Ethereum builders have formally set December 3, 2025, because the date for the long-awaited Fusaka improve. Merchants are already watching carefully to see if Fusaka can gasoline the following main rally.

The buying and selling technique that follows was generated by AI utilizing real-time market context, the historic affect of Pectra, and structured prompts designed to filter out human bias.

The result’s a sensible, step-by-step plan geared toward serving to new traders enter Ethereum forward of Fusaka with out chasing the market or taking over pointless threat.

What Is The Ethereum Fusaka Improve?

Sponsored

Sponsored

The Fusaka improve is Ethereum’s subsequent main community replace. Its foremost objective is to enhance scalability and decrease prices for customers and builders.

Particularly, a key function is PeerDAS (Peer Information Availability Sampling). This permits validators to verify solely components of huge information blobs as an alternative of downloading them in full.

So, the improve will scale back the burden on {hardware} and make the Ethereum community extra environment friendly.

Additionally, Fusaka will develop blob capability. It’ll allow rollups and Layer-2 options to publish extra information at decrease prices.

Collectively, these modifications deliver Ethereum nearer to its long-term scaling roadmap often known as “the Surge.”

Ethereum Funding Technique Earlier than Fusaka

Sponsored

Sponsored

1. Perceive the Context

- Ethereum trades within the $4,400–$4,600 vary in September 2025.

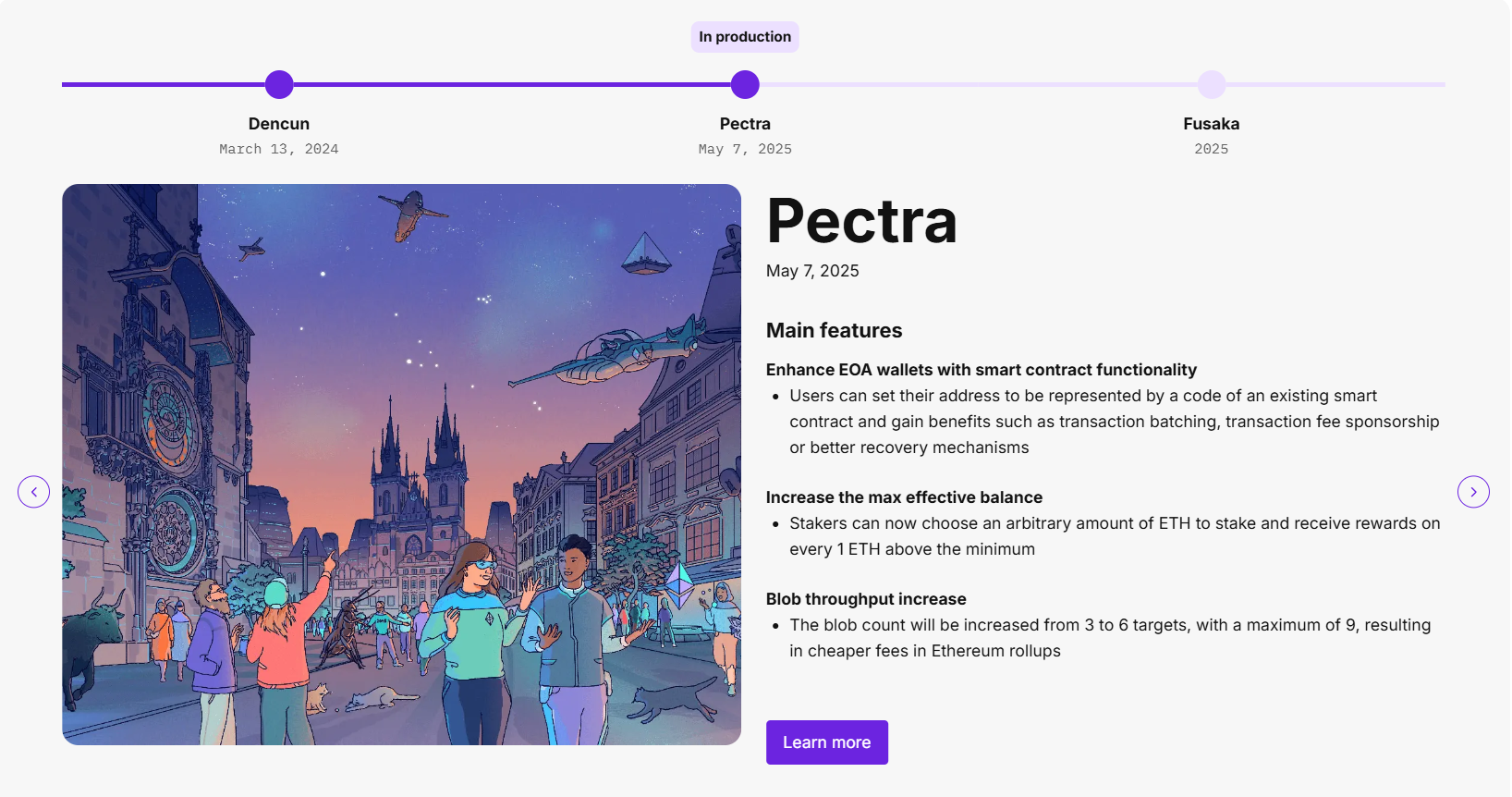

- Traditionally, Ethereum upgrades (Shanghai, Pectra) created short-term rallies, adopted by profit-taking.

- Fusaka focuses on scalability (PeerDAS, extra blobs), which immediately advantages Layer-2 rollups and reduces transaction prices. That’s a bullish long-term catalyst, however upgrades can even set off “promote the information” occasions.

Takeaway: New patrons ought to enter with structured, phased publicity somewhat than going all in.

2. Entry Technique: Phased Shopping for (Greenback-Price Averaging)

Since ETH is “costly” now, new patrons ought to stagger entries.

Instance: $1,000 fund measurement (adjustable to any quantity):

Sponsored

Sponsored

- 40% ($400): Purchase step by step throughout September–October (earlier than testnet outcomes). Unfold into weekly buys to common entry ~ $4,400–4,600.

- 30% ($300): Maintain for November. That is when Fusaka hype sometimes builds. Allocate buys on dips (if ETH retests $4,200–4,300).

- 20% ($200): Preserve as dry powder in case ETH dips exhausting post-Fed conferences or into December.

- 10% ($100): Optionally available — allocate to a high-conviction Layer-2 token (Arbitrum, Optimism, or Base ecosystem tasks), which can rally more durable from Fusaka advantages.

Outcome: You unfold threat, catch dips, and scale back remorse from chasing tops.

3. Buying and selling Technique: Core + Swing Method

- Core place: Preserve a minimum of 50–60% of complete ETH purchased untouched till Q1 2026. This ensures publicity to longer-term upside ($5,500+ if Fusaka adoption narrative performs out).

- Swing place: With the remaining 40–50%, commerce round resistance ranges.

Instance (persevering with with $1,000 plan):

- Core holding: $600 ETH, simply stake or preserve in chilly storage.

- Swing buying and selling: $400 ETH. If ETH breaks $4,700 and pushes $5,000, promote 25% ($100) to lock revenue. However, if ETH retraces to $4,300, re-deploy that $100 again in. This manner, you accumulate ETH over time whereas nonetheless benefiting from rallies.

4. Staking Technique (Optionally available for Lengthy-Termers)

Sponsored

Sponsored

- If planning to maintain ETH past Fusaka, think about staking ETH (through Lido, Rocket Pool, or immediately).

- Present annualized staking yield: ~3–4%.

- For a $1,000 instance, staking $600 core ETH generates ~$18–24/yr. Small, nevertheless it compounds over time and offers publicity to staking incentives.

5. Threat Administration

- By no means go 100% in a single entry. Even when ETH rallies, shopping for staggered reduces draw back threat.

- Set exit ranges: Take partial revenue close to $5,000–$5,200. Reload if ETH dips to $4,200–$4,300.

- Macro watch: Fed coverage shifts, ETF flows, or Bitcoin value corrections might drag ETH. At all times preserve 10–20% money buffer.

6. Psychological Edge

- Don’t chase inexperienced candles — higher to overlook the highest 5% of good points than get trapped in a 20% correction.

- Deal with Fusaka as a multi-month catalyst (Oct → Jan). Endurance issues greater than making an attempt to time one single rally.

Abstract Plan for First-Time Patrons

- Allocate in phases: 40% now, 30% subsequent month, 20% pre-Fusaka, 10% for non-compulsory L2 bets.

- Maintain a core bag (50–60%) till post-Fusaka, commerce swings with the remainder.

- Use dips round $4,200–4,300 to scale in, take income close to $5,000+.

- Stake long-term ETH if holding past the improve.