- Exchanges keep unstable

- SHIB market efficiency

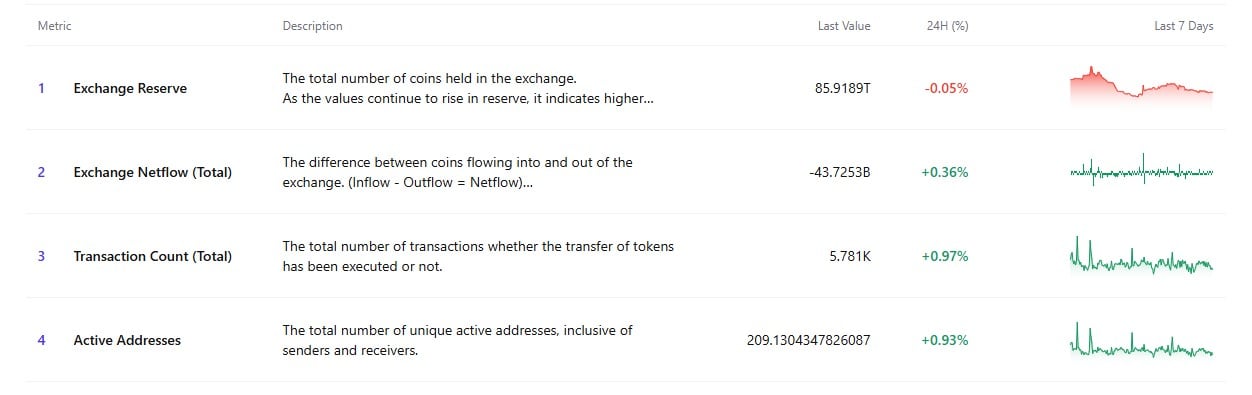

The info behind Shiba Inu’s latest surge in alternate exercise — practically 54 billion tokens moved in a single day — may very well be the final bullish sign left for the asset. On-chain metrics reveal a big drop in alternate reserves, which have dropped by 0.05% to 85 trillion SHIB, whereas netflow is damaging at -43 trillion. As a result of extra tokens are leaving exchanges than coming into, there may be much less strain on the open market to promote.

Exchanges keep unstable

Typically talking, these outflow intervals correspond with decrease draw back volatility and, extra considerably, accumulation phases that come earlier than rallies. As well as, the variety of transactions elevated by virtually 1% in a 24-hour interval, and the variety of energetic addresses elevated by 0.93%, indicating that community exercise is growing.

That is necessary as a result of SHIB has been stagnating for the previous few weeks, forming a giant symmetrical triangle sample. At this level, rising exercise signifies that merchants are preparing for an even bigger transfer.

SHIB market efficiency

SHIB continues to be confined, technically talking, between the rising help trendline under and its 200-day EMA above. The latest lack of $0.000013 lowered short-term bullish momentum, however robust purchaser protection was demonstrated by the bounce from the $0.0000128 zone. SHIB would possibly generate sufficient demand to confront the $0.000014 resistance zone, which additionally coincides with the descending trendline, if the damaging alternate netflows proceed.

SHIB would possibly transfer towards $0.000016-$0.000017 if there’s a breakout there. The draw back danger, then again, consists of a decline again towards $0.0000117 and probably including one other zero if promoting strain all of the sudden will increase and volumes decline, and SHIB loses help at $0.0000125. Nonetheless, in the meanwhile, the mixture of accelerating exercise, lowering alternate provide and bettering community metrics raises the chance that traders are subtly organising for an upside breakout.

Since SHIB is at a pivotal level, it would most likely be determined within the coming periods whether or not or not this accumulation truly results in a rally.