Knowledge exhibits the Bitcoin traders on derivatives exchanges nonetheless lean bearish towards the cryptocurrency even after the latest worth restoration.

Bitcoin Brief Positions Nonetheless Outweigh The Lengthy Ones

In a brand new submit on X, on-chain analytics agency Glassnode has talked about how Bitcoin market sentiment is wanting from the lens of the derivatives market proper now. The indicator shared by Glassnode is the “Lengthy/Brief Bias,” which measures the web quantity of positions that giant merchants have at present opened.

When the worth of this indicator is constructive, it means the lengthy positions outnumber the quick ones. Such a development implies the vast majority of the merchants maintain a bullish sentiment. Then again, the metric being underneath the zero mark implies extra BTC positions are betting on a bearish end result for the cryptocurrency.

Now, right here is the chart shared by the analytics agency that exhibits the development within the Bitcoin Lengthy/Brief Bias over the previous month:

As displayed within the above graph, the Bitcoin Lengthy/Brief Bias has been damaging for some time now, suggesting quick positions have been the extra dominant facet of the market.

Apparently, this hasn’t modified regardless of the value restoration that BTC has seen for the reason that begin of this month. At current, quick positions nonetheless outweigh bullish bets by 485 BTC (value round $56.2 million).

Traditionally, Bitcoin and different cryptocurrencies have tended to maneuver within the path that goes opposite to the group’s expectation, so the dominance of bearish sentiment within the derivatives market will not be such a foul factor.

In one other X thread, Glassnode has mentioned about some metrics associated to the Bitcoin Choices market. First of those is the Implied Volatility (IV), which measures the longer term volatility expectation of the Choices merchants.

Particularly, the model of the metric that’s of curiosity right here is the “At-The-Cash” (ATM) one, which solely exhibits this expectation for the merchants with a strike worth near the present BTC spot worth.

Beneath is a chart that exhibits the development on this indicator throughout the main tenors for Bitcoin over the previous couple of weeks.

From the graph, it’s obvious that the 1-week Bitcoin ATM IV rose forward of the Federal Open Market Committee (FOMC) assembly, however then plunged after the Fed introduced its choice. Longer expiry timeframes displayed no explicit response to the occasion.

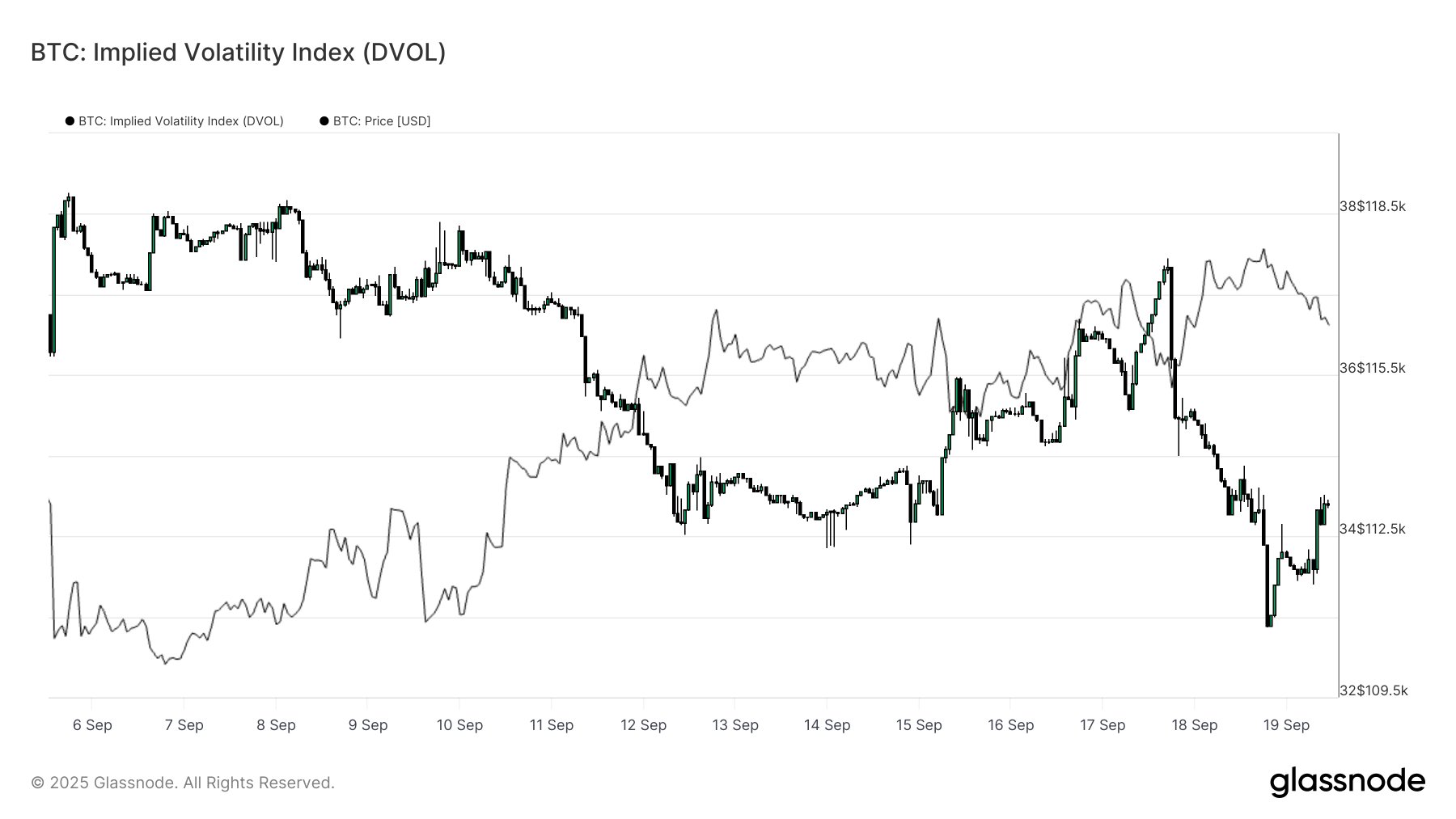

One other gauge for Choices market volatility expectations is the IV Index (DVOL), which aggregates the IV throughout strike costs and tenors.

“Put up-FOMC, DVOL dropped again, confirming the market just isn’t pricing any sharp transfer within the close to time period,” notes Glassnode.

BTC Value

Bitcoin made restoration towards $117,900 earlier, but it surely appears the coin has confronted a retrace as its worth has dropped again to $116,000.