- Most merchants miss trades as a result of sluggish apps, guide setups, and clunky cellular execution—not as a result of they’ll’t spot alpha.

- Archer Bot fixes this by transferring buying and selling into Telegram with on the spot execution, automation, and threat administration baked in.

- The outcome: sooner trades, fewer errors, and the flexibility to truly catch these explosive 100x strikes as an alternative of simply watching them.

You see the proper setup. The chart seems to be flawless, the momentum is constructing, and you already know this might be the commerce that adjustments your week. However by the point you navigate via your buying and selling app, discover the token, alter your settings, and at last hit purchase, the chance is gone. You’re left watching the value pump 300% when you’re nonetheless making an attempt to determine why your transaction failed.

The overwhelming majority of merchants miss one of the best alternatives not as a result of they’ll’t spot them, however as a result of they’ll’t execute them quick sufficient. The quickest merchants have already solved this drawback utilizing instruments like Archer Bot that execute trades immediately via Telegram. Cease lacking trades with Archer Bot →.

Motive #1: Your Buying and selling App is Too Gradual

Conventional buying and selling apps had been constructed for a distinct period—when merchants held positions for days, not minutes. The everyday workflow is a nightmare: see alpha on social media, swap to your buying and selling app, await it to load, navigate a number of screens, seek for the token, arrange parameters, and at last execute—usually 5-10 minutes after the chance seems.

In Solana time, 10 minutes may as effectively be 10 hours. Costs can transfer 100%+ when you’re nonetheless making an attempt to finish a single commerce. Each second spent navigating interfaces is cash left on the desk.

Archer Bot eliminates this by bringing buying and selling straight into Telegram. When alpha drops in your teams, execute trades with out leaving the dialog. Commerce the place the alpha lives →.

Motive #2: Handbook Processes Kill Velocity

Each commerce requiring guide configuration kills momentum. Setting slippage, calculating place sizes, adjusting gasoline charges, manually inputting contract addresses—these steps take time you don’t have throughout explosive strikes.

What number of trades have you ever missed since you copied the fallacious contract tackle or made a typo? Handbook processes are error-prone, particularly below stress. Whenever you’re speeding to catch a pumping token, errors develop into inevitable.

Profitable merchants automate these selections upfront. They’ve predetermined place sizes, slippage settings, and threat parameters to allow them to execute immediately with out calculations or second-guessing.

Motive #3: Threat Administration Slows You Down

Many merchants keep away from setting stop-losses as a result of the method is sophisticated and time-consuming. With out automated threat administration, you’re pressured to babysit each place, stopping you from taking a number of alternatives concurrently.

Revenue-taking is even more durable. Greed makes you maintain winners too lengthy; worry makes you promote too early. Handbook profit-taking requires excellent emotional management that few merchants possess throughout unstable strikes.

Probably the most profitable merchants use systematic guidelines: promote 25% at 2x, 25% at 5x, 25% at 10x, let the ultimate 25% experience. However implementing this manually throughout quick markets is sort of unimaginable.

Motive #4: Cell Buying and selling Doesn’t Work

Most crypto alternatives seem if you’re away out of your pc. Conventional buying and selling apps present horrible cellular experiences—small screens, advanced menus, poor contact interfaces make quick execution almost unimaginable.

Cell buying and selling depends on steady connections that aren’t all the time accessible. Gradual loading instances, failed transactions, and app crashes throughout high-volume intervals are widespread. By the point worth alerts attain your telephone and also you open your buying and selling app, alternatives are sometimes gone.

Making an attempt to execute time-sensitive trades on cellular means fighting tiny buttons and hoping your fingers hit the appropriate areas. The stress results in errors and missed alternatives.

Motive #5: The Social Buying and selling Hole

One of the best alpha comes from social sources—Telegram teams, Twitter calls, Discord communities. However there’s an enormous hole between receiving data and appearing on it. Conventional workflows require leaving these platforms to execute trades, creating delays that kill alternatives.

Alpha has a half-life measured in minutes. By the point you course of data, swap apps, and execute trades, the alpha has usually fully decayed. The sting exists solely for many who can act instantly inside the identical surroundings the place they’re getting data.

Buying and selling in isolation additionally means lacking the collective intelligence of profitable communities—you don’t see how skilled merchants place themselves or handle threat throughout unstable intervals.

The Easy Repair: Archer Bot’s Complete Resolution

Archer Bot solves each execution drawback by bringing professional-grade buying and selling straight into Telegram. No app switching, no interface delays, no guide configurations. When alternatives seem, you’re positioned immediately whereas others are nonetheless opening their buying and selling apps.

Immediate Telegram Execution

Execute trades straight within the communities the place alpha will get shared. Archer Bot transforms Telegram from simply an data supply into an entire buying and selling platform, eliminating the hole between discovery and execution.

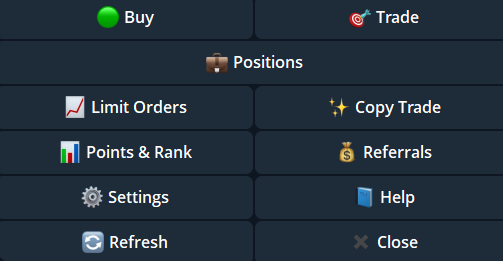

Automated All the things

Set your place sizing and profit-taking guidelines as soon as. Archer Bot executes each commerce with excellent self-discipline, eradicating emotion from vital selections. This automation enables you to take a number of alternatives concurrently with out babysitting positions.

Cell-First Design

Constructed particularly for cellular buying and selling via Telegram, Archer Bot supplies the identical execution velocity whether or not you’re at your desk or on the go. Easy textual content instructions exchange advanced interfaces.

Solana Optimization

Archer Bot is constructed for Solana’s velocity and traits. Computerized token detection, optimum routing, MEV safety, and slippage optimization—all dealt with robotically when you deal with alternatives.

Zero Studying Curve

Paste a contract tackle and make sure—that’s it. No guide calculations, no configuration delays, no room for error. The velocity to catch alternatives plus the automation to handle them correctly.

Able to cease lacking one of the best trades? Archer Bot eliminates each friction level that kills alternatives whereas offering the automation wanted for constant earnings. Rework your buying and selling at this time →

The Backside Line

Lacking good trades isn’t about missing talent or data—it’s about execution infrastructure. The 5 issues above have an effect on almost each dealer, however they’re fully solvable with the appropriate instruments.

The hole between seeing alternatives and benefiting from them will solely widen as markets develop into extra aggressive. Merchants who remedy the execution drawback now will keep sustainable benefits over these utilizing outdated strategies.

Cease watching alternatives slip away and begin capturing them. Archer Bot supplies on the spot execution, automated threat administration, and seamless social integration. Get Archer Bot now →

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.