XRP grabbed recent consideration after two well-known chart analysts outlined bullish setups that might push the token a lot larger if the present momentum holds.

Associated Studying

In keeping with Javon Marks and Ali Martinez, technical indicators are lining up for a doable robust transfer, however merchants are watching whether or not key resistance ranges give approach.

Analysts See Breakout Potential

Dealer Javon Marks posted a chart exhibiting what he referred to as a big accumulation sample. Primarily based on his view, XRP might climb by 226% to succeed in $9.90, and if that zone is cleared the trail to $20 might open.

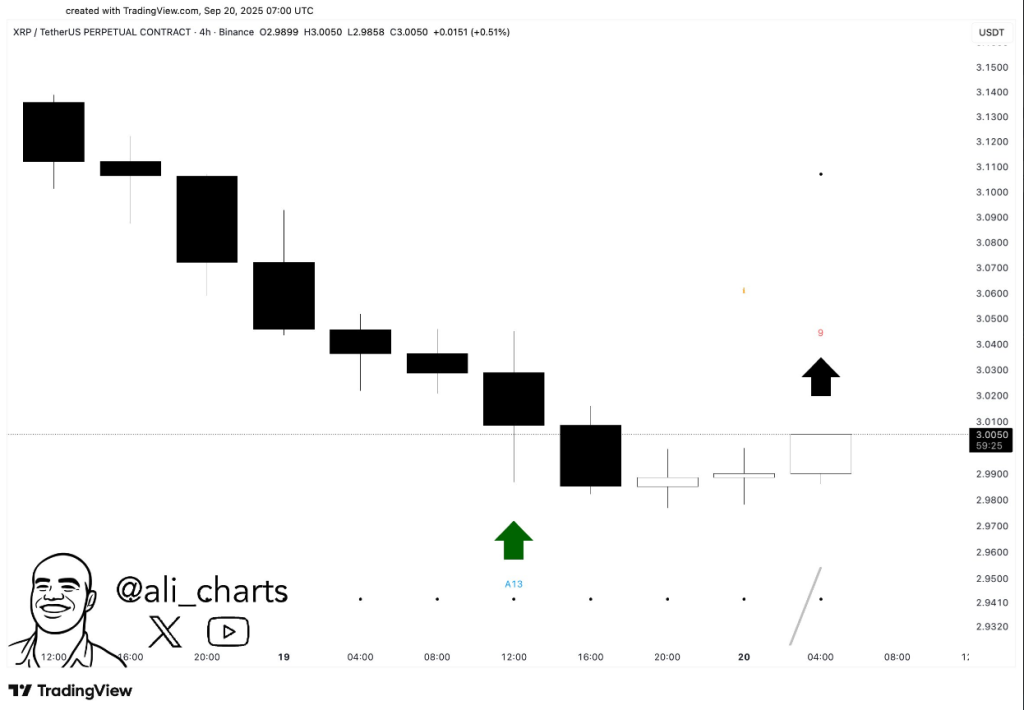

$XRP is a BUY, in response to the TD Sequential! pic.twitter.com/fY7GTgXEB0

— Ali (@ali_charts) September 20, 2025

Marks in contrast in the present day’s value construction to prior lengthy swings that led to sharp positive factors after prolonged sideways intervals. Primarily based on reviews from Martinez, the TD Sequential on the four-hour chart flashed a purchase sign.

That indicator is utilized by many merchants to identify when a development could cease and reverse. Martinez mentioned latest consolidation improved the chances for patrons, and that the shorter-term development now favors upward motion. Each analysts emphasised patterns and indicators somewhat than a set timetable for any rally.

Institutional Strikes Add Liquidity

Experiences have disclosed that the primary US spot XRP ETF started buying and selling this week, a improvement many see as an indication of rising institutional entry. On the similar time, the CME Group has plans to launch futures choices for XRP and Solana, which might deliver extra skilled merchants and deeper liquidity.

$XRP seems to be to be getting ready right here for ANOTHER +226% SURGE TO $9.90+ and a break above might ship it in the direction of $20 and better! pic.twitter.com/ia5jJOcdkp

— JAVON⚡️MARKS (@JavonTM1) September 19, 2025

Tokenized fund plans on the XRP Ledger have additionally surfaced; these funds would commerce like tokens and provides traders regulated publicity with quicker settlement, in response to sources.

Market response has been cautious. XRP has been holding above $3, however value motion slowed because it neared resistance. Merchants are actually watching whether or not the token can push past the subsequent provide zone or retreat again into consolidation.

XRP market cap at the moment at $178 billion. Chart: TradingView

Associated Studying

Carbon Market May Create Demand

In the meantime, there’s a separate line of debate that hyperlinks XRP to tokenized carbon credit. Primarily based on a Priority Analysis projection cited in reviews, the carbon credit score market might increase from about $933 billion in 2025 to greater than $16 trillion by 2034.

Different analysis pointed to the carbon offsets section being round $1.06 trillion in 2023 and presumably rising previous $3 trillion by 2032.

If tokenization of credit positive factors scale, these engaged on market plumbing say quick, low-cost rails could possibly be helpful. The XRP Ledger is reported to be carbon impartial, which supporters argue might make it a sexy possibility for shifting tokenized credit.

Nonetheless, this can be a hypothetical demand case and no clear mannequin ties that potential on to a selected XRP value stage.

Featured picture from Meta, chart from TradingView