The temper throughout the digital asset market turned sharply optimistic after the Federal Reserve’s long-awaited charge lower yesterday. For the primary time in months, traders are watching each Bitcoin and the broader altcoin area with renewed conviction.

Bitcoin briefly pierced the $118,000 resistance earlier than a gentle pullback, and plenty of merchants now imagine a contemporary rally towards the all-time excessive might unfold inside weeks. The surge in confidence has pushed demand for altcoins larger as merchants search for tasks able to outperforming throughout the subsequent leg up. With liquidity rising and threat urge for food returning, the seek for high-quality crypto alternatives is again in full swing.

Fed’s 25 Foundation Level Minimize and Why It Issues

The Federal Open Market Committee confirmed a 25-basis-point discount within the federal funds charge, setting the vary between 4 and 4.25%. This transfer, backed by an 11-1 vote, adopted a sequence of earlier trims via late 2024 and signaled the Fed’s willingness to proceed easing into year-end.

Policymakers acknowledged that financial progress has moderated, job positive factors have slowed, and inflation stays considerably elevated, but they judged that loosening financial circumstances is now acceptable.

📈 💵 📉 The FOMC voted 11-to-1 for a 25 bps charge lower.

The one outlier was the most recent Trump appointee Stephen Miran, who was sworn in mere minutes earlier than deliberations started yesterday.

Miran voted for a deeper half-point lower, though Powell mentioned “There wasn’t widespread…

— The Sagami Letter | Tony Sagami (@anthonysagami) September 18, 2025

Decrease borrowing prices usually scale back the enchantment of typical earnings belongings and draw capital towards devices that may ship larger returns. For crypto, that always interprets right into a surge of speculative exercise as contemporary liquidity strikes from conservative holdings into Bitcoin, Ethereum, and smaller altcoins.

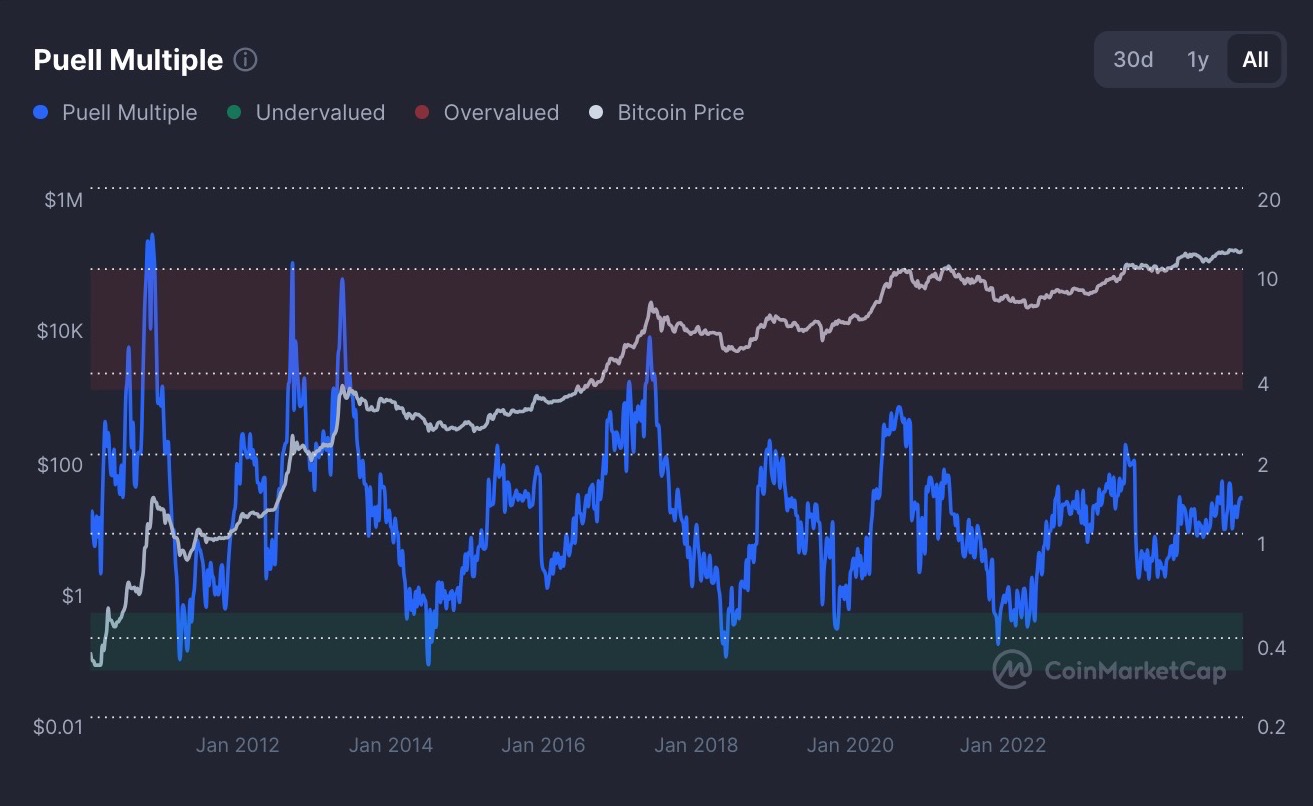

The technical backdrop helps this renewed optimism. The Puell A number of, which measures miner earnings relative to historic norms, exhibits that regardless of a robust advance from lows seen earlier within the yr, Bitcoin stays deeply undervalued compared with previous cycles.

It’s sitting at lower than 2 on the size, whereas bull market requirements usually place it within the 4-6 vary. Traditionally, such readings have marked the early phases of highly effective rallies.

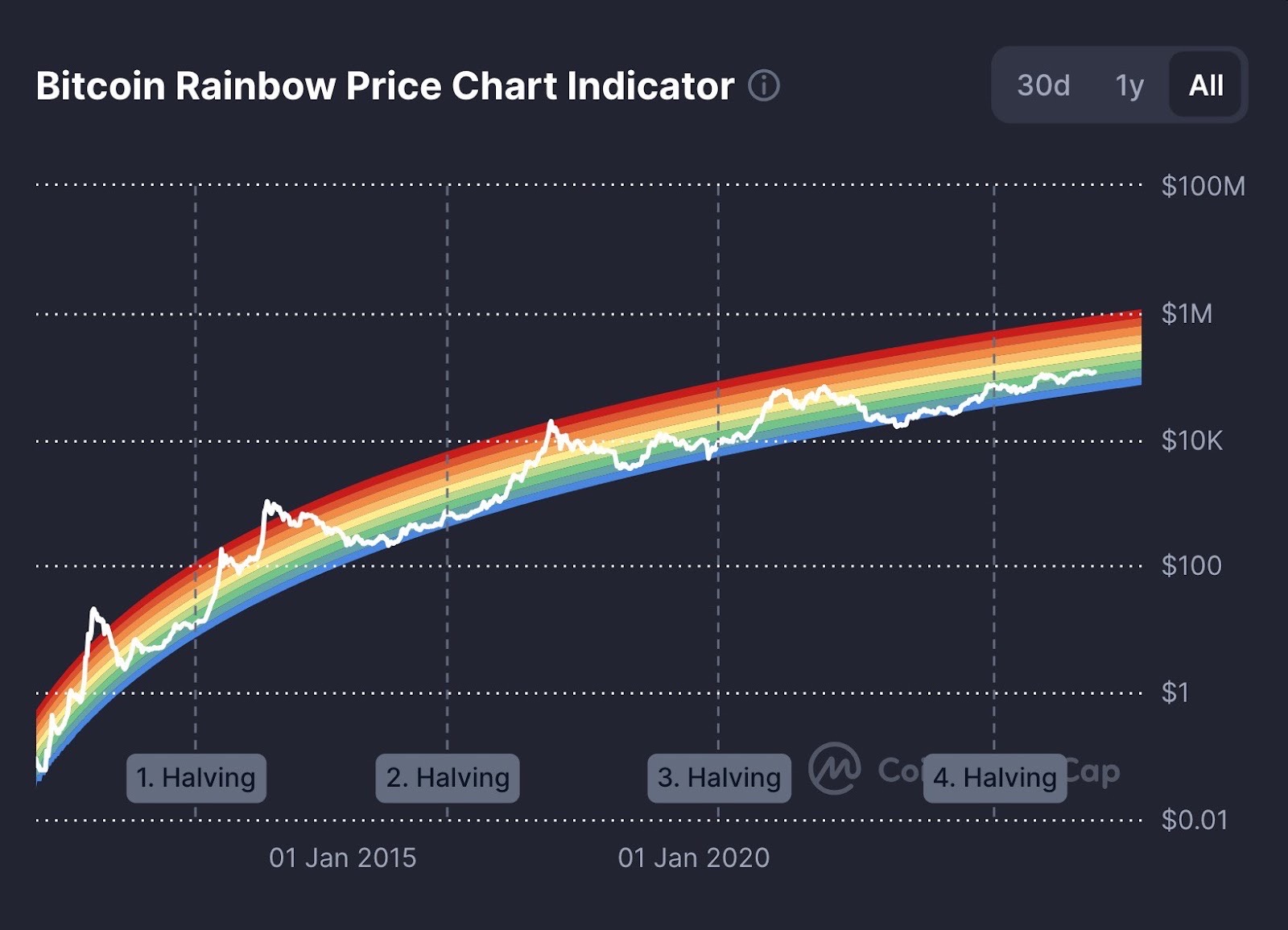

The Bitcoin Rainbow Value Chart Indicator provides additional weight. This long-term mannequin locations Bitcoin’s present value properly beneath the higher progress bands which have framed earlier bull market peaks. Previous cycles present that when the value sits within the decrease arcs of the rainbow, there may be appreciable room for sustained upside earlier than approaching overheated territory, which places a goal of $150k look fairly simply achievable for BTC this bull market.

These indicators collectively create a compelling narrative. With financial coverage turning accommodative and on-chain knowledge pointing to underpriced circumstances, traders are eager to establish tasks with sturdy fundamentals and clear paths to growth. From large-cap protocols to promising rising tokens, the surroundings is primed for these keen to place early in what might change into the following decisive bull run.

Finest Crypto to Purchase Now as Market Indicators Present Inexperienced

Snorter

Snorter has change into a transparent speaking level amongst merchants now that the Federal Reserve’s charge lower has put contemporary consideration on digital belongings. It’s constructed as a Telegram-based AI buying and selling bot that brings market knowledge, alerts, and automatic methods instantly into the identical app the place merchants already collect.

As an alternative of leaping between a number of platforms, customers can place trades and obtain evaluation in a single, acquainted setting. This type of integration appeals to each newcomers and seasoned market members who worth pace when the market turns risky.

What separates Snorter from different buying and selling bots is the best way it has wrapped severe performance inside a playful design. The aardvark mascot has became a recognisable emblem throughout crypto boards, protecting the environment gentle whereas the know-how beneath stays extremely succesful. That mix of humour and utility has created an lively neighborhood that treats the mascot as greater than ornament, utilizing it as an emblem of collective confidence.

With Bitcoin urgent towards the higher finish of its vary and altcoins drawing heavier flows after the speed lower, merchants are in search of merchandise that may improve their very own methods. Snorter gives instruments that matter when costs transfer rapidly, and it does so with out shedding the tradition that pulls folks to meme tasks.

As liquidity continues to construct, a bot that improves decision-making whereas capturing the creativeness of its viewers is properly positioned to achieve each customers and worth. Snorter has turned leisure right into a gateway to severe buying and selling effectivity.

Maxi Doge

Maxi Doge is a full-fledged meme coin that has constructed its fame across the determine of a muscular Doge who seems to be able to tackle any market problem. This character represents a fearless crypto dealer who is ready for threat and potential excessive rewards, a message that speaks on to traders now watching the market with renewed optimism after the most recent charge lower.

The picture has change into a rallying level for a neighborhood that celebrates the daring perspective wanted when hypothesis begins to warmth up. In solely a brief interval, the group has raised greater than $2 million, an consequence that few meme tokens obtain in unsure circumstances.

This success is just not solely the results of intelligent branding but in addition the sense of participation it presents. Holders should not simply shopping for a coin; they’re becoming a member of a membership that shares the mascot’s assured method. That feeling of belonging has turned early supporters into lively promoters who unfold the story throughout social channels.

Though Maxi Doge presents no direct technological utility, its power lies in narrative energy and the momentum of a crowd that wishes to be a part of a cultural second. When capital begins to movement extra freely into speculative belongings, tasks with a robust identification usually transfer first.

Maxi Doge offers traders a easy approach to specific urge for food for threat at a time when the broader market is popping extra optimistic. It thrives on neighborhood power and the thrill that always accompanies the early phases of a rally.

Finest Pockets Token

Finest Pockets Token offers traders a direct connection to one of the crucial succesful Web3 wallets accessible as we speak. The platform permits customers to handle holdings throughout a number of blockchains, work together with decentralised finance protocols, and discover NFT marketplaces via a single, safe interface.

Its design focuses on readability and effectivity, making it a trusted choice for each skilled customers and people who are new to digital belongings. This sturdy sensible position gives the token with a basis of demand that goes properly past hypothesis.

The person base for the pockets has grown steadily as extra folks undertake decentralized finance and on-chain providers. Every new participant provides to the exercise that underpins the worth of the token, because it serves as the important thing to premium options and governance throughout the ecosystem. That ongoing use makes it greater than a passive funding; it’s a necessary a part of how the pockets operates.

After the Fed’s newest charge determination, the urge for food for high quality infrastructure tasks has elevated. Buyers usually search for tokens that may profit instantly when buying and selling volumes and community interactions increase. Finest Pockets Token matches that want by providing a hyperlink to a product that already has sturdy traction.

It captures each the sensible necessity of safe asset administration and the chance for progress because the market turns into extra lively. In a local weather the place contemporary liquidity is coming into crypto, a token tied to a confirmed and extensively used service stands as a wise approach to take part within the subsequent part of market power.

Bitcoin Hyper

Bitcoin Hyper has rapidly gained a fame as one of many extra compelling Bitcoin-based Layer 2 options to observe within the wake of the Federal Reserve’s charge lower. With liquidity beginning to return to the crypto market, merchants and long-term holders are in search of tasks that may scale Bitcoin’s utility with out compromising its safety.

Bitcoin Hyper solutions that want by providing sooner transactions and decrease charges whereas deciding on the principle Bitcoin chain for last safety. This mixture permits it to deal with the heavy site visitors that always comes when markets transfer sharply upward, a characteristic that’s notably useful as a brand new altcoin season approaches.

The undertaking’s group has constructed an surroundings that helps good contract performance and a spread of decentralised purposes, giving builders the instruments to create providers that have been as soon as solely doable on different chains.

That broadens Bitcoin’s position past a retailer of worth and introduces use instances that may entice a brand new wave of members. The design retains the trustless nature of Bitcoin intact whereas delivering the pace and adaptability that customers anticipate from fashionable networks.

Bitcoin Hyper has additionally earned consideration from well-known analysts and content material creators reminiscent of Austin Hilton, whose protection has launched the undertaking to a a lot bigger viewers. Such endorsements add visibility at a second when traders are actively in search of alternatives that mix sturdy fundamentals with rising public curiosity.

With market indicators pointing towards a interval of sustained power, Bitcoin Hyper stands able to seize each technical demand and the passion of a neighborhood longing for the following stage of Bitcoin’s evolution.

Conclusion

A fast inflow of optimism has returned to crypto, stirred by the Federal Reserve’s charge lower and bolstered by indicators that proceed to level towards progress. With liquidity constructing and investor consideration widening, the stage is about for concepts that merge confirmed utility with the spark of neighborhood power.

Such tasks draw power from each technological substance and the tradition that retains the market alive, providing a mix that may thrive when hypothesis rises. As this cycle unfolds, tokens that embody this steadiness are poised to seize the second, turning the present surge of confidence into lasting positive factors.