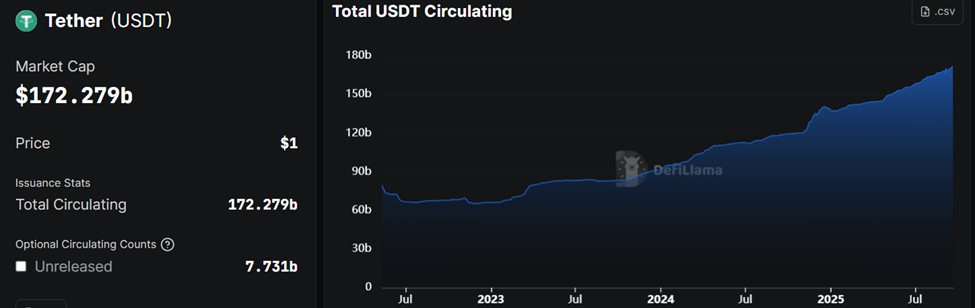

Tether’s USDT has surged to a market capitalization of $172.279 billion, in response to DefiLlama information, additional cementing its place because the world’s largest stablecoin.

The milestone comes as Japanese carmakers Toyota and Yamaha, alongside China’s BYD, started accepting USDT funds in Bolivia.

USDT Adoption Accelerates in Bolivia

Tether CEO Paolo Ardoino highlighted the event, framing it as a turning level for mainstream stablecoin adoption.

Sponsored

Sponsored

Ardoino positioned USDT because the digital greenback for lots of of hundreds of thousands within the rising markets, highlighting the foreign money’s rising ubiquity past crypto-native circles.

He additionally acknowledged the surge in USDT market cap, with information on DefiLlama corroborating the outlook and exhibiting that Tether accounts for 58.8% of complete stablecoin market worth.

The timing is important, coming solely months after Bolivia’s central financial institution (BCB) lately reported that crypto transactions within the nation soared to $430 million within the 12 months since lifting its blanket ban on digital belongings in 2024.

“In a single yr, operations in digital belongings grew by greater than % and reached $430 million,” the BCB shared in a June submit.

That determine represents a 630% year-over-year (YoY) surge, with the primary half of 2025 alone recording $294 million in crypto funds, up from $46.5 million a yr earlier. This can be a bounce of greater than 530%.

The BCB sees crypto as an enabler to international foreign money transactions, together with remittances, small purchases, and funds.

Sponsored

Sponsored

The nation’s rising adoption comes as digital belongings profit micro and small enterprise homeowners throughout varied sectors, with new developments stretching perks to the car trade.

Bolivian legislator Mariela Baldivieso of the Comunidad Ciudadana social gathering lately highlighted crypto’s potential as an enabler to Latin America’s financial basis.

She defined extra carefully that Bolivia’s crypto adoption places the nation among the many high 5 adopters in Latin America, citing progressive coverage reforms.

Bolivia’s Macroeconomic Backdrop Explains the Momentum

In the meantime, Bolivia’s macroeconomic outlook provides credence to the rising adoption. The nation in South America is grappling with extreme greenback shortages, 40-year-high inflation, and lengthy gasoline queues as international reserves dwindle.

Sponsored

Sponsored

The boliviano has misplaced practically half its worth on the black market this yr, forcing households and companies to hunt steady alternate options.

Whereas the federal government maintains an artificially regular official charge, the widening hole has pushed many into crypto rails, notably stablecoins like USDT.

Economists, nonetheless, warning towards decoding the surge as proof of long-term stability.

“This (crypto uptick) isn’t an indication of stability…It’s extra a mirrored image of the deteriorating buying energy of households,” Reuters reported lately, citing former central financial institution head Jose Gabriel Espinoza.

Nonetheless, Tether sees the development as validation. Ardoino famous that USDT brings digital greenback financial savings to the world.

He additionally famous the addition of two.9x extra new $1+ holders than all different stablecoins mixed over the previous three months.

Sponsored

Sponsored

The mixing of USDT into mainstream commerce in Bolivia mirrors how briskly stablecoins are embedding into on a regular basis financial life throughout rising markets.

However, whereas Latin America provides to the listing of Tether’s rising footprint, the stablecoin issuer attracts the road in Europe.

MiCA (Markets in Crypto Property) is the principle obstacle, with the Tether govt refusing to regulate the agency’s ideas to fulfill regulation.

“When MiCA turns into safer for shoppers and stablecoin issuers, then we would rethink,” Ardoino mentioned in a submit.

In the meantime, trade friends and market opponents like Circle, which points USDC stablecoin, leverage this edge.

That includes amongst 14 stablecoin issuers formally labeled as e-money tokens or EMT issuers, Circle acquired MiCA licenses earlier within the yr.

This permits the agency to “passport” companies throughout 30 EEA international locations without having separate approvals in every jurisdiction.