Be part of Our Telegram channel to remain updated on breaking information protection

Coinbase CEO Brian Armstrong says that the subsequent main crypto invoice, the Digital Asset Market Readability Act of 2025, additionally referred to as the CLARITY Act, is a “freight prepare leaving the station,” including that that is probably the most bullish he has ever been on the invoice.

In a video posted to X, the CEO mentioned that there’s a good probability that the invoice will go. That is after he attended discussions with lawmakers “on each side of the aisle,” and added that the invoice has bipartisan help.

“The Senate is strongly supportive of getting this carried out; the members I met with on each side of the aisle are able to get this laws handed,” Armstrong mentioned within the video.

Armstrong Says New Invoice Will Guarantee There Is Not One other Gary Gensler

The invoice was launched in Could this yr, and seeks to create a complete market-structure framework for digital belongings. It additionally attracts a line between US Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) roles in regulating the house.

Armstrong mentioned in his video that draft texts are already being exchanged backwards and forwards between lawmakers. Crypto business executives have additionally been concerned within the course of to supply further remark, the Coinbase CEO mentioned.

Along with Coinbase’s Armstrong, different crypto representatives that reportedly attended the discussions had been executives from Ripple, Kraken, Circle, and Cardano.

Humorous factor about “closed-door” classes in DC… they in some way was conferences with Home + Senate members on each side final week. After which in some way public.

I used to be there the entire time selling and educating, market construction, and why readability issues for builders,… https://t.co/MrKNSylXKF

— Arjun Sethi (@arjunsethi) September 18, 2025

Representatives from tech-focused enterprise capital companies a16z, Multicoin Capital and Paradigm additionally reportedly joined the discussions.

Armstrong added that there was “loads of alignment” between everybody that attended the discussions.

That’s after Senator Cynthia Lummis predicted earlier this month that the CLARITY Act would get to President Donald Trump’s desk to signal earlier than the top of the yr.

Armstrong wrote in his submit that the invoice will “make sure the crypto business might be constructed right here in America, driving innovation and defending shoppers, and ensuring we by no means have one other Gary Gensler attempting to take your rights.”

Coinbase and several other different US companies working within the crypto house noticed lawsuits initiated in opposition to them by the SEC below its former Chair Gary Gensler previous to the Trump Administration taking workplace.

The principle argument for these lawsuits was that the businesses had been coping with unregistered securities, whereas the Gensler-led SEC selected to not outline whether or not some cryptos had been certainly securities or in the event that they had been thought-about commodities. This classification will probably be one of many issues that the CLARITY Act will attempt to set up.

Massive Banks Nonetheless Making an attempt To “Throw A Wrench Into Issues”

Despite the fact that there was alignment in the course of the discussions, Armstrong mentioned that massive banks are nonetheless attempting “to throw a wrench into issues.”

Extra particularly, they’re attempting to ban rewards on stablecoins, he added. Nonetheless, Armstrong doesn’t appear fazed by this, and mentioned the members of the Senate that he spoke to “aren’t gonna let that occur,” including they’re not going to deliver up points round stablecoin rewards once more.

Armstrong went on to say that the regulation round stablecoin rewards was already “litigated and determined” on within the GENIUS Act, which was signed into legislation by President Trump in July this yr.

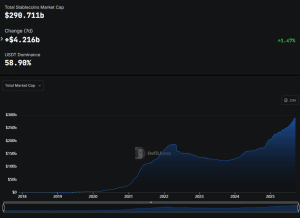

Its goal is to create a complete regulatory framework for cost stablecoins which are issued within the US by each home and international issuers. For the reason that Act was signed into legislation, it has led to accelerated development for the stablecoin market.

Stablecoin market cap (Supply: DefiLlama)

Whereas the GENIUS Act prohibits issuers from instantly paying yields or curiosity to token holders, banking teams have just lately flagged a loophole within the Act that leaves room for exchanges or different intermediaries to supply rewards on behalf of issuers.

Banks have additionally warned that stablecoins pose a threat of deposit flight from the standard monetary system if that loophole is just not addressed. They argued that clients could choose to maneuver funds out of the banking system and deposit their capital into stablecoin platforms in an effort to chase greater yields.

On account of the truth that banks are topic to regulatory constraints, capital and liquidity necessities, deposit insurance coverage, and so on., the banks consider it’s unfair that non-banks like stablecoin issuers would possibly mimic bank-like features with out the identical stage of oversight.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection