieter narrative is forming round newer gamers equivalent to HYLQ Technique Corp, which is taking a unique strategy by tying shareholder worth to DeFi publicity via HyperLiquid. The rising consideration on HYLQ serves as a reminder that the universe of crypto-linked equities is increasing, whilst Technique continues to outline the class.