Be a part of Our Telegram channel to remain updated on breaking information protection

Shares in Gemini Area Station, the crypto agency led by Tyler and Cameron Winklevoss, slid under their IPO value of $28 to increase their losses lower than per week after the corporate debuted on the Nasdaq.

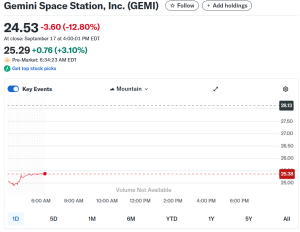

Buying and selling below the ticker “GEMI,” Gemini’s share value dropped 12.80% within the newest buying and selling session to shut off the day at $24.53. There was, nonetheless, some shopping for exercise within the after-hours buying and selling session that has seen the shares rise over 3% throughout this era, information from Yahoo Finance exhibits.

GEMI value chart (Supply: Yahoo Finance)

Regardless of the minor uptick in after-hours buying and selling, GEMI continues to be down greater than 33% over the previous seven days.

Gemini Market Cap Falls Beneath $3 Billion

On the primary day of its IPO, GEMI opened at $37.01 per share, and managed to succeed in a excessive of $45.89 earlier than closing off its debut day at $32. This marked a 14% achieve for the corporate’s inventory on its first day of buying and selling, with the corporate elevating $425 million on the day as properly.

🌐 The place the world buys, sells, and earns crypto.

🤝 @Gemini is the bridge between crypto and conventional finance, constructed for what’s subsequent.

🎉 Proud to name you #NasdaqListed, $GEMI! pic.twitter.com/wysZZQ9FuR

— Nasdaq Change (@NasdaqExchange) September 12, 2025

The IPO value was additionally above the anticipated vary between $24 and $26, and the IPO elevate positioned the corporate’s valuation at round $3.3 billion.

Nevertheless, that robust IPO momentum appears to have dwindled since, with the share value dropping 24% in just some days after the general public market debut. Following the continued drop in share value, Gemini’s market cap has fallen under $3 billion.

Gemini’s Losses Pile Up As SEC Settlement Nears

The continued drop in value additionally comes after the crypto change reported a $283 million web loss within the first half of this yr. This was greater than the $159 million web loss the change reported for the entire of 2024.

Gemini is concerned in a long-running dispute with the US Securities and Change Fee (SEC) over its Gemini Earn lending program as properly. The SEC sued the change at the beginning of 2023, alleging that this system constituted an unregistered providing of securities to retail buyers.

Earlier this week, nonetheless, the SEC and Gemini submitted a joint submitting within the Southern District Court docket of New York saying that the 2 events have reached a “decision in precept.”

A settlement in precept is a authorized time period that means that two events have agreed on the important thing, basic phrases of resolve a dispute however haven’t finalized the formal written settlement with all of the detailed phrases.

Now that Gemini and the SEC have reached that settlement, the ultimate paperwork for the settlement shall be submitted to the SEC for approval. Attorneys have requested the court docket to increase the deadline for the ultimate paperwork to Dec. 15.

Different Crypto Firms Expertise Put up-IPO Stoop

Different crypto firms which have gone public this yr have additionally seen their share costs drop after their robust public market debuts, though to not the extent that Gemini’s inventory has plummeted.

Circle, the issuer of the second-largest stablecoin by market cap USD Coin (USDC), entered the general public area earlier this yr in June. Its IPO value was $31, however the providing was over-subscribed as a result of robust demand. Because of this, Circle shares opened their first buying and selling day at $69 and closed the session off at $83.23. This marked a 168% achieve from the IPO value.

Within the weeks after the IPO, Circle shares continued to rise and reached highs within the $130-$140 vary. In keeping with information from Google Finance, Circle shares are buying and selling at $131.04, and are up over 57% prior to now six months. Extra lately, nonetheless, the corporate’s inventory has pulled again over 7% prior to now month.

In August, digital buying and selling platform Bullish additionally made its market debut. With an IPO value of $37 per share, the corporate’s inventory opened the day at $90. On the primary day, it then reached a excessive of $118 earlier than closing off its debut at $68.

Bullish has since seen its inventory drop to $54.35 following a greater than 14% correction over the previous month. Over the previous 24 hours, consumers have since returned to the inventory’s charts, with Bullish’s share value rising over 5% within the final buying and selling day. The shopping for exercise continued in after-hours buying and selling.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection