- Bitcoin dips beneath $116k regardless of ETF inflows and constructive sentiment.

- Analysts spotlight $115k because the make-or-break degree for near-term path.

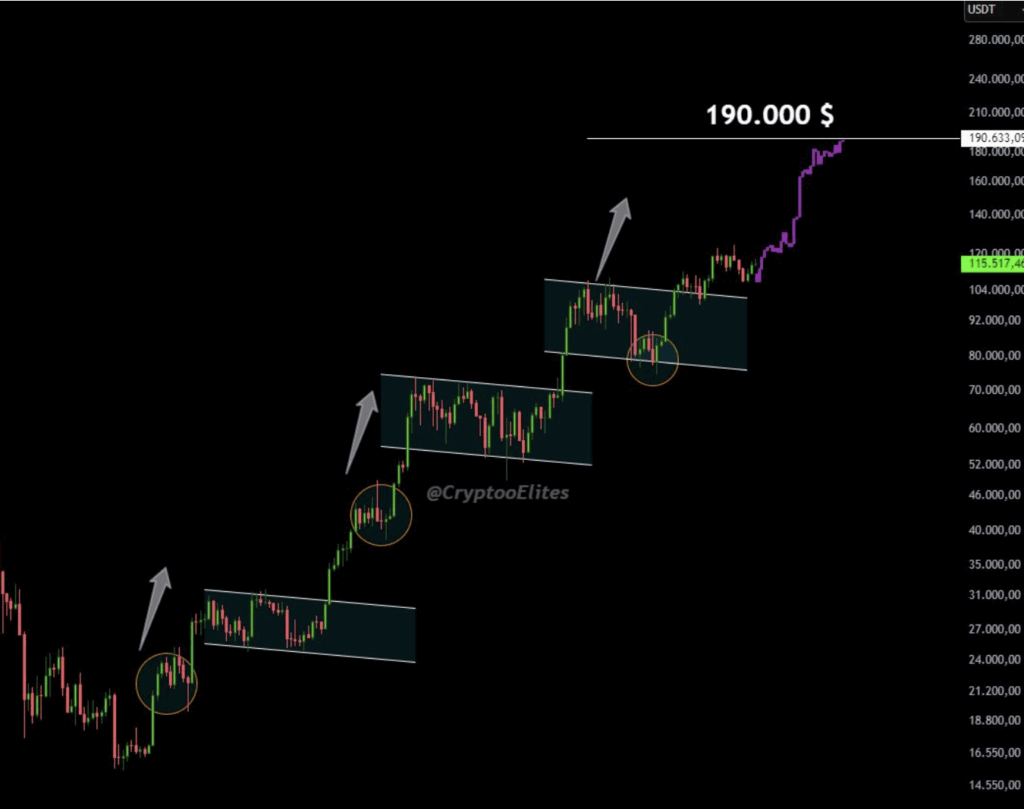

- Predictions vary from a rally towards $190k to a slide again below $100k.

Bitcoin (BTC) slipped below $116K after a uneven buying and selling session, dropping short-term momentum at the same time as analysts undertaking long-term upside. One daring forecast suggests Bitcoin may ultimately rally to $190,000, although key assist ranges should maintain to maintain that outlook alive.

Bitcoin Assist Ranges: Why $115K Is Essential

BTC has been ranging between $116,495 and $115,141 up to now 24 hours, with futures open curiosity down 0.6%. Analysts warn that dropping the $115K zone may set off a pointy selloff, sending BTC towards $93K. On the flip aspect, holding this degree may gasoline a rebound towards $137K within the close to time period.

Analyst Prediction: Can Bitcoin Attain $190K?

CryptoELITES sparked debate with a Bitcoin worth prediction focusing on $190K, citing historic cycles as a information. Whereas previous patterns don’t assure future features, the evaluation has caught merchants’ consideration. Ali Martinez echoed the significance of defending $115,440, saying a profitable bounce may ship BTC surging.

Macro Occasions Shaping Bitcoin’s Quick-Time period Outlook

The Fed’s current fee minimize didn’t preserve BTC bullish for lengthy, however upcoming catalysts may very well be extra impactful. Traders are watching Jerome Powell’s September 23 speech and U.S. PCE inflation knowledge, anticipated at 2.7%. A warmer studying could weigh on Bitcoin, whereas softer inflation may enhance danger urge for food.

Bitcoin Value Forecast: Volatility Nonetheless in Management

Regardless of bearish strain, Bitcoin continues to attract sturdy institutional inflows, with U.S. spot ETFs including $886M final week. If BTC holds $115K, a run towards $137K—and ultimately greater—stays attainable. However a break decrease may take a look at $90K, exhibiting that volatility nonetheless guidelines Bitcoin’s path ahead.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.